answer for all

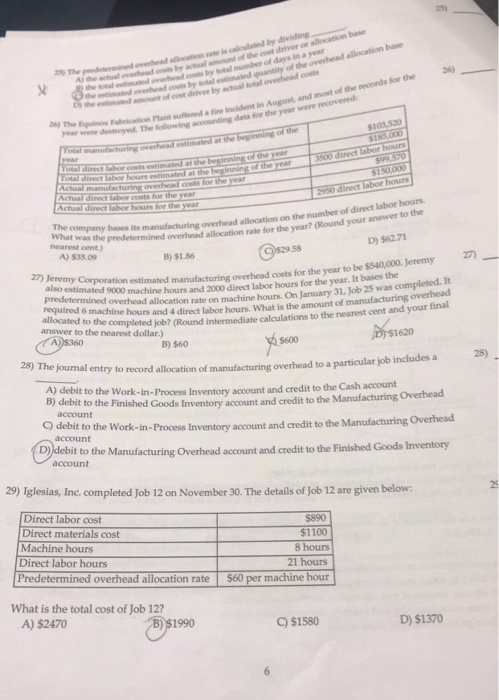

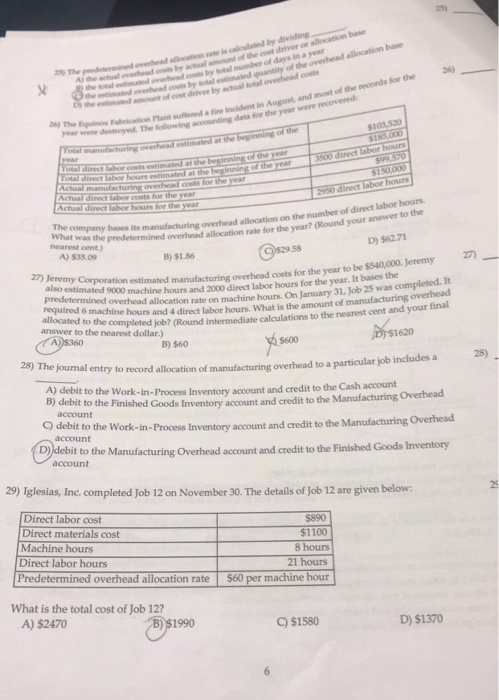

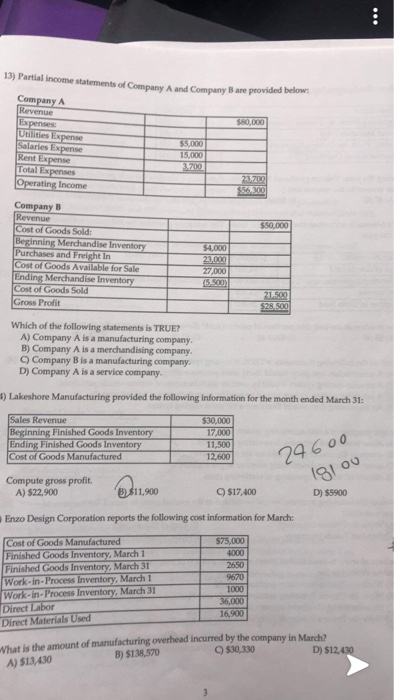

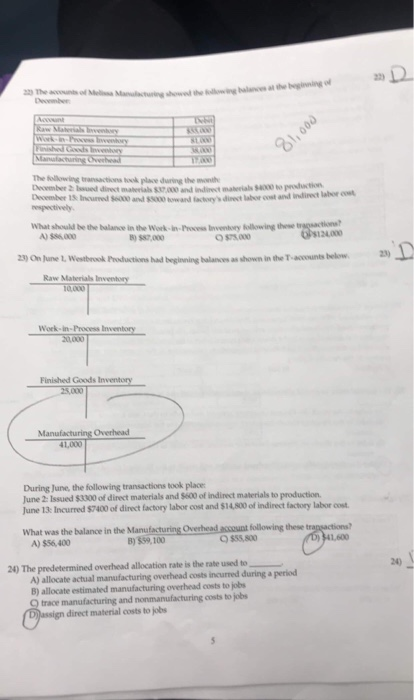

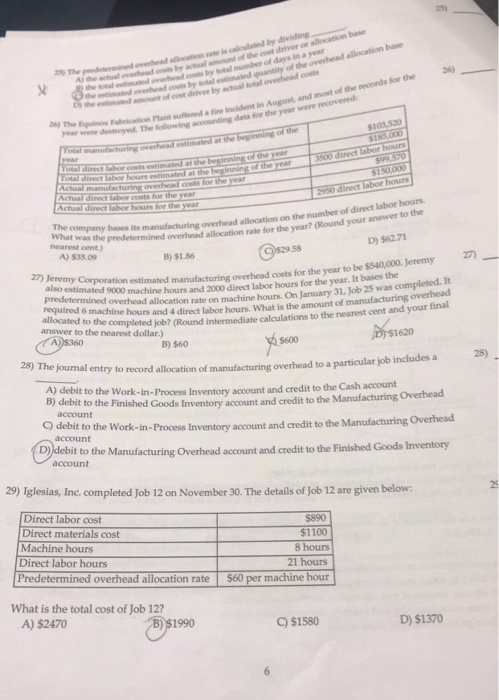

Aj the actual overhead cots by actal amount of the cst driver or allocation base mhe otal etmated overead csts by otal number of days in a year Gecimated ovehead costs by total estiated quantity of the overhead allocation base the e ted amount of cost driver by actual total overhead costs 2) The predee d ovehead allocation rate i caleulated by dividing 26) 2 The Equno Fabecation Plant suffeed a fire incident in August and most of the reconds for the year wene destroyed The following accoounting data for the year were recovered SI03.520 S185000 Total manulachuring overhead estimated at the beginning of the year 3500 direct labor hours s99.570 Lotal direct labor costs estimated at the beginning of the year Total direct labor hours estimated at the beginning of the year Actual manufacturing overhead costs for the year Actual direct labor costs for the year Actual direct labor hours for the year $150,000 2950 direct labor hours The company bases its manufacturingg overhead allocation on the number of direct labor hours. What was the predetermined overhead allocation rate for the year? (Round your answer to the nearest cent.) D) $62.71 s29.58 A) $35.09 B) $1.86 27) 27) Jeremy Corporation estimated manufacturing overhead costs for the year to be $540,000. Jeremy also estimated 9000 machine hours and 2000 direct labor hours for the year. It bases the predetermined overhead allocation rate on machine hours. On January 31, Job 25 was completed. It required 6 machine hours and 4 direct labor hours. What is the amount of manufacturing overhead allocated to the completed job? (Round intermediate calculations to the nearest cent and your final answer to the nearest dollar) Srs1620 A))5360 B) $60 $600 28) The joural entry to record allocation of manufacturing overhead to a particular job includes a 28) A) debit to the Work-in-Process Inventory account and credit to the Cash account B) debit to the Finished Goods Inventory account and credit to the Manufacturing Overhead account debit to the Work-in-Process Inventory account and credit to the Manufacturing Overhead account D))debit to the Manufacturing Overhead account and credit to the Finished Goods Inventory account 29) Iglesias, Inc. completed Job 12 on November 30. The details of Job 12 are given below: Direct labor cost Direct materials cost Machine hours Direct labor hours Predetermined overhead allocation rate $890 $1100 8 hours 21 hours $60 per machine hour What is the total cost of Job 12? A) $2470 B $199 0 9 $1580 D) $1370 13) Partial income statements of Company A and Company B are provided below: Company A Revenue Expenses Utilities Expense Salaries Expense Rent Expense Total Expenses $80,000 $5.000 15,000 3.700 23.700 $56,300 Operating Income Company B Revenue Cost of Goods Sold: Beginning Merchandise Inventory Purchases and Freight In Cost of Goods Available for Sale Ending Merchandise Inventory Cost of Goods Sold Gross Profit $50,000 $4,000 23,000 27,000 (5,500) 21.500 $28,500 Which of the following statements is TRUE A) Company A is a manufacturing company. B) Company A is a merchandising company. 9 Company B is a manufacturing company. D) Company A is a service company. ) Lakeshore Manufacturing provided the following information for the month ended March 31: Sales Revenue Beginning Finished Goods Inventory Ending Finished Goods Inventory Cost of Goods Manufactured $30,000 17,000 24600 (g1 o0 11.500 12.600 Compute gross profit. A) $22,900 9 $17,400 B11,900 D) $5900 Enzo Design Corporation reports the following cost information for March: Cost of Goods Manufactured Finished Goods Inventory, March 1 Finished Goods Inventory, March 31 Work-in-Process Inventory, March 1 Work-in-Process Inventory, March 31 $75,000 4000 2650 9670 1000 36,000 16.900 Direct Labor Direct Materials Used What is the amount of manufacturing overhead incurred by the company in Manch2 B) $138,570 9 $30,330 D) $12,430 A) $13,430 The accouts of Mel Manacturing showed the following balances al the beginning of December Account kw Matrials ry Work in-Pro bwnory Fsbed Coods wenory Manufacturing Overhead 81, 000 The following transactions took place during the month December 2 lsued direct materials 37 000 and indiret materials $4000 to production. December 13 Incurred Se000 and $5000 towward factory's dinect labor cost and indinect labor cost aadsa What should be the balance in the Work-in-Proes Ivemtory following these trosactions? A) $86000 Gs12400 B) s87,000 O000 23) On June 1, Westbrook Productions had beginning balances as shown in the T-accounts below 23) Raw Materials Inventory 10.000 Work-in-Process Inventory 20,000 Finished Goods Inventory 25,000 Manufacturing Overhead 41,000 During June, the following transactions took place June 2: Issued $3300 of direct materials and S600 of indirect materials to production. June 13: Incurred $7400 of direct factory labor cost and $14,800 of indirect factory labor cost. What was the balance in the Manufacturing Overhead account following these trappactions A) $56,400 B) $59,100 O $55.800 D)341600 24) The predetermined overhead allocation rate is the rate used to A) allocate actual manufacturing overhead costs incurred during a period B) allocate estimated manufacturing overhead costs to jobs O trace manufacturing and nonmanufacturing costs to jobs Dassign direct material costs to jobs 24)