Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ANSWER FOR c PLEASE 36. A couple negotiated with a vendor and purchased a two-bedroom house financed through a bank. They signed a mortgage contract

ANSWER FOR c PLEASE

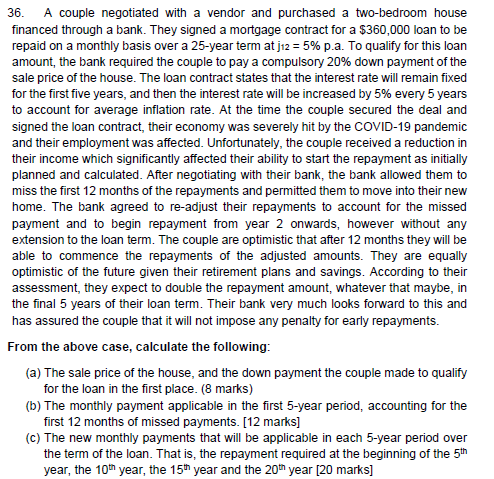

36. A couple negotiated with a vendor and purchased a two-bedroom house financed through a bank. They signed a mortgage contract for a $360,000 loan to be repaid on a monthly basis over a 25-year term at j12 = 5% p.a. To qualify for this loan amount, the bank required the couple to pay a compulsory 20% down payment of the sale price of the house. The loan contract states that the interest rate will remain fixed for the first five years, and then the interest rate will be increased by 5% every 5 years to account for average inflation rate. At the time the couple secured the deal and signed the loan contract, their economy was severely hit by the COVID-19 pandemic and their employment was affected. Unfortunately, the couple received a reduction in their income which significantly affected their ability to start the repayment as initially planned and calculated. After negotiating with their bank, the bank allowed them to miss the first 12 months of the repayments and permitted them to move into their new home. The bank agreed to re-adjust their repayments to account for the missed payment and to begin repayment from year 2 onwards, however without any extension to the loan term. The couple are optimistic that after 12 months they will be able to commence the repayments of the adjusted amounts. They are equally optimistic of the future given their retirement plans and savings. According to their assessment, they expect to double the repayment amount, whatever that maybe, in the final 5 years of their loan term. Their bank very much looks forward to this and has assured the couple that it will not impose any penalty for early repayments. From the above case, calculate the following: (a) The sale price of the house, and the down payment the couple made to qualify for the loan in the first place. (8 marks) (b) The monthly payment applicable in the first 5-year period, accounting for the first 12 months of missed payments. [12 marks] (c) The new monthly payments that will be applicable in each 5-year period over the term of the loan. That is, the repayment required at the beginning of the 5th year, the 10th year, the 15th year and the 20th year [20 marks]Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started