Answered step by step

Verified Expert Solution

Question

1 Approved Answer

answer for this 1. Computation - Solve the problems below. (5 items, 10 points) 1. On January 1, 2014, Easy Company's Supplies account showed a

answer for this

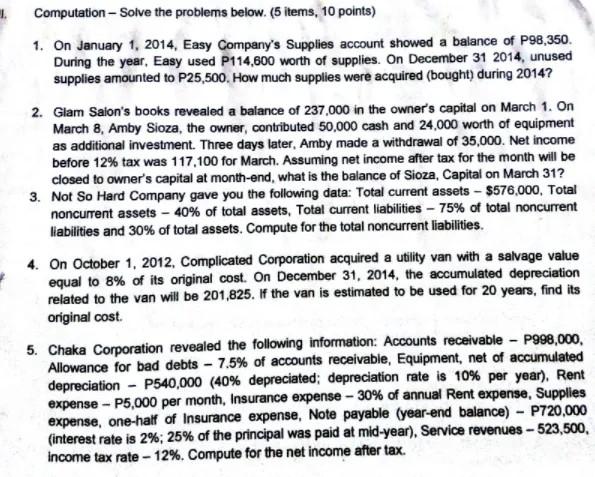

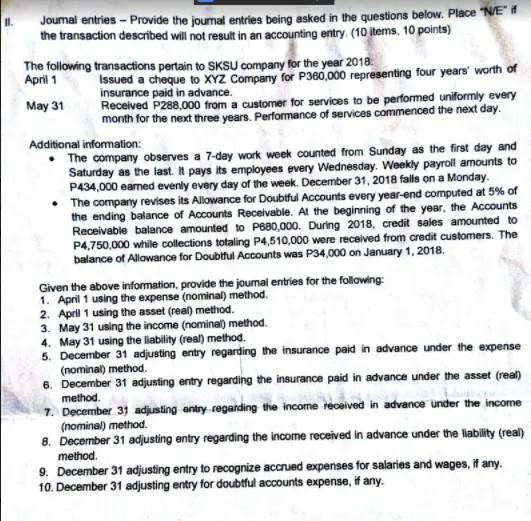

1. Computation - Solve the problems below. (5 items, 10 points) 1. On January 1, 2014, Easy Company's Supplies account showed a balance of P98,350. During the year, Easy used P114,600 worth of supplies. On December 31 2014, unused supplies amounted to P25,500. How much supplies were acquired (bought) during 2014? 2. Glam Saion's books revealed a balance of 237,000 in the owner's capital on March 1. On March 8, Amby Sioza, the owner, contributed 50,000 cash and 24,000 worth of equipment as additional investment. Three days later, Amby made a withdrawal of 35,000. Net income before 12% tax was 117,100 for March. Assuming net income after tax for the month will be closed to owner's capital at month-end, what is the balance of Sioza, Capital on March 31? 3. Not So Hard Company gave you the following data: Total current assets - $576,000, Total noncurrent assets - 40% of total assets, Total current liabilities - 75% of total noncurrent liabilities and 30% of total assets. Compute for the total noncurrent liabilities. 4. On October 1, 2012, Complicated Corporation acquired a utility van with a salvage value equal to 8% of its original cost. On December 31, 2014, the accumulated depreciation related to the van will be 201,825. If the van is estimated to be used for 20 years, find its original cost. 5. Chaka Corporation revealed the following information: Accounts receivable - P998,000 Allowance for bad debts - 7.5% of accounts receivable, Equipment, net of accumulated depreciation - P540,000 (40% depreciated; depreciation rate is 10% per year), Rent expense - P5,000 per month, Insurance expense - 30% of annual Rent expense, Supplies expense, one-half of Insurance expense, Note payable (year-end balance) - P720,000 (interest rate is 2%, 25% of the principal was paid at mid-year), Service revenues - 523,500 income tax rate - 12%. Compute for the net income after tax. Journal entries - Provide the journal entries being asked in the questions below. Place "NE** the transaction described will not result in an accounting entry (10 items, 10 points) The following transactions pertain to SKSU company for the year 2018 April 1 Issued a cheque to XYZ Company for P380,000 representing four years' worth of insurance paid in advance. May 31 Received P288,000 from a customer for services to be performed uniformly every month for the next three years. Performance of services commenced the next day. Additional information: The company observes a 7-day work week counted from Sunday as the first day and Saturday as the last. It pays its employees every Wednesday, Weekly payroll amounts to P434,000 earned evenly every day of the week. December 31, 2018 falls on a Monday. The company revises its Allowance for Doubtful Accounts every year-end computed at 5% of the ending balance of Accounts Receivable. At the beginning of the year, the Accounts Receivable balance amounted to P880,000. During 2018, credit sales amounted to P4,750,000 while collections totaling P4,510,000 were received from credit customers. The balance of Allowance for Doubtful Accounts was P34,000 on January 1, 2018 Given the above information, provide the joumal entries for the following: 1. April 1 using the expense (nominal) method. 2. April 1 using the asset (real) method. 3. May 31 using the income (nominal) method. 4. May 31 using the liability (real) method. 5. December 31 adjusting entry regarding the insurance paid in advance under the expense (nominal) method 6. December 31 adjusting entry regarding the insurance paid in advance under the asset (real) method. 7. December 31 adjusting entry regarding the income received in advance under the income (nominal) method. 8. December 31 adjusting entry regarding the income received in advance under the liability (real) method 9. December 31 adjusting entry to recognize accrued expenses for salaries and wages, if any. 10. December 31 adjusting entry for doubtful accounts expense, if anyStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started