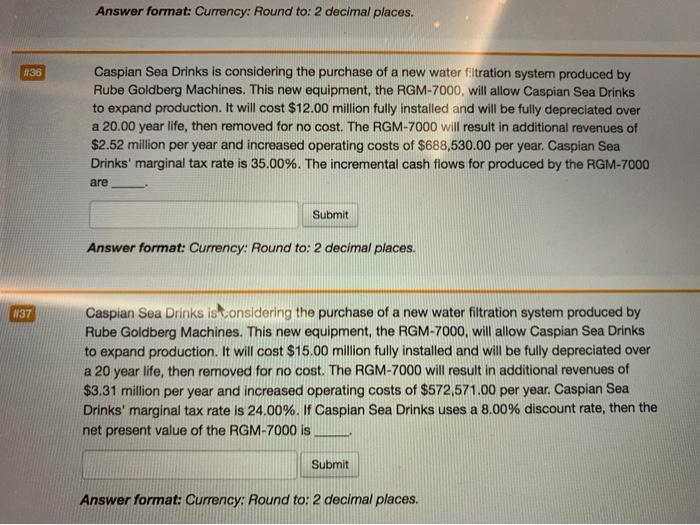

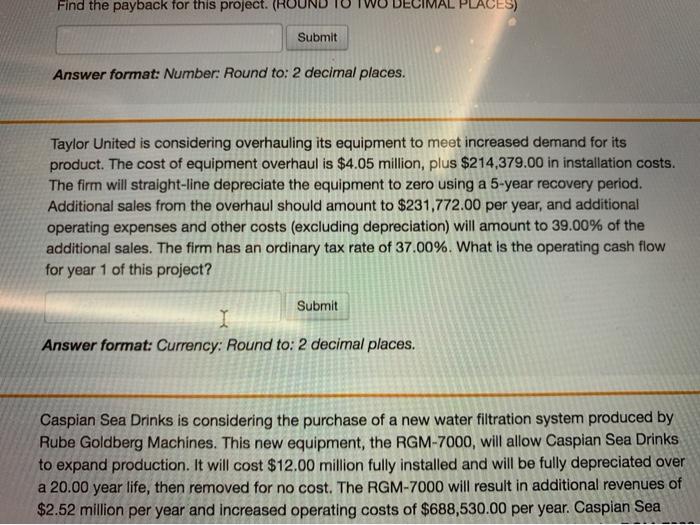

Answer format: Currency: Round to: 2 decimal places. 138 Caspian Sea Drinks is considering the purchase of a new water filtration system produced by Rube Goldberg Machines. This new equipment, the RGM-7000, will allow Caspian Sea Drinks to expand production. It will cost $12.00 million fully installed and will be fully depreciated over a 20.00 year life, then removed for no cost. The RGM-7000 will result in additional revenues of $2.52 million per year and increased operating costs of $688,530.00 per year. Caspian Sea Drinks' marginal tax rate is 35.00%. The incremental cash flows for produced by the RGM-7000 are Submit Answer format: Currency: Round to: 2 decimal places. 137 Caspian Sea Drinks is considering the purchase of a new water filtration system produced by Rube Goldberg Machines. This new equipment, the RGM-7000, will allow Caspian Sea Drinks to expand production. It will cost $15.00 million fully installed and will be fully depreciated over a 20 year life, then removed for no cost. The RGM-7000 will result in additional revenues of $3.31 million per year and increased operating costs of $572,571.00 per year. Caspian Sea Drinks' marginal tax rate is 24.00%. If Caspian Sea Drinks uses a 8.00% discount rate, then the net present value of the RGM-7000 is Submit Answer format: Currency: Round to: 2 decimal places. Find the payback for this project. (RO PLACES) Submit Answer format: Number: Round to: 2 decimal places. Taylor United is considering overhauling its equipment to meet increased demand for its product. The cost of equipment overhaul is $4.05 million, plus $214,379.00 in installation costs. The firm will straight-line depreciate the equipment to zero using a 5-year recovery period. Additional sales from the overhaul should amount to $231,772.00 per year, and additional operating expenses and other costs (excluding depreciation) will amount to 39.00% of the additional sales. The firm has an ordinary tax rate of 37.00%. What is the operating cash flow for year 1 of this project? Submit I Answer format: Currency: Round to: 2 decimal places. Caspian Sea Drinks is considering the purchase of a new water filtration system produced by Rube Goldberg Machines. This new equipment, the RGM-7000, will allow Caspian Sea Drinks to expand production. It will cost $12.00 million fully installed and will be fully depreciated over a 20.00 year life, then removed for no cost. The RGM-7000 will result in additional revenues of $2.52 million per year and increased operating costs of $688,530.00 per year. Caspian Sea