Answered step by step

Verified Expert Solution

Question

1 Approved Answer

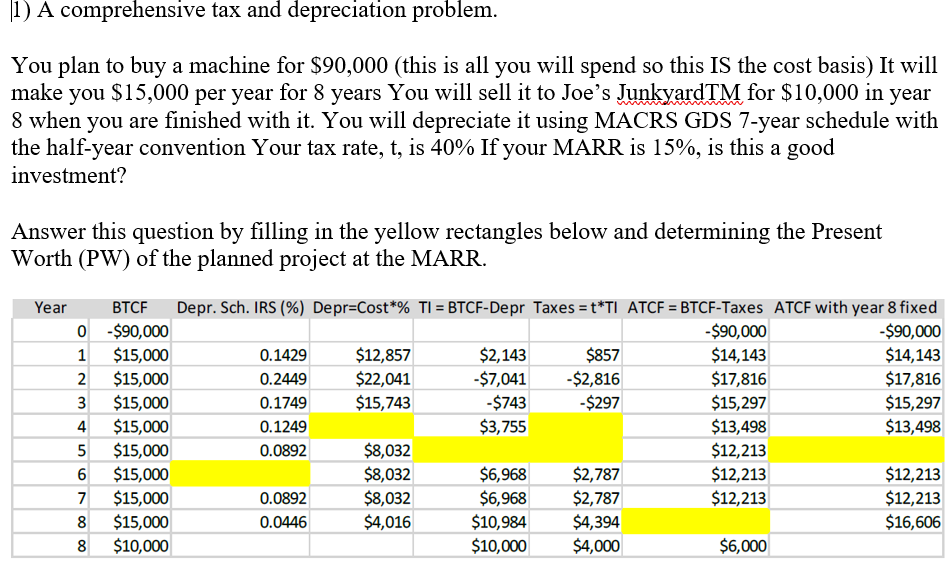

Answer Hint: Project looks sketchy, even BTCF simple payback does not payback until end of year 6! 1) A comprehensive tax and depreciation problem. You

Answer Hint: Project looks sketchy, even BTCF simple payback does not payback until end of year 6!

1) A comprehensive tax and depreciation problem. You plan to buy a machine for $90,000 (this is all you will spend so this IS the cost basis) It will make you $15,000 per year for 8 years You will sell it to Joe's JunkyardTM for $10,000 in year 8 when you are finished with it. You will depreciate it using MACRS GDS 7-year schedule with the half-year convention Your tax rate, t, is 40% If your MARR is 15%, is this a good investment? Answer this question by filling in the yellow rectangles below and determining the Present Worth (PW) of the planned project at the MARR. Year BTCF 0 $90,000 1 $15,000 2 $15,000 3 $15,000 4 $15,000 5 $15,000 6 $15,000 7 $15,000 8 $15,000 8 $10,000 Depr. Sch. IRS (%) Depr=Cost*% TI = BTCF-Depr Taxes = t*TI ATCF = BTCF-Taxes ATCF with year 8 fixed -$90,000 -$90,000 0.1429 $12,857 $2,143 $857 $14,143 $14,143 0.2449 $22,041 -$7,041 -$2,816 $17,816 $17,816 0.1749 $15,743 -$743 -$297 $15,297 $15,297 0.1249 $3,755 $13,498 $13,498 0.0892 $8,032 $12,213 $8,032 $6,968 $2,787 $12,213 $12,213 0.0892 $8,032 $6,968 $2,787 $12, 213 $12,213 0.0446 $4,016 $10,984 $4,394 $16,606 $10,000 $4,000 $6,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started