Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Answer in detail. thanks A financial institution wishes to unwind a position of 120 million shares in a stock over 8 days. The dollar bid-offer

Answer in detail. thanks

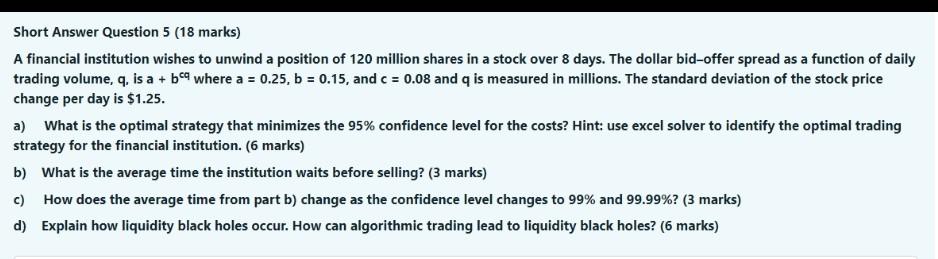

A financial institution wishes to unwind a position of 120 million shares in a stock over 8 days. The dollar bid-offer spread as a function of daily trading volume, q, is a+bcq where a=0.25,b=0.15, and c=0.08 and q is measured in millions. The standard deviation of the stock price change per day is $1.25. a) What is the optimal strategy that minimizes the 95% confidence level for the costs? Hint: use excel solver to identify the optimal trading strategy for the financial institution. ( 6 marks) b) What is the average time the institution waits before selling? ( 3 marks) c) How does the average time from part b) change as the confidence level changes to 99% and 99.99% ? (3 marks) d) Explain how liquidity black holes occur. How can algorithmic trading lead to liquidity black holes? (6 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started