Answered step by step

Verified Expert Solution

Question

1 Approved Answer

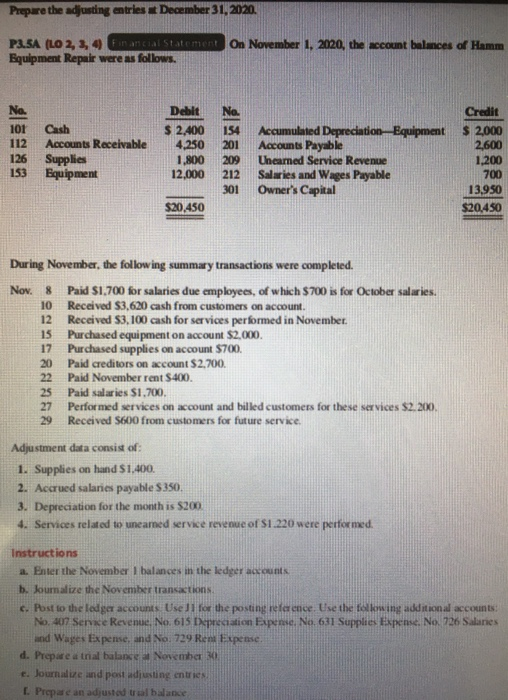

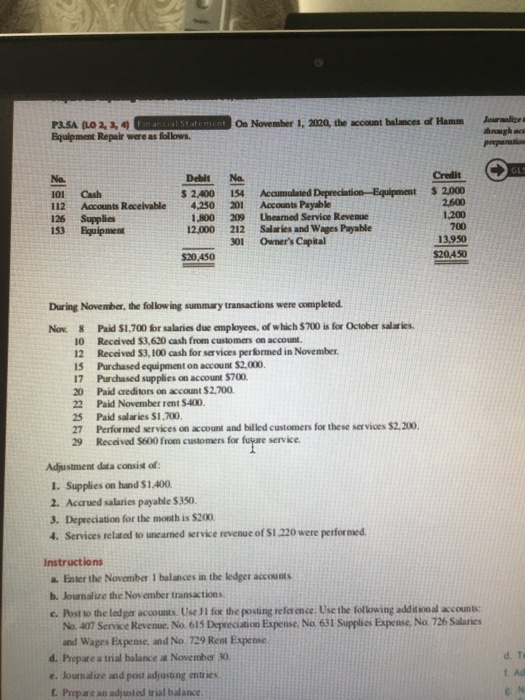

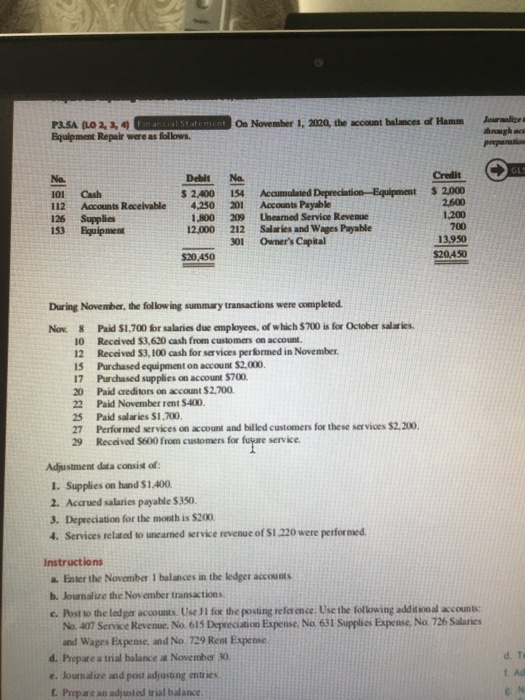

Answer instructions a-f Prepare the adjusting entries December 31, 2020. P3.5A (LO 2, 3, 4 an ancial Statement on November 1, 2020, the account balances

Answer instructions a-f

Prepare the adjusting entries December 31, 2020. P3.5A (LO 2, 3, 4 an ancial Statement on November 1, 2020, the account balances of Hamm Equipment Repair were as follows. No. No. 101 112 126 153 Cash Accounts Receivable Supplies Equipment Debit $ 2,400 4,250 1.800 12,000 154 201 209 212 301 Credit Accumulated Depreciation Equipment S2,000 Accounts Payable 2.600 Uncamned Service Revenue 1,200 Salaries and Wages Payable 700 Owner's Capital 13,950 $20.450 $20,450 During November, the following summary transactions were completed. Nov. 8 Paid S1,700 for salaries due employees, of which $700 is for October salaries. 10 Received $3,620 cash from customers on account 12 Received $3.100 cash for services performed in November. 15 Purchased equipment on account $2,000. 17 Purchased supplies on account $700. 20 Paid creditors on account $2.700. 22 Paid November rent $400. 25 Paid salaries $1.700. 27 Performed services on account and billed customers for these services $2.200. 29 Received S600 from customers for future service Adjustment data consist of: 1. Supplies on hand $1,400. 2. Accrued salaries payable $350. 3. Depreciation for the month is 5200 4. Services related to uneared service revenue of $1.220 were performed. Instructions a. Enter the November I balances in the ledger accounts b. Journalize the November transactions c. Post to the ledger accounts Usell for the posting reference. Use the following additional accounts: No. 407 Senze Revenue. No. 615 Depreciation Experte. No 631 Supplies Expense. No 726 Salaries and Wages Expense, and No. 729 Rem Expense d. Prepare a trial balance November 30 1. Journalize and post adjusting entries I. Prepare an adjusted trial balance P3.SA (LO 2, 3, 4 Einancial Statement on November 1, 2020, the account balances of Hamm Equipment Repair were as follows Journage through ac prior GLS No. 101 112 126 153 Cash Accounts Receivable Supplies Equipment Debit $ 2,400 4,250 1,800 12.000 No. 154 201 209 212 301 Accumulated Depreciation Equipment Accounts Payable Uneamed Service Revenue Salaries and Wages Payable Owner's Capital Credit $ 2,000 2600 1,200 700 13,950 $20,450 $20.450 During November, the following summary transactions were completed. Nov. 8 Paid $1,700 for salaries due employees, of which $ 700 is for October salaries 10 Received $3,620 cash from customers on account 12 Received $3,100 cash for services performed in November 15 Purchased equipment on account $2,000. 17 Purchased supplies on account 5700 20 Paid creditors on account $2.700 22 Paid November rent S-400 25 Paid salaries S1.700. 27 Performed services on account and billed customers for these services $2,200, 29 Received S600 from customers for fugare service. Adjustment data consist of: 1. Supplies on hand $1,400 2. Accrued salaries payable $350. 3. Depreciation for the month is $200. 4. Services related to uneared service revenue of 1.220 were performed. Instructions a. Enter the November 1 balances in the ledger accounts b. Journalize the November transactions c. Post to the ledger accounts. Use Jl for the posting reference. Use the following additional accounts: No. 407 Service Revenue, No. 615 Depreciation Expense No. 631 Supplies Expense, No. 726 Salaries and Wages Expense, and No. 729 Rent Expense d. Prepare a trial balance November 30, e. Journalize and post adjusting entries. L Prepare an adjusted trial balance d. T 1. Ad

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started