Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Answer is E, but not sure how to get to this answer. please show all steps and calculations so I can fully understand how to

Answer is E, but not sure how to get to this answer. please show all steps and calculations so I can fully understand how to solve. thank you

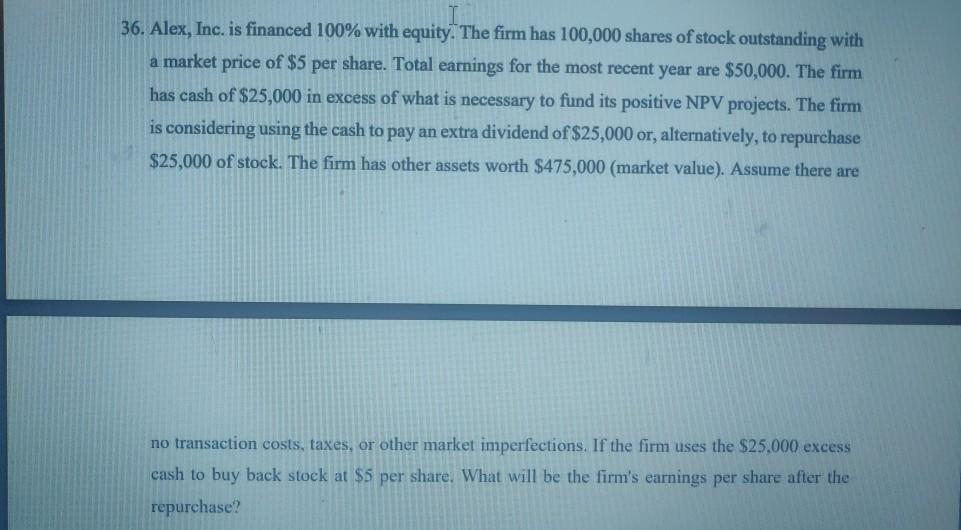

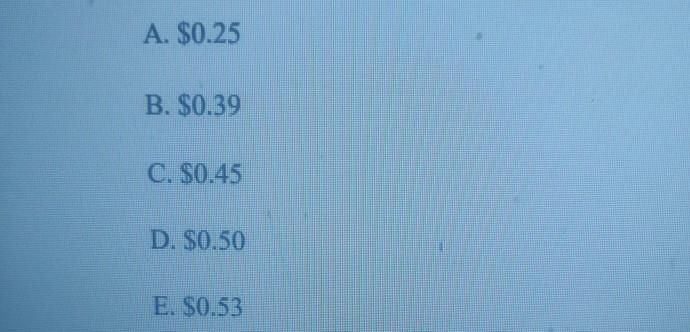

36. Alex, Inc. is financed 100% with equity. The firm has 100,000 shares of stock outstanding with a market price of $5 per share. Total earnings for the most recent year are $50,000. The firm has cash of $25,000 in excess of what is necessary to fund its positive NPV projects. The firm is considering using the cash to pay an extra dividend of $25,000 or, alternatively, to repurchase $25,000 of stock. The firm has other assets worth $475,000 (market value). Assume there are no transaction costs, taxes, or other market imperfections. If the firm uses the $25,000 excess cash to buy back stock at $5 per share. What will be the firm's earnings per share after the repurchase? A. $0.25 B. $0.39 C. $0.45 D. $0.50 E. $0.53Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started