Answered step by step

Verified Expert Solution

Question

1 Approved Answer

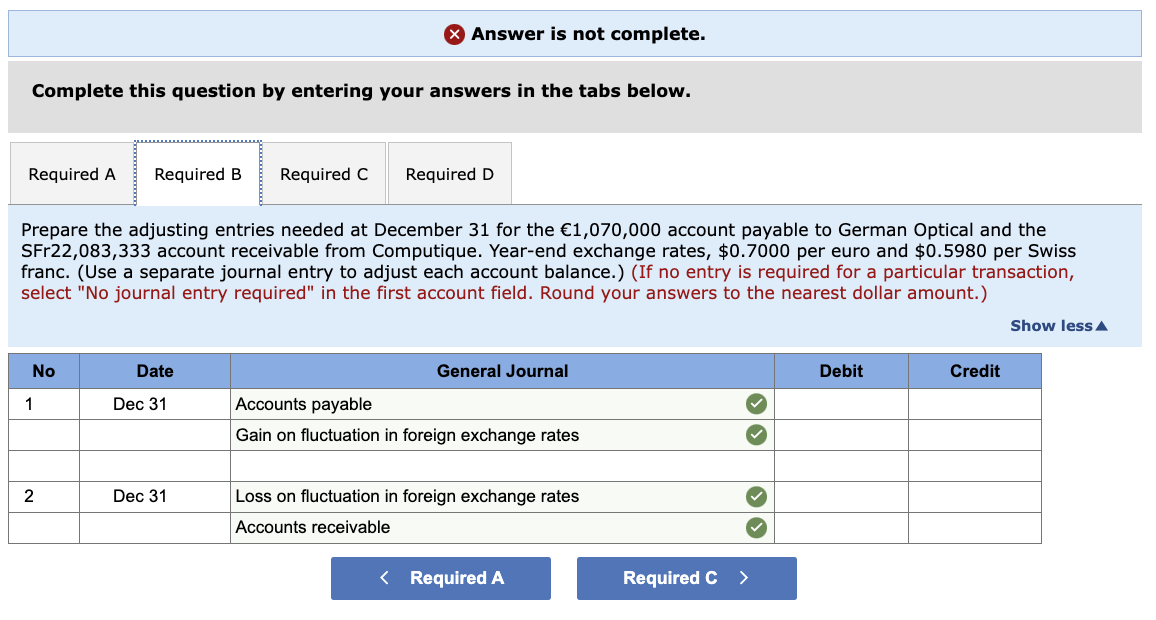

Answer is not complete. Complete this question by entering your answers in the tabs below. Prepare the adjusting entries needed at December 31 for the

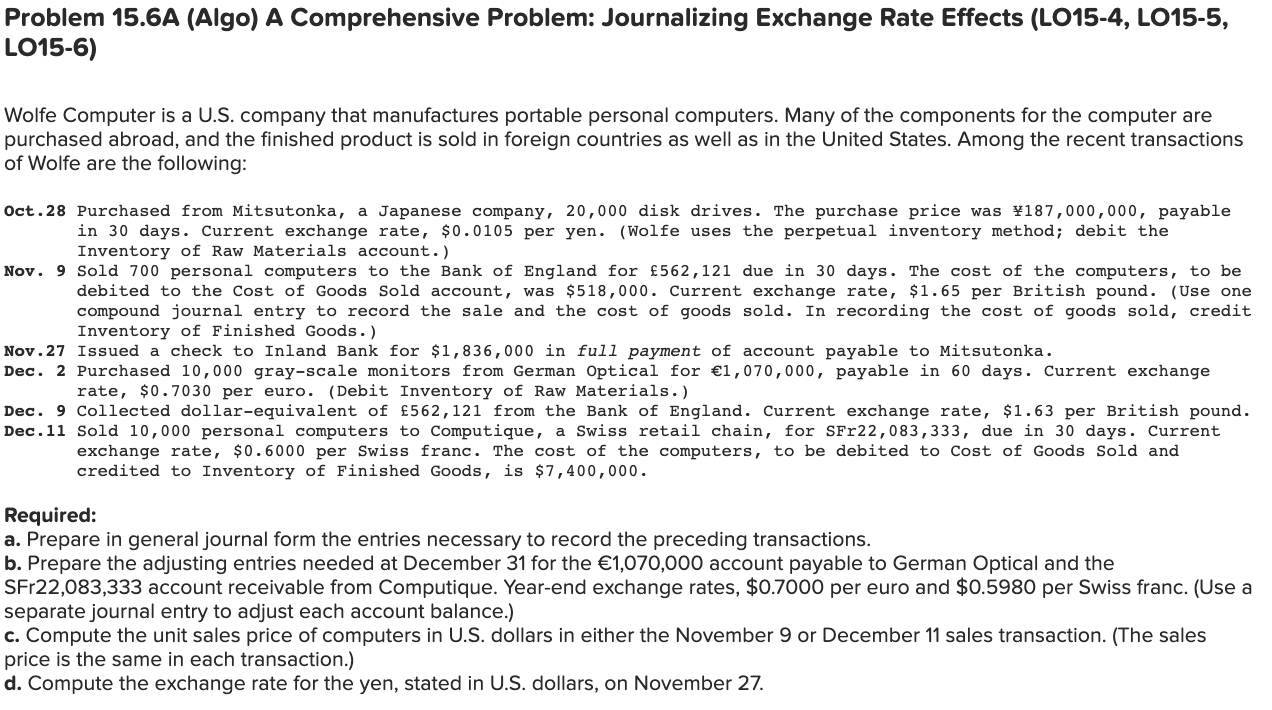

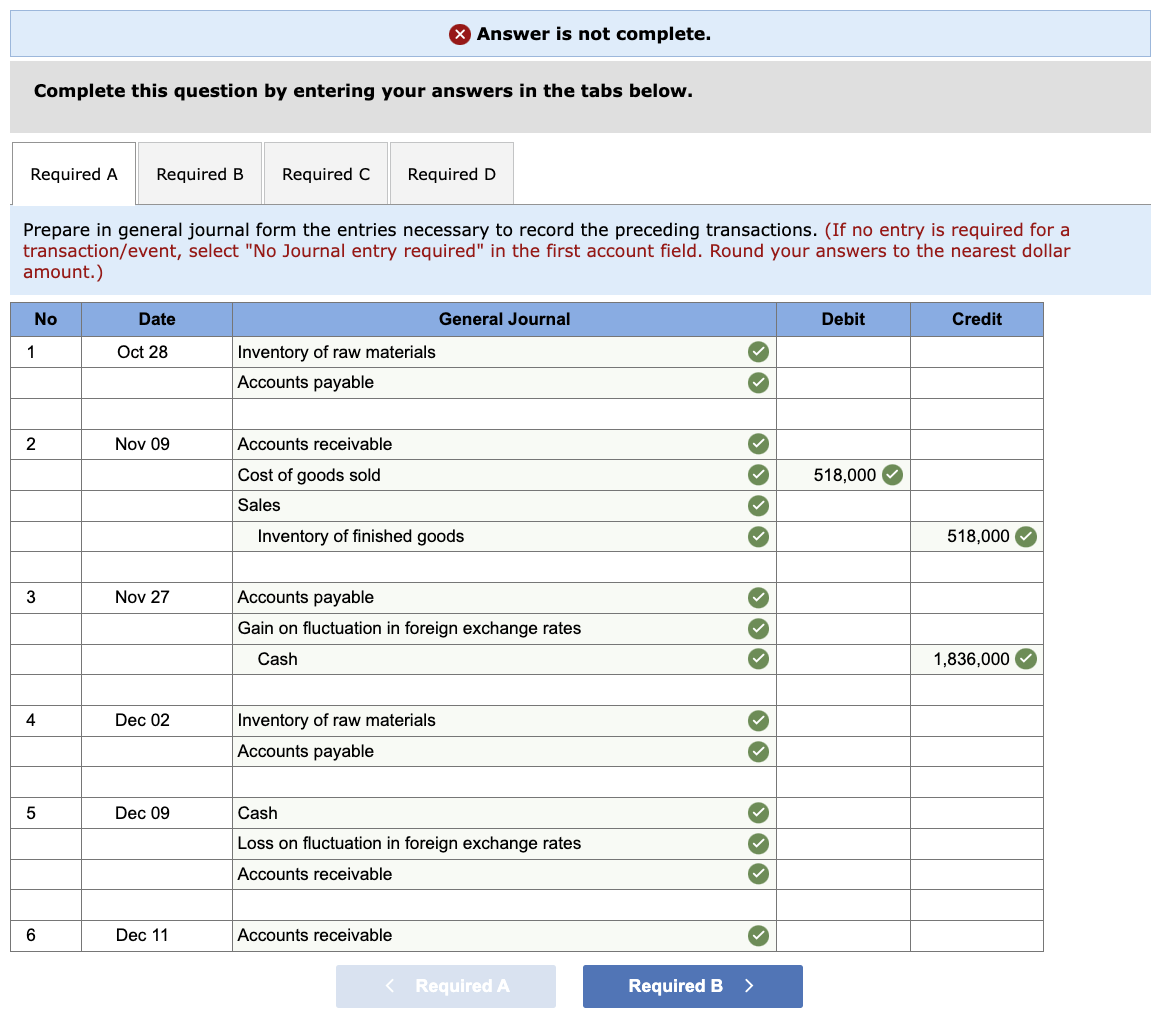

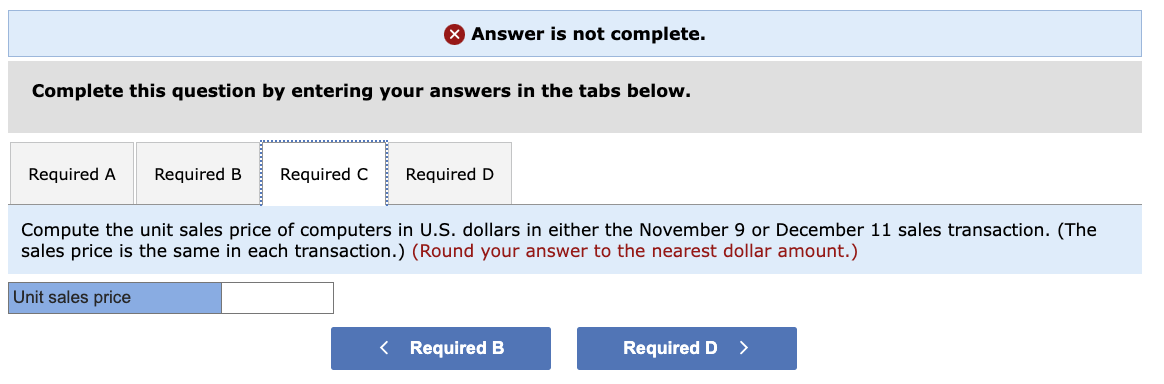

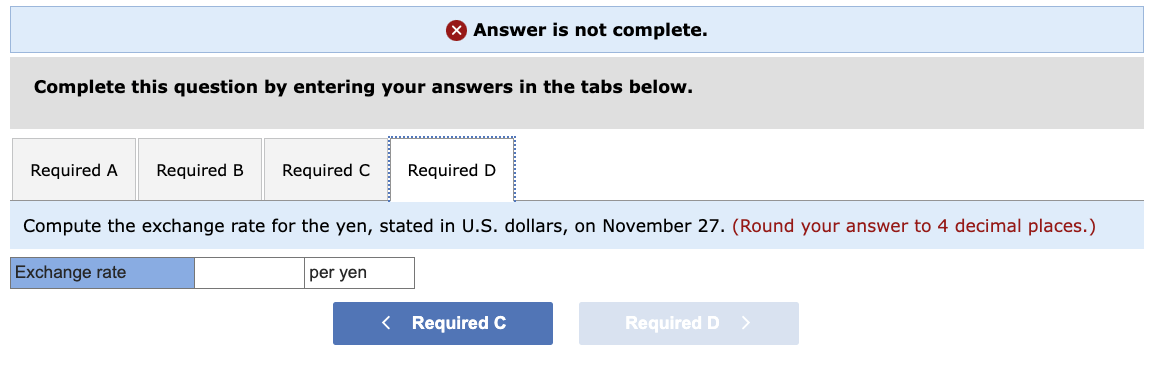

Answer is not complete. Complete this question by entering your answers in the tabs below. Prepare the adjusting entries needed at December 31 for the 1,070,000 account payable to German Optical and the SFr22,083,333 account receivable from Computique. Year-end exchange rates, $0.7000 per euro and $0.5980 per Swiss franc. (Use a separate journal entry to adjust each account balance.) (If no entry is required for a particular transaction, select "No journal entry required" in the first account field. Round your answers to the nearest dollar amount.) Answer is not complete. Complete this question by entering your answers in the tabs below. Compute the exchange rate for the yen, stated in U.S. dollars, on November 27. (Round your answer to 4 decimal places.) Answer is not complete. Complete this question by entering your answers in the tabs below. Compute the unit sales price of computers in U.S. dollars in either the November 9 or December 11 sales transaction. (The sales price is the same in each transaction.) (Round your answer to the nearest dollar amount.) LO15-6) Wolfe Computer is a U.S. company that manufactures portable personal computers. Many of the components for the computer are purchased abroad, and the finished product is sold in foreign countries as well as in the United States. Among the recent transactions of Wolfe are the following: Oct.28 Purchased from Mitsutonka, a Japanese company, 20,000 disk drives. The purchase price was 187,000,000, payable in 30 days. Current exchange rate, $0.0105 per yen. (Wolfe uses the perpetual inventory method; debit the Inventory of Raw Materials account.) Nov. 9 Sold 700 personal computers to the Bank of England for 562,121 due in 30 days. The cost of the computers, to be debited to the Cost of Goods Sold account, was $518,000. Current exchange rate, $1.65 per British pound. (Use one compound journal entry to record the sale and the cost of goods sold. In recording the cost of goods sold, credit Inventory of Finished Goods.) Nov.27 Issued a check to Inland Bank for $1,836,000 in full payment of account payable to Mitsutonka. Dec. 2 Purchased 10,000 gray-scale monitors from German Optical for 1,070,000, payable in 60 days. Current exchange rate, $0.7030 per euro. (Debit Inventory of Raw Materials.) Dec. 9 Collected dollar-equivalent of 562,121 from the Bank of England. Current exchange rate, $1.63 per British pound. Dec.11 Sold 10,000 personal computers to Computique, a Swiss retail chain, for SFr22,083,333, due in 30 days. Current exchange rate, $0.6000 per Swiss franc. The cost of the computers, to be debited to Cost of Goods Sold and credited to Inventory of Finished Goods, is $7,400,000. Required: a. Prepare in general journal form the entries necessary to record the preceding transactions. b. Prepare the adjusting entries needed at December 31 for the 1,070,000 account payable to German Optical and the SFr22,083,333 account receivable from Computique. Year-end exchange rates, $0.7000 per euro and $0.5980 per Swiss franc. (Use a separate journal entry to adjust each account balance.) c. Compute the unit sales price of computers in U.S. dollars in either the November 9 or December 11 sales transaction. (The sales price is the same in each transaction.) d. Compute the exchange rate for the yen, stated in U.S. dollars, on November 27. Answer is not complete. Complete this question by entering your answers in the tabs below. Prepare in general journal form the entries necessary to record the preceding transactions. (If no entry is required for a cransaction/event, select "No Journal entry required" in the first account field. Round your answers to the nearest dollar amount.)

Answer is not complete. Complete this question by entering your answers in the tabs below. Prepare the adjusting entries needed at December 31 for the 1,070,000 account payable to German Optical and the SFr22,083,333 account receivable from Computique. Year-end exchange rates, $0.7000 per euro and $0.5980 per Swiss franc. (Use a separate journal entry to adjust each account balance.) (If no entry is required for a particular transaction, select "No journal entry required" in the first account field. Round your answers to the nearest dollar amount.) Answer is not complete. Complete this question by entering your answers in the tabs below. Compute the exchange rate for the yen, stated in U.S. dollars, on November 27. (Round your answer to 4 decimal places.) Answer is not complete. Complete this question by entering your answers in the tabs below. Compute the unit sales price of computers in U.S. dollars in either the November 9 or December 11 sales transaction. (The sales price is the same in each transaction.) (Round your answer to the nearest dollar amount.) LO15-6) Wolfe Computer is a U.S. company that manufactures portable personal computers. Many of the components for the computer are purchased abroad, and the finished product is sold in foreign countries as well as in the United States. Among the recent transactions of Wolfe are the following: Oct.28 Purchased from Mitsutonka, a Japanese company, 20,000 disk drives. The purchase price was 187,000,000, payable in 30 days. Current exchange rate, $0.0105 per yen. (Wolfe uses the perpetual inventory method; debit the Inventory of Raw Materials account.) Nov. 9 Sold 700 personal computers to the Bank of England for 562,121 due in 30 days. The cost of the computers, to be debited to the Cost of Goods Sold account, was $518,000. Current exchange rate, $1.65 per British pound. (Use one compound journal entry to record the sale and the cost of goods sold. In recording the cost of goods sold, credit Inventory of Finished Goods.) Nov.27 Issued a check to Inland Bank for $1,836,000 in full payment of account payable to Mitsutonka. Dec. 2 Purchased 10,000 gray-scale monitors from German Optical for 1,070,000, payable in 60 days. Current exchange rate, $0.7030 per euro. (Debit Inventory of Raw Materials.) Dec. 9 Collected dollar-equivalent of 562,121 from the Bank of England. Current exchange rate, $1.63 per British pound. Dec.11 Sold 10,000 personal computers to Computique, a Swiss retail chain, for SFr22,083,333, due in 30 days. Current exchange rate, $0.6000 per Swiss franc. The cost of the computers, to be debited to Cost of Goods Sold and credited to Inventory of Finished Goods, is $7,400,000. Required: a. Prepare in general journal form the entries necessary to record the preceding transactions. b. Prepare the adjusting entries needed at December 31 for the 1,070,000 account payable to German Optical and the SFr22,083,333 account receivable from Computique. Year-end exchange rates, $0.7000 per euro and $0.5980 per Swiss franc. (Use a separate journal entry to adjust each account balance.) c. Compute the unit sales price of computers in U.S. dollars in either the November 9 or December 11 sales transaction. (The sales price is the same in each transaction.) d. Compute the exchange rate for the yen, stated in U.S. dollars, on November 27. Answer is not complete. Complete this question by entering your answers in the tabs below. Prepare in general journal form the entries necessary to record the preceding transactions. (If no entry is required for a cransaction/event, select "No Journal entry required" in the first account field. Round your answers to the nearest dollar amount.) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started