Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Answer is not complete. ! Required information [ The following information applies to the questions displayed below. ] Tracy Company, a manufacturer of air conditioners,

Answer is not complete.

Required information

The following information applies to the questions displayed below.

Tracy Company, a manufacturer of air conditioners, sold units to Thomas Company on November The units

have a list price of $ each, but Thomas was given a trade discount. The terms of the sale were

Required:

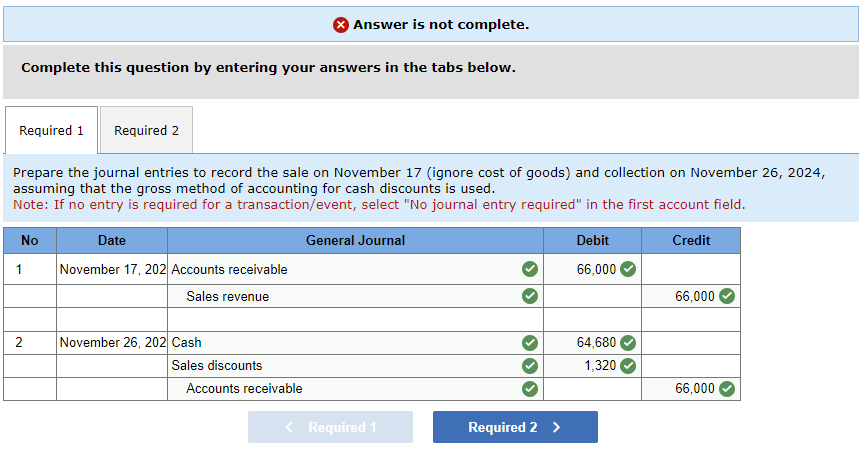

Prepare the journal entries to record the sale on November ignore cost of goods and collection on November

assuming that the gross method of accounting for cash discounts is used.

Prepare the journal entries to record the sale on November ignore cost of goods and collection on December

assuming that the gross method of accounting for cash discounts is used.

Complete this question by entering your answers in the tabs below.

Required

Prepare the journal entries to record the sale on November ignore cost of goods and collection on November assuming that the gross method of accounting for cash discounts is used.

Note: If no entry is required for a transactionevent select No journal entry required" in the first account field.

tableNoDate,General Journal,Debit,CreditNovember Accounts receivable,Sales revenue,,,November Cash,Sales discounts,VAccounts receivable,Vvv

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started