Question: Allergan is a major pharmaceutical firm. You work for Allergan's CFO and are evaluating a major and expensive drug trial. The drug trial would

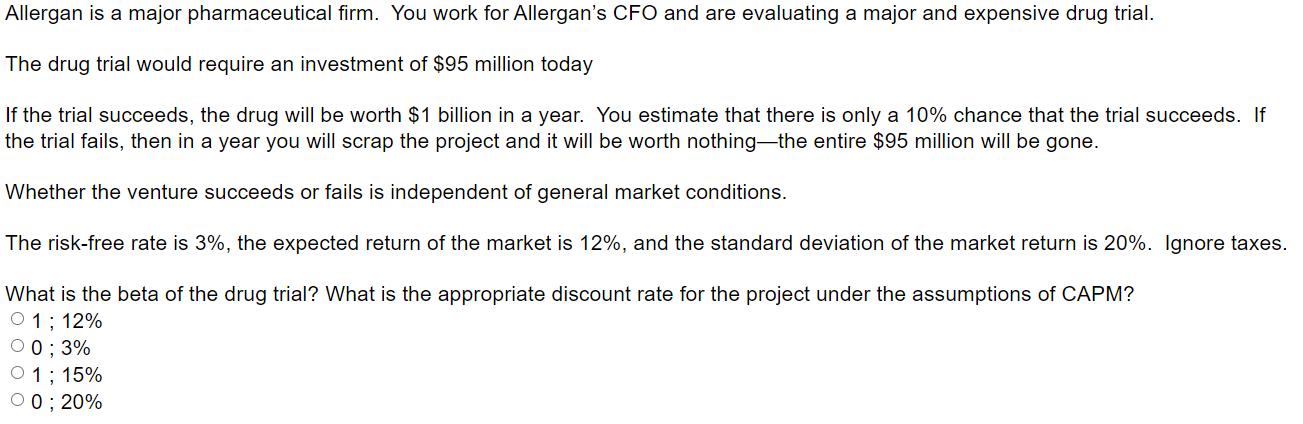

Allergan is a major pharmaceutical firm. You work for Allergan's CFO and are evaluating a major and expensive drug trial. The drug trial would require an investment of $95 million today If the trial succeeds, the drug will be worth $1 billion in a year. You estimate that there is only a 10% chance that the trial succeeds. If the trial fails, then in a year you will scrap the project and it will be worth nothing the entire $95 million will be gone. Whether the venture succeeds or fails is independent of general market conditions. The risk-free rate is 3%, the expected return of the market is 12%, and the standard deviation of the market return is 20%. Ignore taxes. What is the beta of the drug trial? What is the appropriate discount rate for the project under the assumptions of CAPM? 01; 12% O 0; 3% O 1; 15% 0; 20%

Step by Step Solution

3.39 Rating (158 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts