Answered step by step

Verified Expert Solution

Question

1 Approved Answer

answer MCQS with justification 3. Mr X has significant influence over A Berhad and Mr X is also a Key Management personnel of C Berhad.

answer MCQS with justification

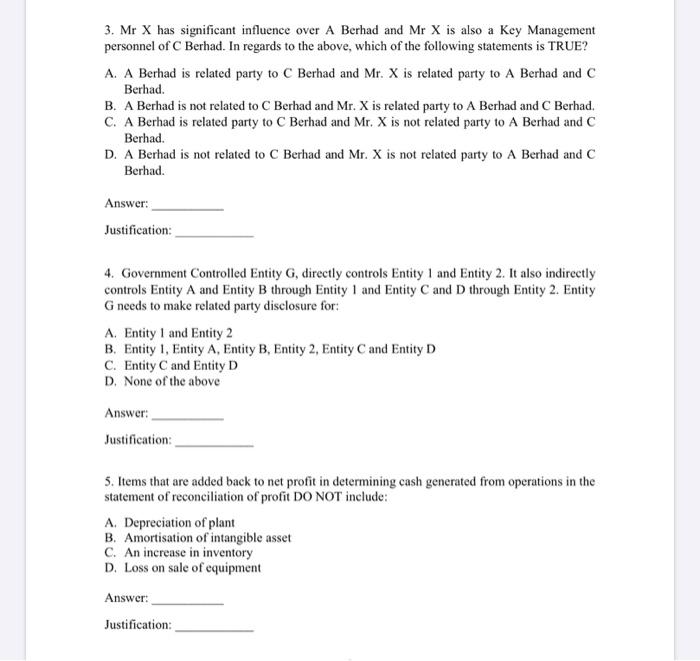

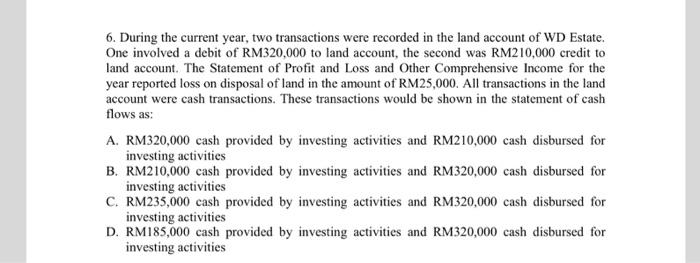

3. Mr X has significant influence over A Berhad and Mr X is also a Key Management personnel of C Berhad. In regards to the above, which of the following statements is TRUE? A. A Berhad is related party to C Berhad and Mr. X is related party to A Berhad and C Berhad. B. A Berhad is not related to C Berhad and Mr. X is related party to A Berhad and C Berhad. C. A Berhad is related party to C Berhad and Mr. X is not related party to A Berhad and C Berhad. D. A Berhad is not related to C Berhad and Mr. X is not related party to A Berhad and C Berhad. Answer: Justification: 4. Government Controlled Entity G, directly controls Entity 1 and Entity 2. It also indirectly controls Entity A and Entity B through Entity 1 and Entity and through Entity 2. Entity G needs to make related party disclosure for: A. Entity and Entity 2 B. Entity 1, Entity A, Entity B. Entity 2, Entity C and Entity D C. Entity C and Entity D D. None of the above Answer: Justification: 5. Items that are added back to net profit in determining cash generated from operations in the statement of reconciliation of profit DO NOT include: A. Depreciation of plant B. Amortisation of intangible asset C. An increase in inventory D. Loss on sale of equipment Answer: Justification: 6. During the current year, two transactions were recorded in the land account of WD Estate. One involved a debit of RM320,000 to land account, the second was RM210,000 credit to land account. The Statement of Profit and Loss and Other Comprehensive Income for the year reported loss on disposal of land in the amount of RM25,000. All transactions in the land account were cash transactions. These transactions would be shown in the statement of cash flows as: A. RM320,000 cash provided by investing activities and RM210,000 cash disbursed for investing activities B. RM210,000 cash provided by investing activities and RM320,000 cash disbursed for investing activities C. RM235,000 cash provided by investing activities and RM320,000 cash disbursed for investing activities D. RM185,000 cash provided by investing activities and RM320,000 cash disbursed for investing activities

3. Mr X has significant influence over A Berhad and Mr X is also a Key Management personnel of C Berhad. In regards to the above, which of the following statements is TRUE? A. A Berhad is related party to C Berhad and Mr. X is related party to A Berhad and C Berhad. B. A Berhad is not related to C Berhad and Mr. X is related party to A Berhad and C Berhad. C. A Berhad is related party to C Berhad and Mr. X is not related party to A Berhad and C Berhad. D. A Berhad is not related to C Berhad and Mr. X is not related party to A Berhad and C Berhad. Answer: Justification: 4. Government Controlled Entity G, directly controls Entity 1 and Entity 2. It also indirectly controls Entity A and Entity B through Entity 1 and Entity and through Entity 2. Entity G needs to make related party disclosure for: A. Entity and Entity 2 B. Entity 1, Entity A, Entity B. Entity 2, Entity C and Entity D C. Entity C and Entity D D. None of the above Answer: Justification: 5. Items that are added back to net profit in determining cash generated from operations in the statement of reconciliation of profit DO NOT include: A. Depreciation of plant B. Amortisation of intangible asset C. An increase in inventory D. Loss on sale of equipment Answer: Justification: 6. During the current year, two transactions were recorded in the land account of WD Estate. One involved a debit of RM320,000 to land account, the second was RM210,000 credit to land account. The Statement of Profit and Loss and Other Comprehensive Income for the year reported loss on disposal of land in the amount of RM25,000. All transactions in the land account were cash transactions. These transactions would be shown in the statement of cash flows as: A. RM320,000 cash provided by investing activities and RM210,000 cash disbursed for investing activities B. RM210,000 cash provided by investing activities and RM320,000 cash disbursed for investing activities C. RM235,000 cash provided by investing activities and RM320,000 cash disbursed for investing activities D. RM185,000 cash provided by investing activities and RM320,000 cash disbursed for investing activities

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started