Question

*Answer MUST contain excel formula/function. List below Your boss now wants you to help Higgs Bassoon Corporation. Higgs Bassoon Corporation is a custom manufacturer of

*Answer MUST contain excel formula/function. List below

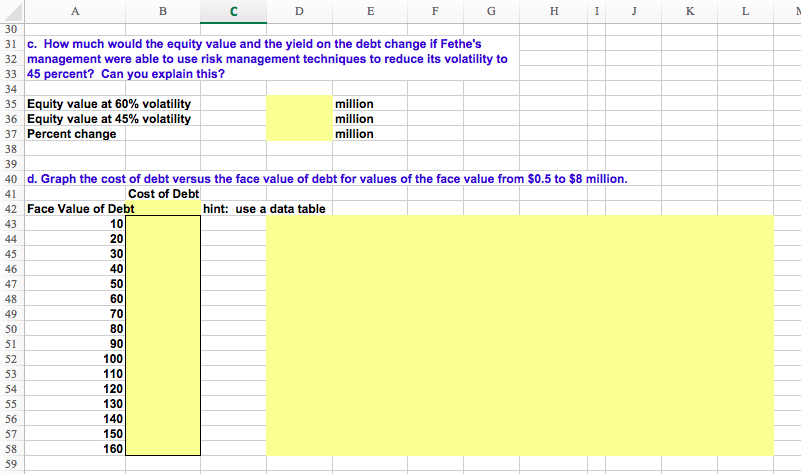

Your boss now wants you to help Higgs Bassoon Corporation. Higgs Bassoon Corporation is a custom manufacturer of bassoons and other wind instruments. Its current value of operations, which is also its value of debt plus equity, is estimated to be $200 million. Higgs has zero coupon debt outstanding that matures in 3 years with $110 million face value. The risk-free rate is 5%, and the standard deviation of returns for similar companies is 60%. The owners of Higgs Bassoon view their equity investment as an option and would like to know its value. Start with the attachedpartial model, and answer the following questions:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started