Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Answer Options Are: A. 1.51% B. 4.86% C. 5.06% D. 4.96% E. 12.67% - INCORRECT 6. The most recent financial statements for Live Co. are

Answer Options Are:

A. 1.51%

B. 4.86%

C. 5.06%

D. 4.96%

E. 12.67% - INCORRECT

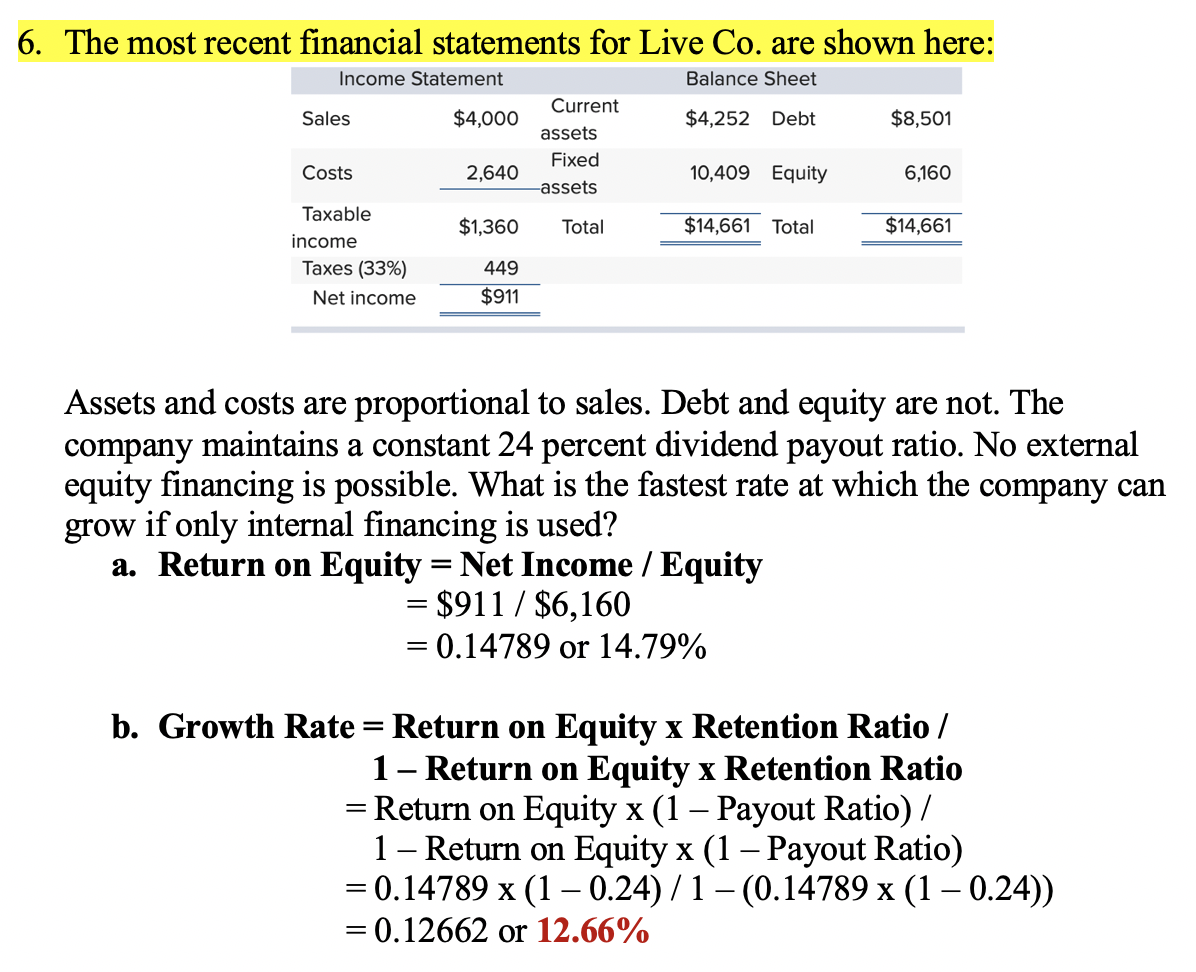

6. The most recent financial statements for Live Co. are shown here: Income Statement Balance Sheet Current Sales $4,000 $4,252 Debt $8,501 assets Fixed Costs 2,640 10,409 Equity 6,160 -assets Taxable $1,360 Total $14,661 Total $14,661 income Taxes (33%) 449 Net income $911 Assets and costs are proportional to sales. Debt and equity are not. The company maintains a constant 24 percent dividend payout ratio. No external equity financing is possible. What is the fastest rate at which the company can grow if only internal financing is used? a. Return on Equity = Net Income / Equity = $911 / $6,160 = 0.14789 or 14.79% b. Growth Rate = Return on Equity x Retention Ratio / 1- Return on Equity x Retention Ratio = Return on Equity x (1 Payout Ratio) / 1 - Return on Equity x (1 Payout Ratio) = 0.14789 x (1 0.24) / 1 (0.14789 x (1 0.24)) = 0.12662 or 12.66%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started