Answered step by step

Verified Expert Solution

Question

1 Approved Answer

answer part 1 please! Cost Classification (Requirement #1) The first action plan was to list all the key products or items that is needed to

answer part 1 please!

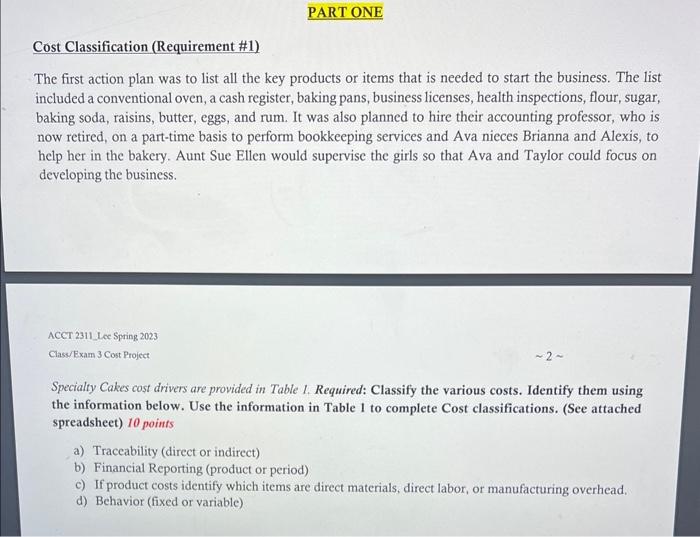

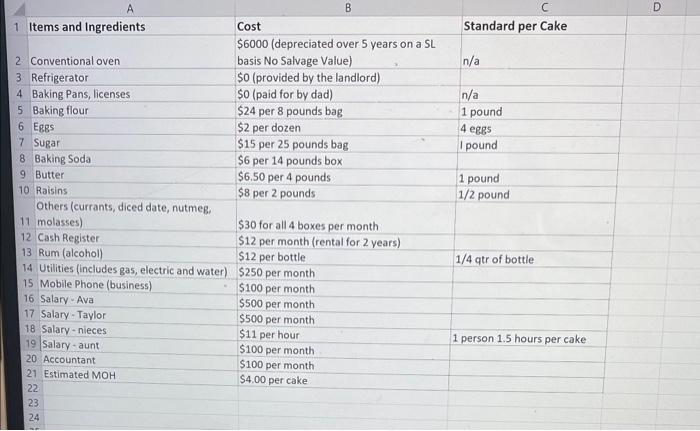

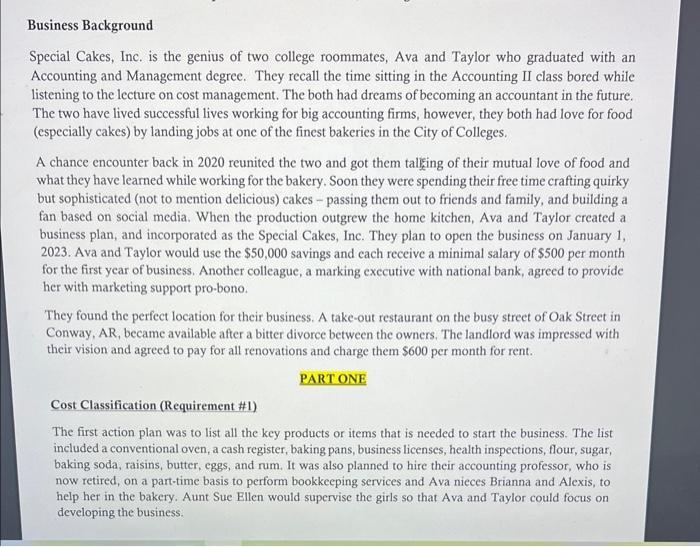

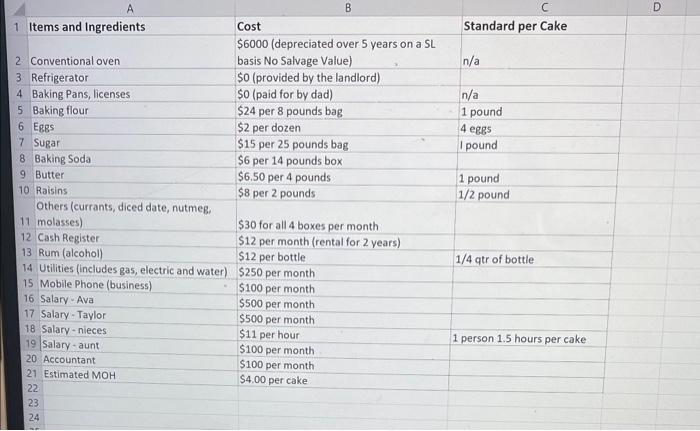

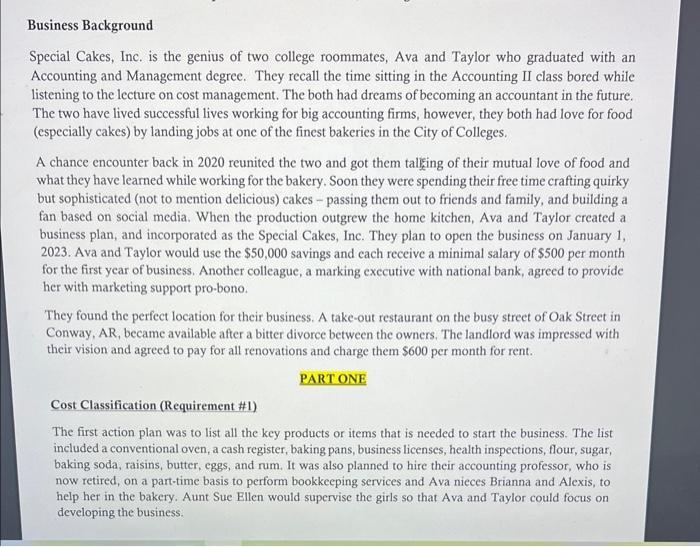

Cost Classification (Requirement \#1) The first action plan was to list all the key products or items that is needed to start the business. The list included a conventional oven, a cash register, baking pans, business licenses, health inspections, flour, sugar, baking soda, raisins, butter, eggs, and rum. It was also planned to hire their accounting professor, who is now retired, on a part-time basis to perform bookkeeping services and Ava nieces Brianna and Alexis, to help her in the bakery. Aunt Sue Ellen would supervise the girls so that Ava and Taylor could focus on developing the business. ACCT 2311 Lee Spring 2023 Class/Exam 3 Cost Project 2 Specialty Cakes cost drivers are provided in Table 1. Required: Classify the various costs. Identify them using the information below. Use the information in Table 1 to complete Cost classifications. (See attached spreadsheet) 10 points a) Traceability (direct or indirect) b) Financial Reporting (product or period) c) If product costs identify which items are direct materials, direct labor, or manufacturing overhead. d) Behavior (fixed or variable) Business Background Special Cakes, Inc. is the genius of two college roommates, Ava and Taylor who graduated with an Accounting and Management degree. They recall the time sitting in the Accounting II class bored while listening to the lecture on cost management. The both had dreams of becoming an accountant in the future. The two have lived successful lives working for big accounting firms, however, they both had love for food (especially cakes) by landing jobs at one of the finest bakeries in the City of Colleges. A chance encounter back in 2020 reunited the two and got them talliking of their mutual love of food and what they have learned while working for the bakery. Soon they were spending their free time crafting quirky but sophisticated (not to mention delicious) cakes - passing them out to friends and family, and building a fan based on social media. When the production outgrew the home kitchen, Ava and Taylor created a business plan, and incorporated as the Special Cakes, Inc. They plan to open the business on January 1 , 2023. Ava and Taylor would use the $50,000 savings and each receive a minimal salary of $500 per month for the first year of business. Another colleague, a marking executive with national bank, agreed to provide her with marketing support pro-bono. They found the perfect location for their business. A take-out restaurant on the busy street of Oak Street in Conway, AR, became available after a bitter divorce between the owners. The landlord was impressed with their vision and agreed to pay for all renovations and charge them $600 per month for rent. PART ONE Cost Classification (Requirement \#1) The first action plan was to list all the key products or items that is needed to start the business. The list included a conventional oven, a cash register, baking pans, business licenses, health inspections, flour, sugar, baking soda, raisins, butter, eggs, and rum. It was also planned to hire their accounting professor, who is now retired, on a part-time basis to perform bookkeeping services and Ava nieces Brianna and Alexis, to help her in the bakery. Aunt Sue Ellen would supervise the girls so that Ava and Taylor could focus on developing the business

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started