Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Answer part A & B.. Nash Library, a nonprofit organization, presented the following statement of financial position and statement of activities for its fiscal year

Answer part A & B..

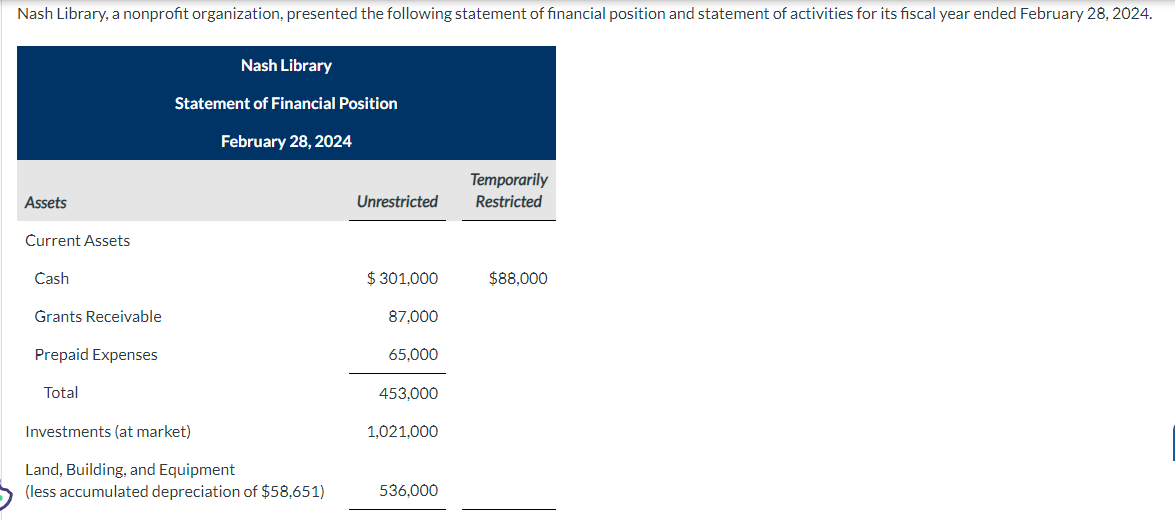

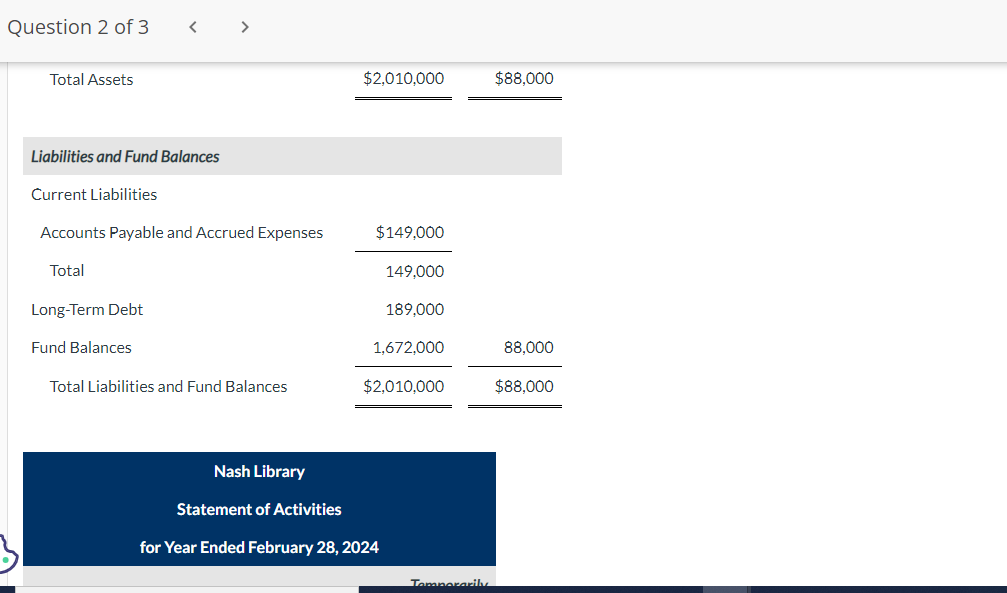

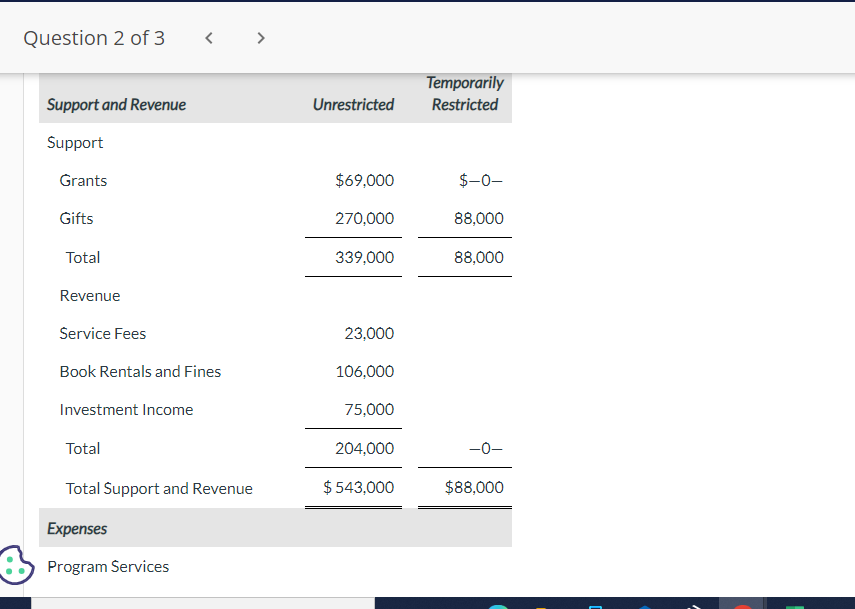

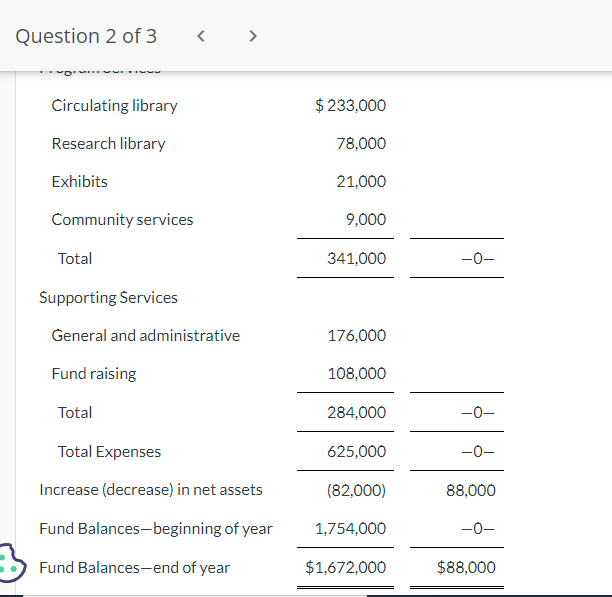

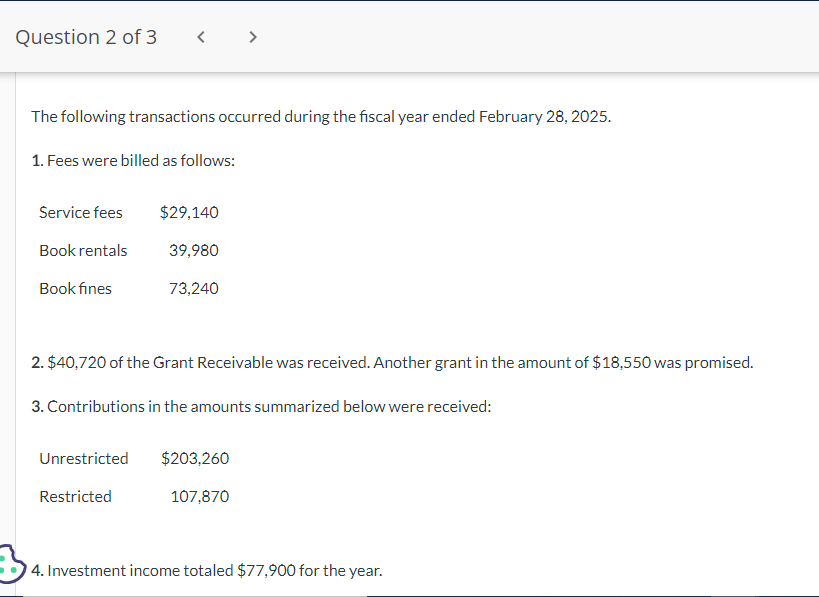

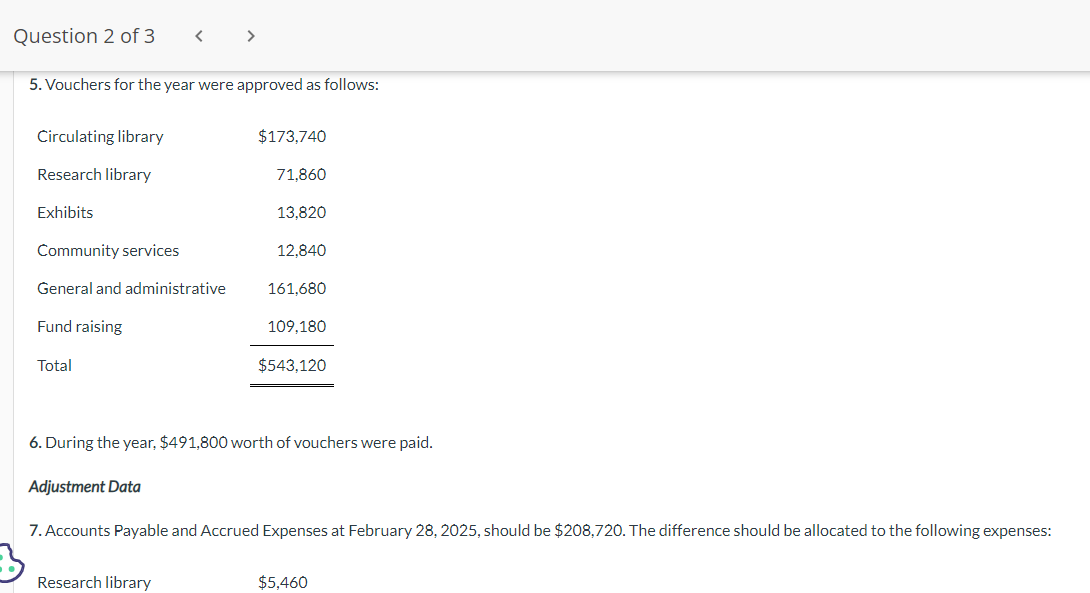

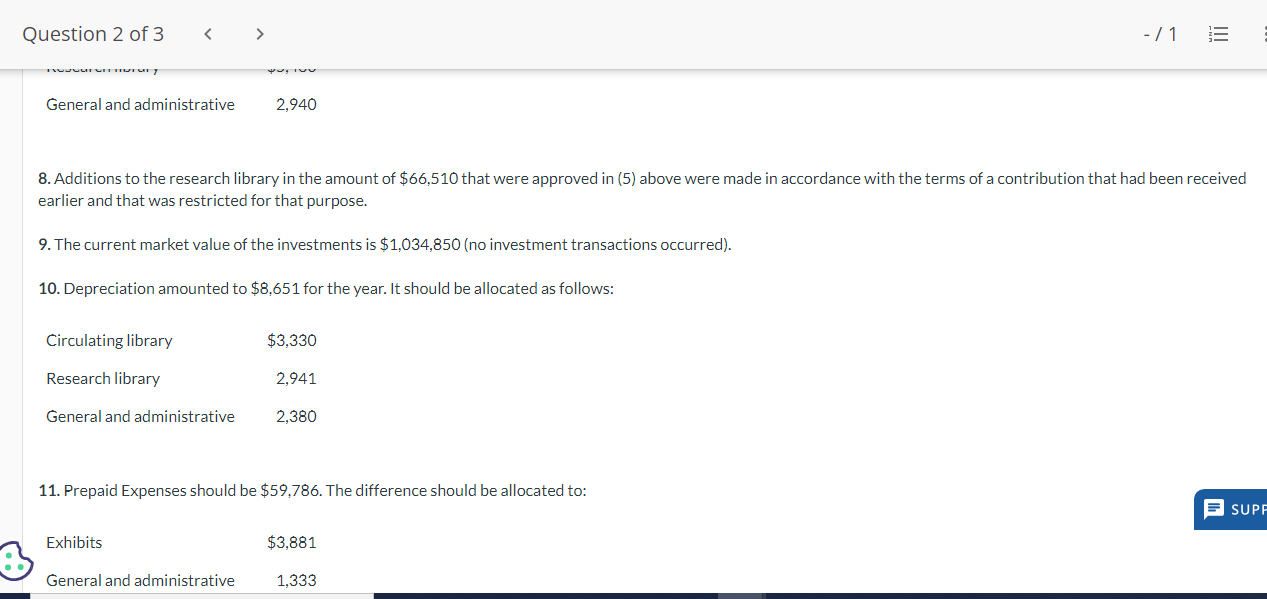

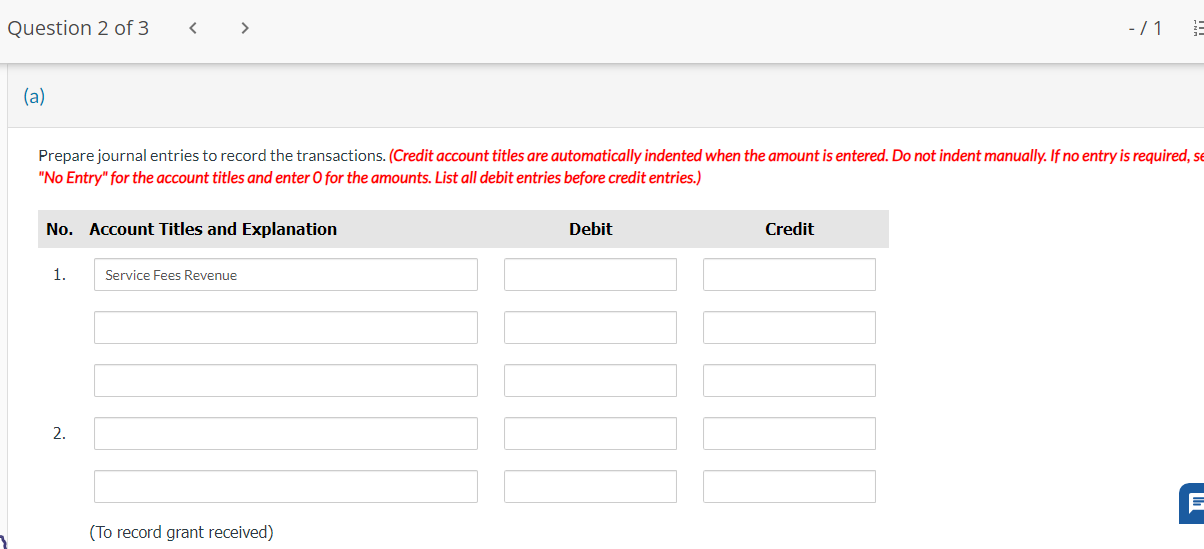

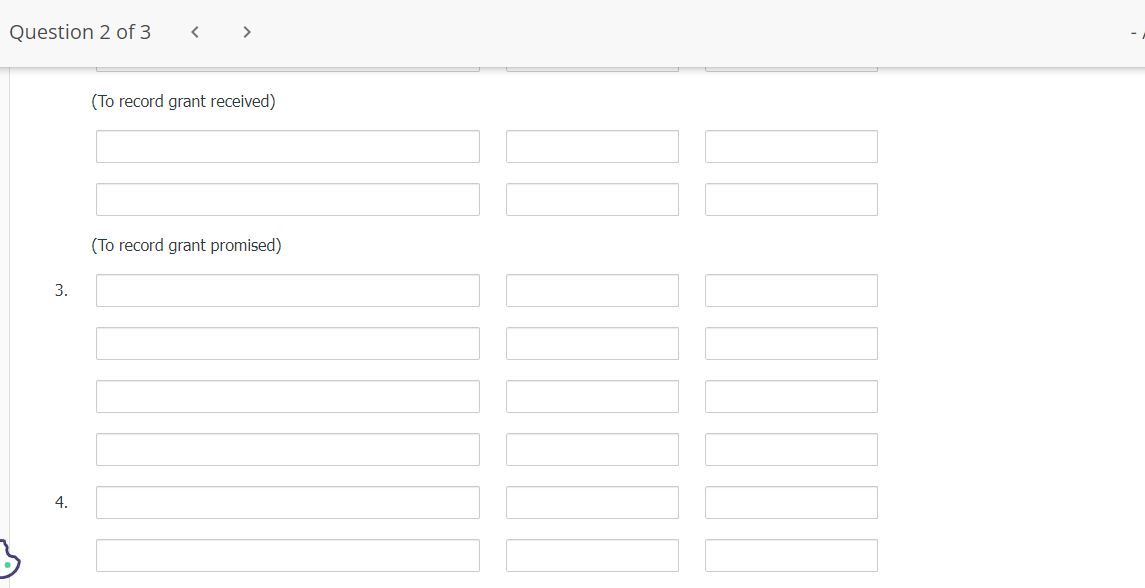

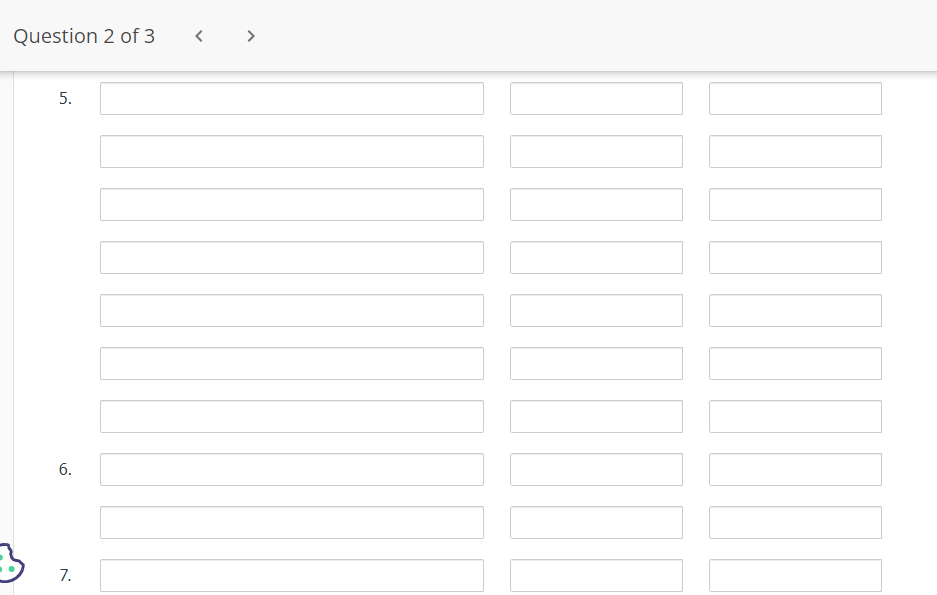

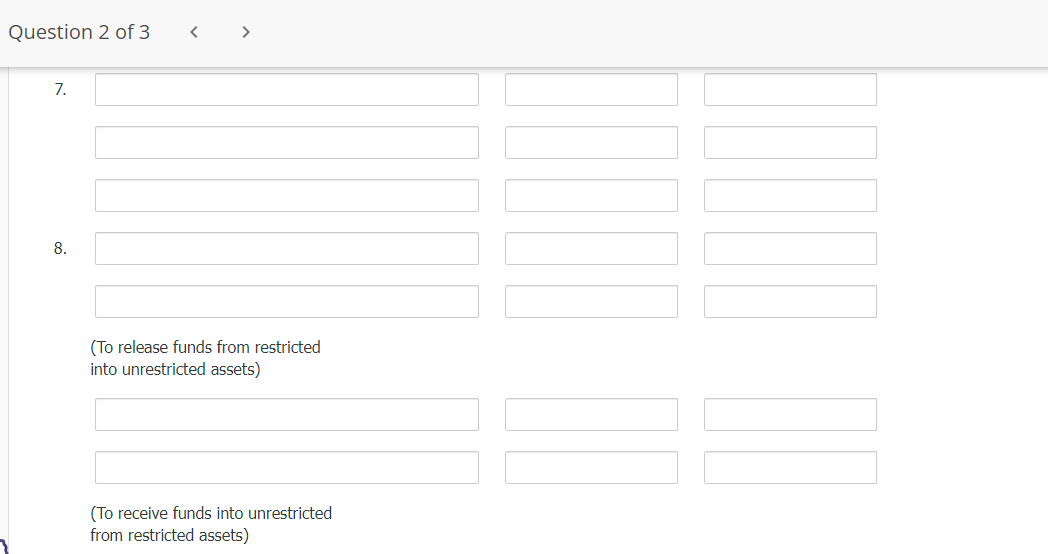

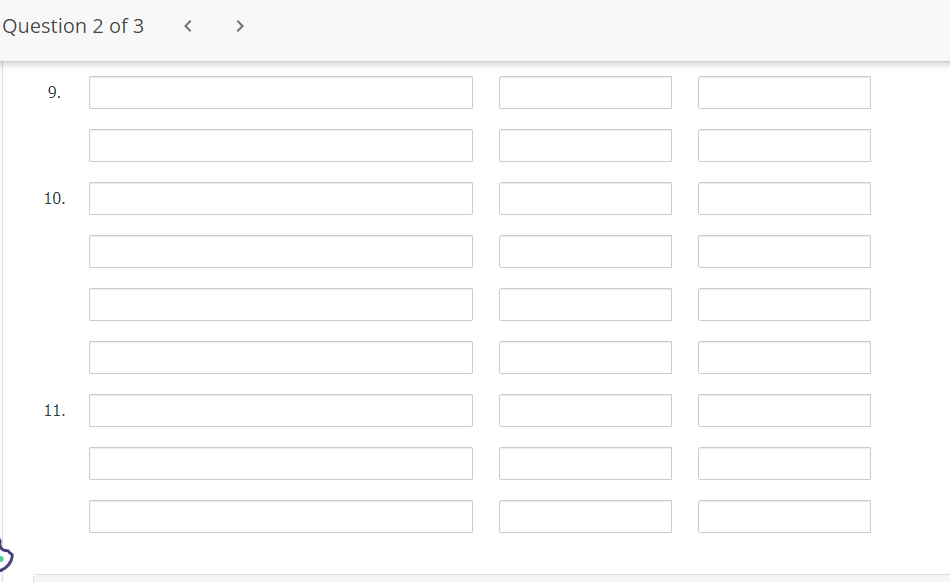

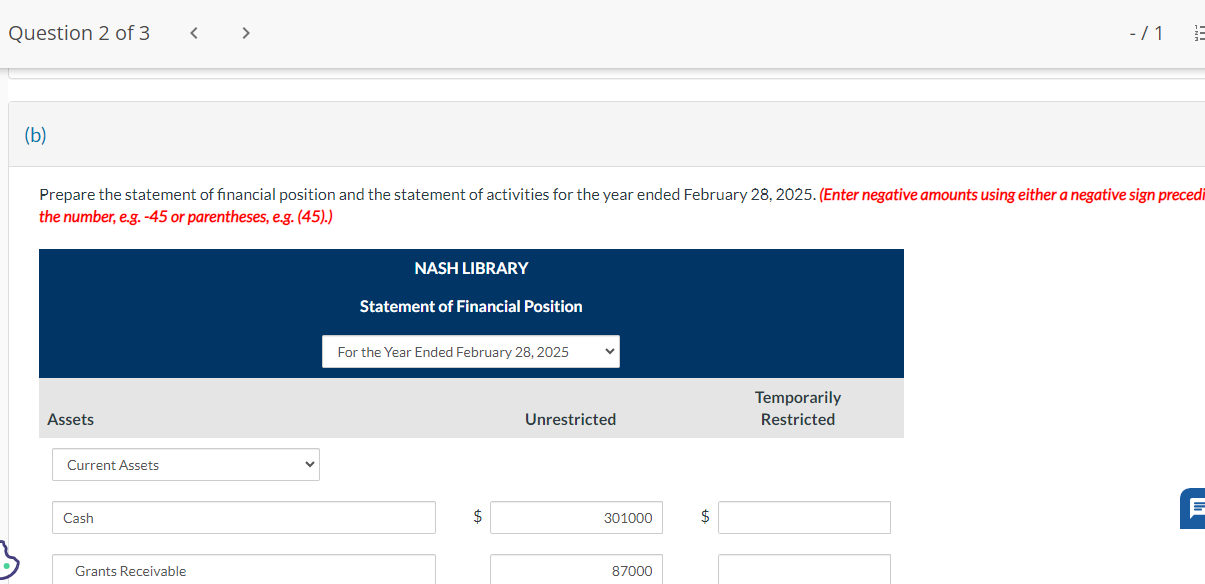

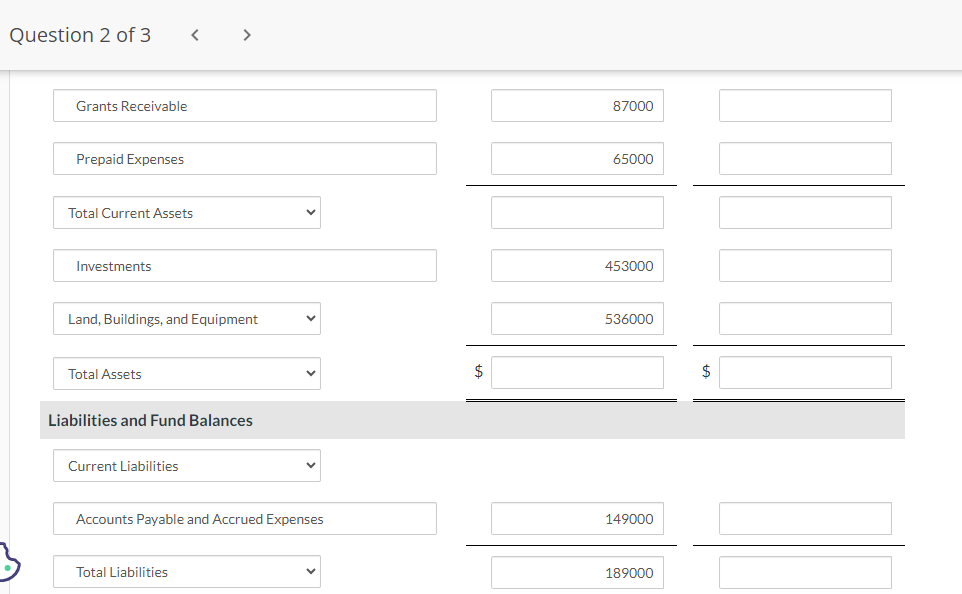

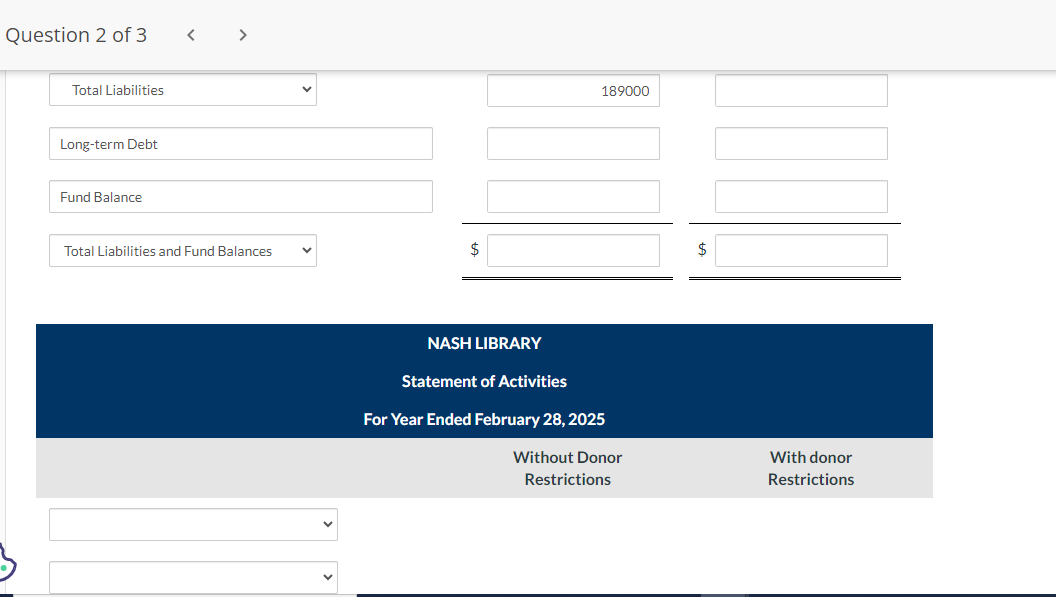

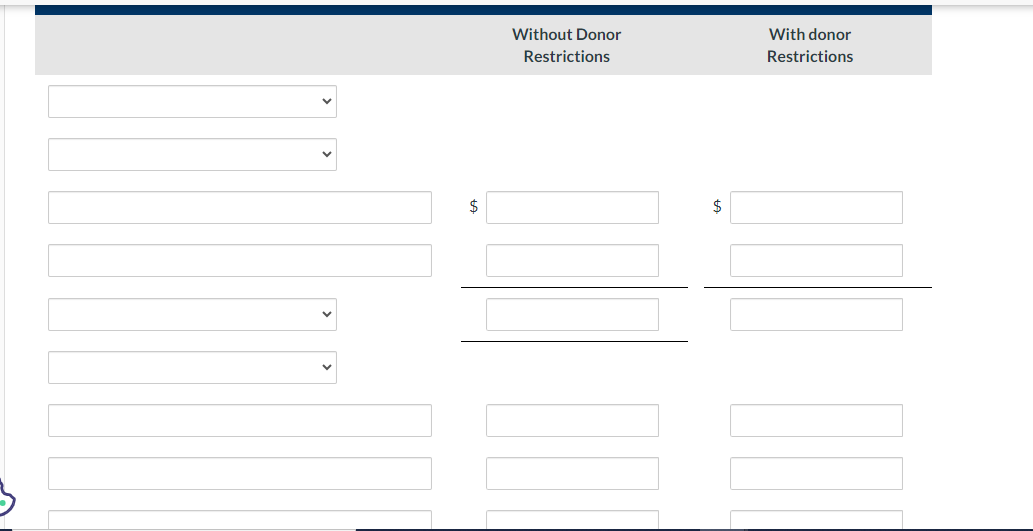

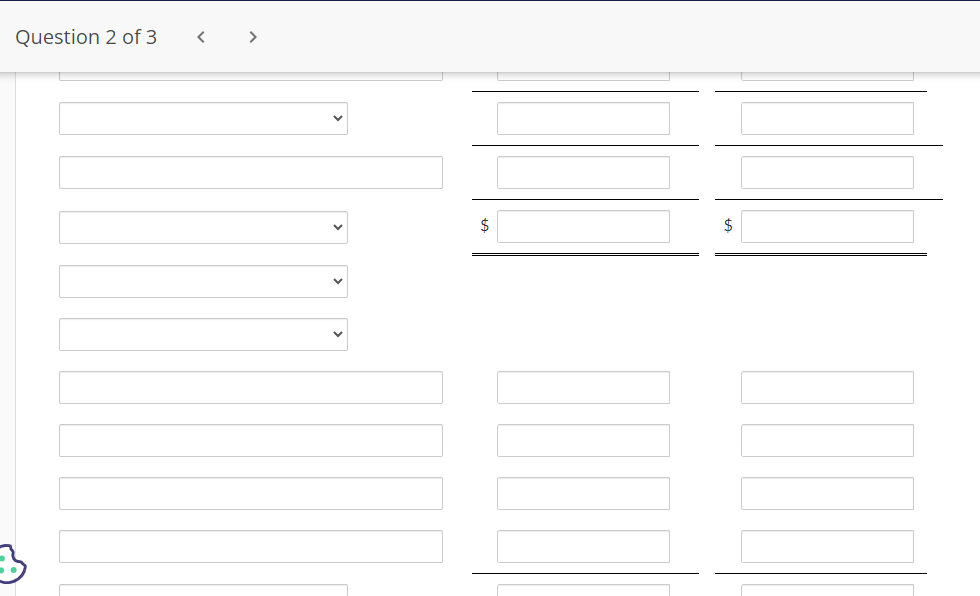

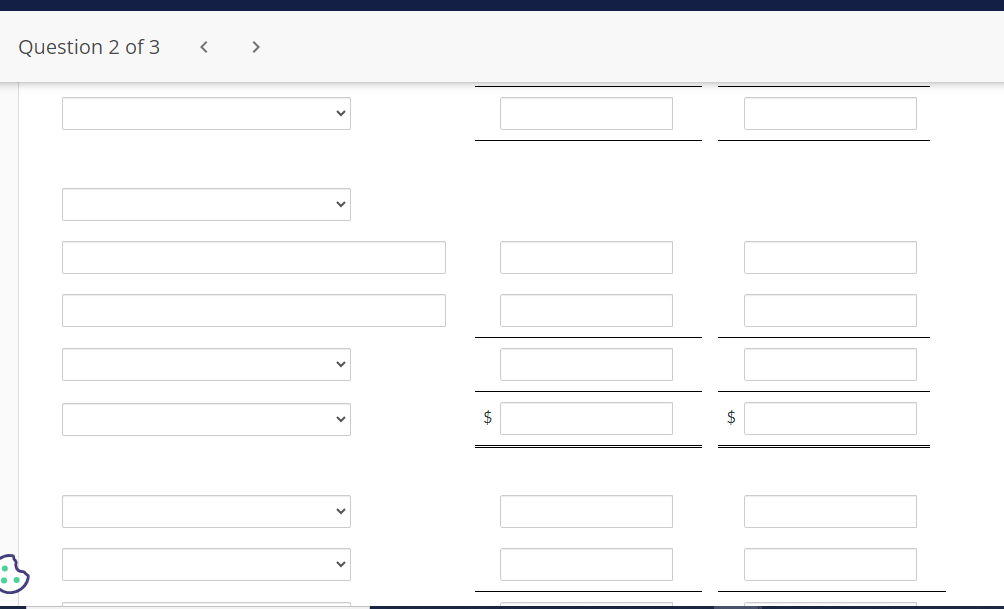

Nash Library, a nonprofit organization, presented the following statement of financial position and statement of activities for its fiscal year ended February 28,2024. \begin{tabular}{|c|c|c|} \hline \multicolumn{3}{|c|}{\begin{tabular}{c} Nash Library \\ Statement of Financial Position \\ February 28, 2024 \end{tabular}} \\ \hline Assets & Unrestricted & \begin{tabular}{l} Temporarily \\ Restricted \end{tabular} \\ \hline \multicolumn{3}{|l|}{ Current Assets } \\ \hline Cash & $301,000 & $88,000 \\ \hline Grants Receivable & 87,000 & \\ \hline Prepaid Expenses & 65,000 & \\ \hline Total & 453,000 & \\ \hline Investments (at market) & 1,021,000 & \\ \hline \begin{tabular}{l} Land, Building, and Equipment \\ (less accumulated depreciation of $58,651 ) \end{tabular} & 536,000 & \\ \hline \end{tabular} Question 2 of 3 Total Assets \begin{tabular}{|c|c|} \hline$2,010,000 & $88,000 \\ \hline \end{tabular} Liabilities and Fund Balances Current Liabilities \begin{tabular}{|c|c|c|} \hline Accounts Payable and Accrued Expenses & $149,000 & \\ \hline Total & 149,000 & \\ \hline Long-Term Debt & 189,000 & \\ \hline Fund Balances & 1,672,000 & 88,000 \\ \hline Total Liabilities and Fund Balances & $2,010,000 & $88,000 \\ \hline \end{tabular} Nash Library Statement of Activities for Year Ended February 28, 2024 Question 2 of 3 \begin{tabular}{|c|c|c|} \hline Support and Revenue & Unrestricted & \begin{tabular}{c} Temporarily \\ Restricted \end{tabular} \\ \hline \multicolumn{3}{|l|}{ Support } \\ \hline Grants & $69,000 & $0 \\ \hline Gifts & 270,000 & 88,000 \\ \hline Total & 339,000 & 88,000 \\ \hline \multicolumn{3}{|l|}{ Revenue } \\ \hline Service Fees & 23,000 & \\ \hline Book Rentals and Fines & 106,000 & \\ \hline Investment Income & 75,000 & \\ \hline Total & 204,000 & 0 \\ \hline Total Support and Revenue & $543,000 & $88,000 \\ \hline \end{tabular} Program Services The following transactions occurred during the fiscal year ended February 28, 2025. 1. Fees were billed as follows: 2. $40,720 of the Grant Receivable was received. Another grant in the amount of $18,550 was promised. 3. Contributions in the amounts summarized below were received: 4. Investment income totaled $77,900 for the year. 5. Vouchers for the year were approved as follows: 6. During the year, $491,800 worth of vouchers were paid. Adjustment Data 7. Accounts Payable and Accrued Expenses at February 28,2025 , should be $208,720. The difference should be allocated to the following expenses: 8. Additions to the research library in the amount of $66,510 that were approved in (5) above were made in accordance with the terms of a contribution that had been received earlier and that was restricted for that purpose. 9. The current market value of the investments is $1,034,850 (no investment transactions occurred). 10. Depreciation amounted to $8,651 for the year. It should be allocated as follows: 11. Prepaid Expenses should be $59,786. The difference should be allocated to: Prepare journal entries to record the transactions. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, "No Entry" for the account titles and enter 0 for the amounts. List all debit entries before credit entries.) Question 2 of 3 (To record grant received) (To record grant promised) 3. 4. Question 2 of 3 5. 6. 7. Question 2 of 3 7. 8. (To release funds from restricted into unrestricted assets) (To receive funds into unrestricted from restricted assets) Question 2 of 3 9. 10. 11. Prepare the statement of financial position and the statement of activities for the year ended February 28,2025 . (Enter negative amounts using either a negative sign precec the number, e.g. -45 or parentheses, e.g. (45).) Question 2 of 3 Grants Receivable Prepaid Expenses Total Current Assets Investments Land, Buildings, and Equipment Total Assets Liabilities and Fund Balances Current Liabilities Accounts Payable and Accrued Expenses Total Liabilities Question 2 of 3 Total Liabilities Long-term Debt Fund Balance Total Liabilities and Fund Balances 189000 NASH LIBRARY Statement of Activities For Year Ended February 28, 2025 Without Donor Restrictions With donor Restrictions Without Donor With donor Restrictions Restrictions Question 2 of 3 Question 2 of 3

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started