Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Answer part b (20) 9. The Pioneer Company has the following balance sheet: Assets Cash Marketable securities Accounts receivable Inventory Total current assets Plant &

Answer part b

Answer part b

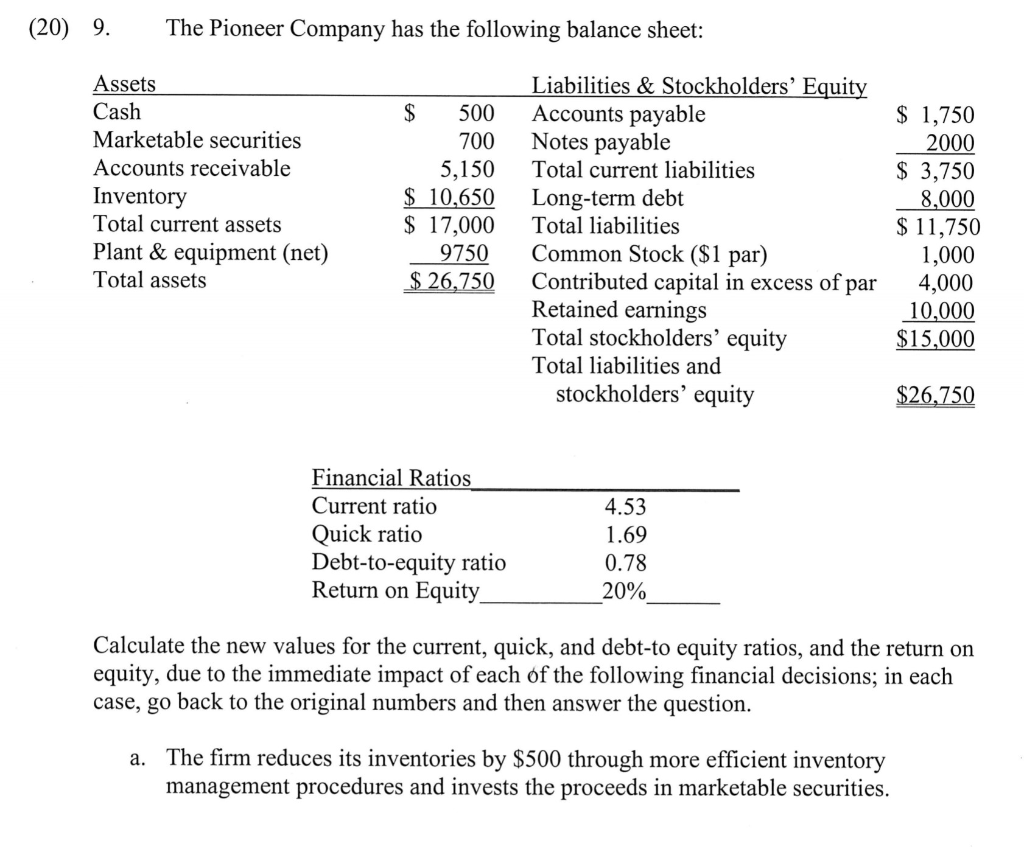

(20) 9. The Pioneer Company has the following balance sheet: Assets Cash Marketable securities Accounts receivable Inventory Total current assets Plant & equipment (net) Total assets $ 500 700 5,150 $ 10,650 $ 17,000 9750 $ 26,750 Liabilities & Stockholders' Equity Accounts payable Notes payable Total current liabilities Long-term debt Total liabilities Common Stock ($1 par) Contributed capital in excess of par Retained earnings Total stockholders' equity Total liabilities and stockholders' equity $ 1,750 2000 $ 3,750 8,000 $ 11,750 1,000 4,000 10,000 $15,000 $26,750 Financial Ratios Current ratio Quick ratio Debt-to-equity ratio Return on Equity 4.53 1.69 0.78 20% Calculate the new values for the current, quick, and debt-to equity ratios, and the return on equity, due to the immediate impact of each of the following financial decisions; in each case, go back to the original numbers and then answer the question. a. The firm reduces its inventories by $500 through more efficient inventory management procedures and invests the proceeds in marketable securities. b. The firm decides to purchase 20 new delivery trucks for a total of $500 and pays for them by selling marketable securities

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started