Answered step by step

Verified Expert Solution

Question

1 Approved Answer

answer please 1. Philip is retiring and wants to sell his company to his junior partners and is using discounted cash flow analysis to value

answer please

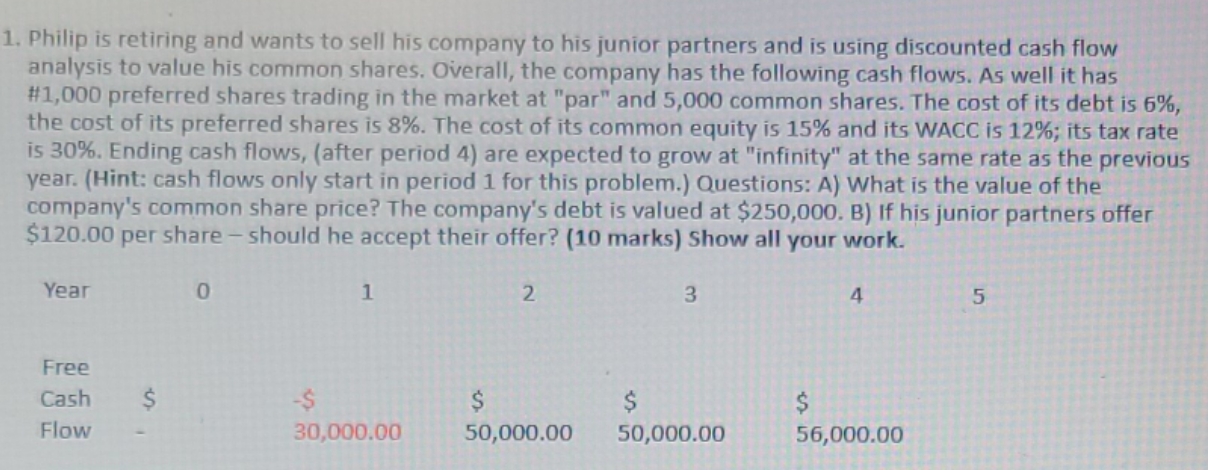

1. Philip is retiring and wants to sell his company to his junior partners and is using discounted cash flow analysis to value his common shares. Overall, the company has the following cash flows. As well it has #1,000 preferred shares trading in the market at "par" and 5,000 common shares. The cost of its debt is 6%, the cost of its preferred shares is 8%. The cost of its common equity is 15% and its WACC is 12%; its tax rate is 30%. Ending cash flows, (after period 4) are expected to grow at "infinity" at the same rate as the previous year. (Hint: cash flows only start in period 1 for this problem.) Questions: A) What is the value of the company's common share price? The company's debt is valued at $250,000. B) If his junior partners offer $120.00 per share-should he accept their offer? (10 marks) Show all your work. Year Free Cash Flow 0 1 2 3 4 5 ST $ $ 30,000.00 50,000.00 50,000.00 56,000.00

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the value of the companys common share price well use the discounted cash flow DCF anal...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started