Answered step by step

Verified Expert Solution

Question

1 Approved Answer

answer please A young graduate is planning on buying a new car in two years. The car the young graduate wants is a BMW 3.Series

answer please

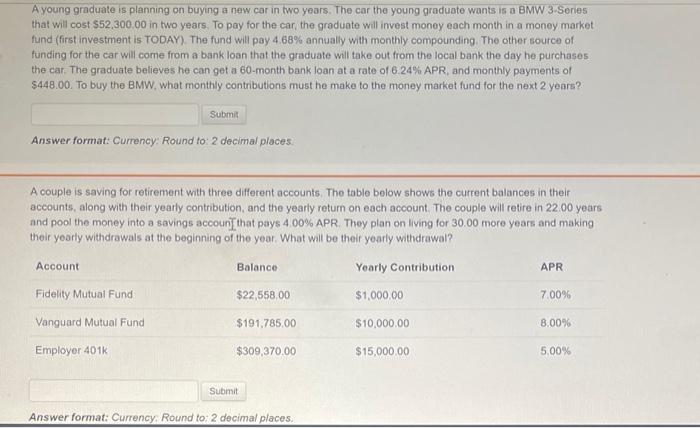

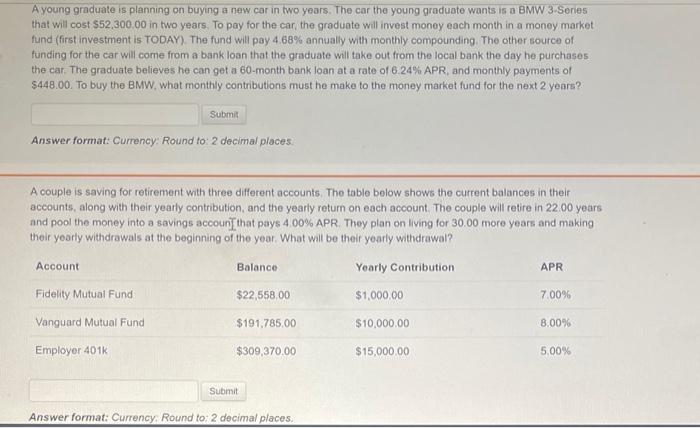

A young graduate is planning on buying a new car in two years. The car the young graduate wants is a BMW 3.Series that will cost $52,300.00 in two years. To pay for the car, the graduate will invest money each month in a money market fund (first investment is TODAY). The fund will pay 4.68% annually with monthly compounding. The other source of funding for the car will come from a bank loan that the graduate will take out from the local bank the day he purchases the car- The graduate believes he can get a 60 -month bank loan at a rate of 6.24% APR, and monthly payments of $448.00. To buy the BMW, what monthly contributions must he make to the money market fund for the next 2 years? Answer format: Currency: Round to: 2 decimal places. A couple is saving for retirement with three different accounts. The table below shows the current balances in their accounts, along with their yearly contribution, and the yearly return on each account. The couple will retire in 22.00 years and pool the money into a savings accounf that pays 4.00% APR. They plan on living for 30.00 more years and making their yoarly withdrawals at the beginning of the year. What will be their yearly withdrawal? Answer format: Currency: Round to: 2 decimal places

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started