Answered step by step

Verified Expert Solution

Question

1 Approved Answer

answer please all questions A new retail business has sales of $100,000, cost of goods sold of $35,000, salaries of $15,000, rental of $4,000, and

answer please all questions

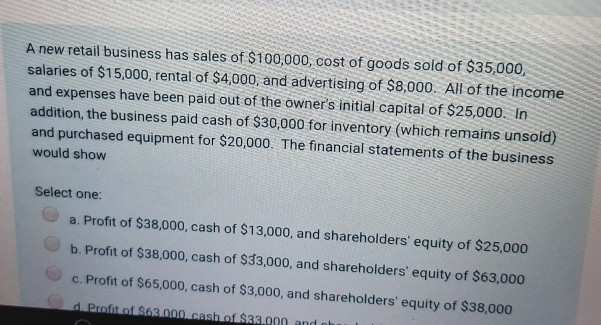

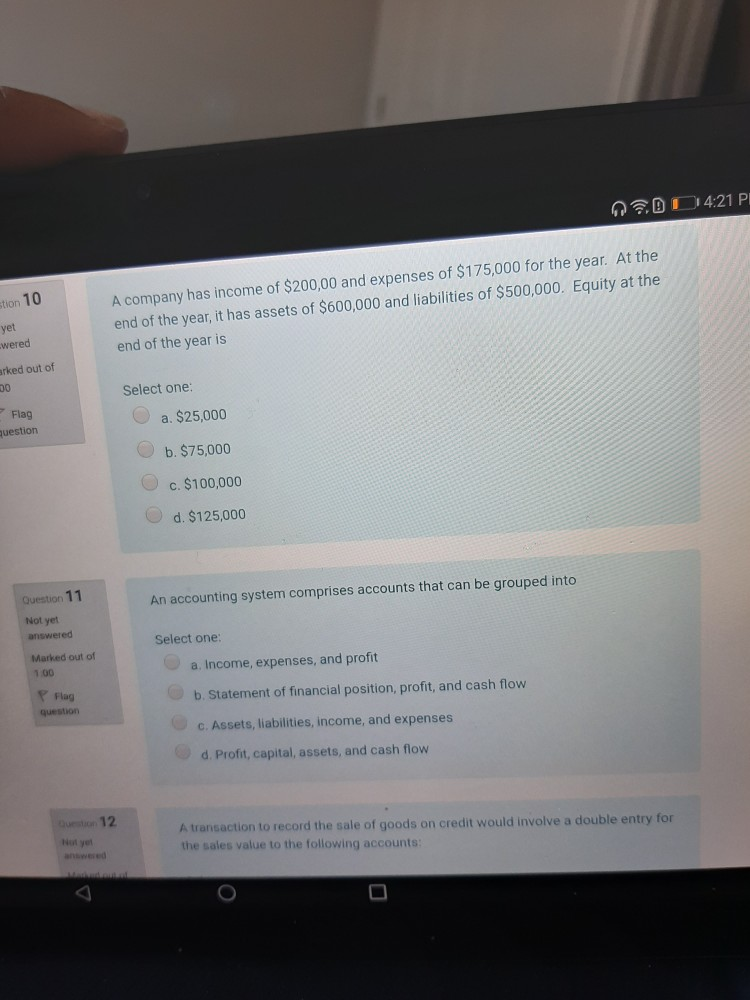

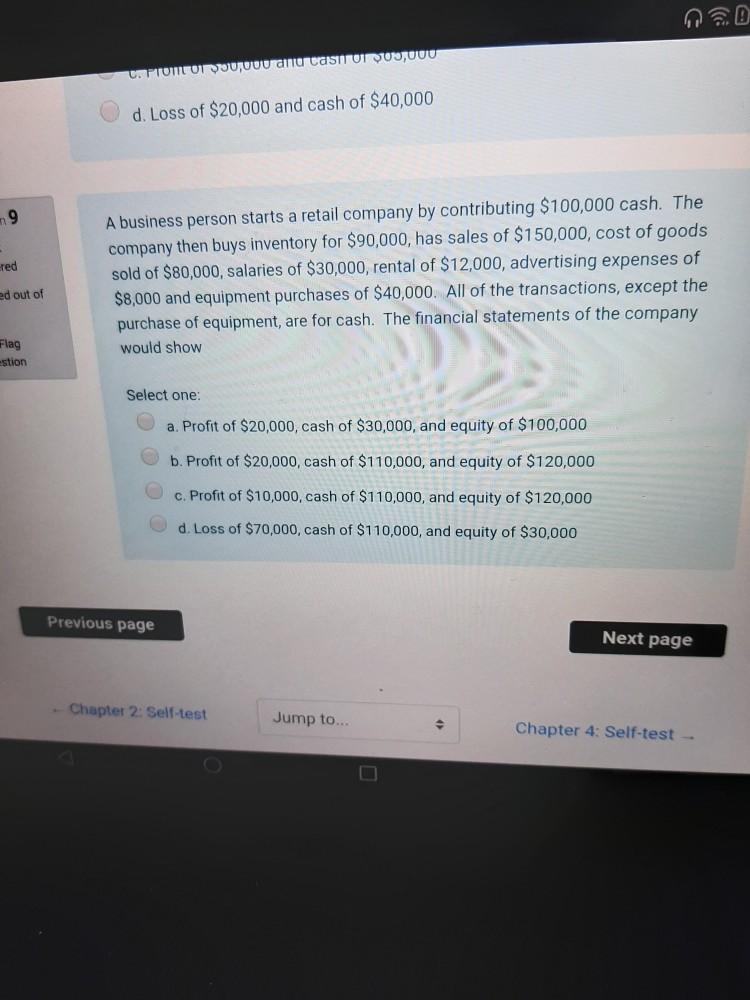

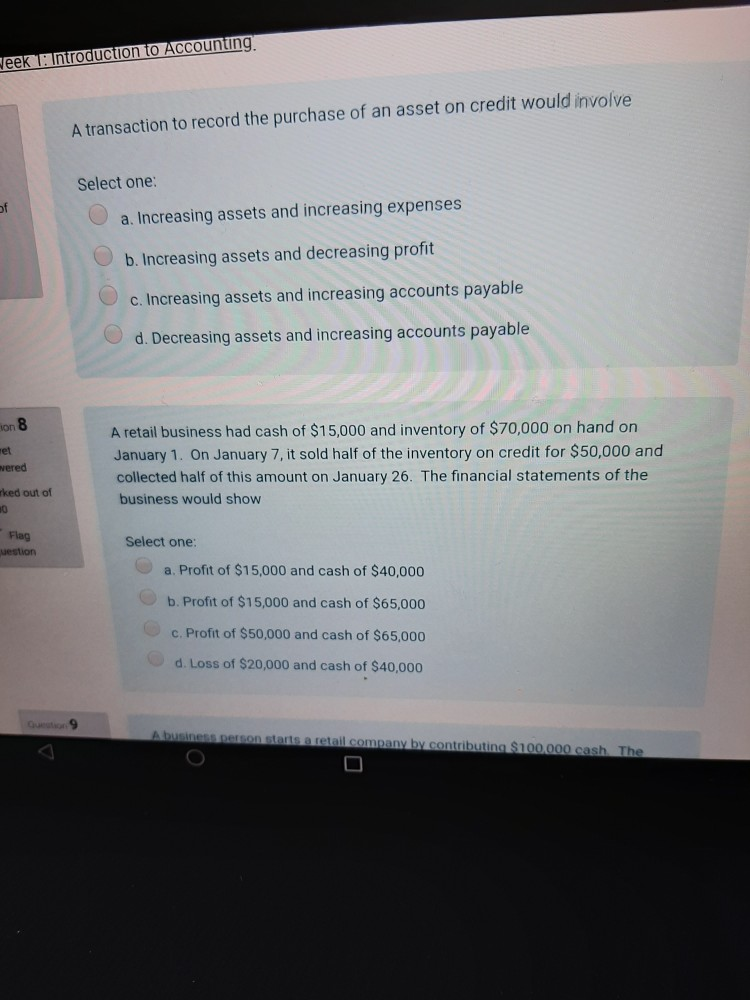

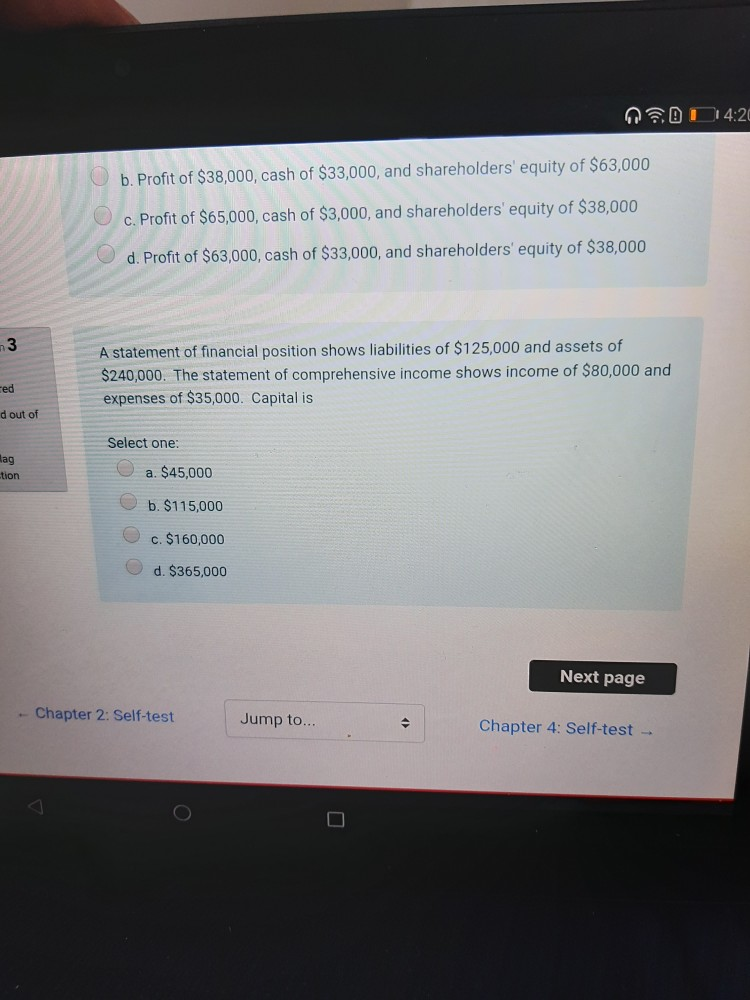

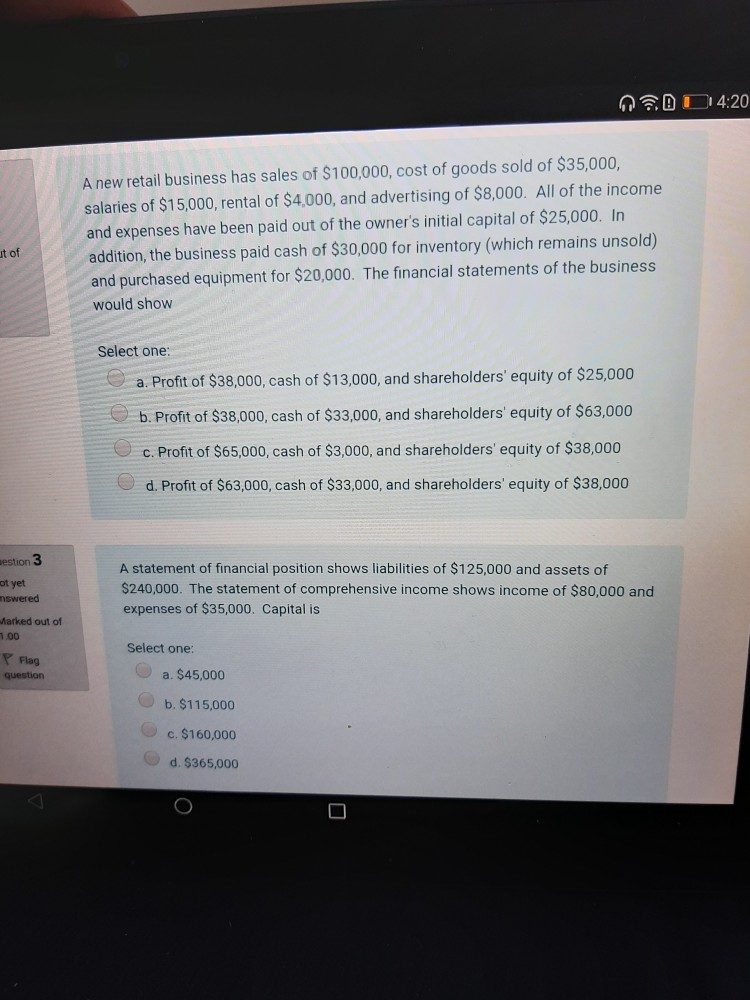

A new retail business has sales of $100,000, cost of goods sold of $35,000, salaries of $15,000, rental of $4,000, and advertising of $8,000. All of the income and expenses have been paid out of the owner's initial capital of $25,000. In addition, the business paid cash of $30,000 for inventory (which remains unsold) and purchased equipment for $20,000. The financial statements of the business would show Select one: a. Profit of $38,000, cash of $13,000, and shareholders' equity of $25,000 b. Profit of $38,000, cash of $33,000, and shareholders' equity of $63,000 c. Profit of $65,000, cash of $3,000, and shareholders' equity of $38,000 d. Profit of $62.000 cash of $32.000 and OD 4:21 PI stion 10 yet A company has income of $200,00 and expenses of $175,000 for the year. At the end of the year, it has assets of $600,000 and liabilities of $500,000. Equity at the end of the year is wered arked out of 00 Select one: Flag a. $25,000 question b. $75,000 c. $100,000 d. $125,000 Question 11 An accounting system comprises accounts that can be grouped into Not yet answered Select one: Marked out of 100 a. Income, expenses, and profit P Flag question b. Statement of financial position, profit, and cash flow c. Assets, liabilities, income, and expenses d. Profit, capital, assets, and cash flow Question 12 A transaction to record the sale of goods on credit would involve a double entry for the sales value to the following accounts: , cas d. Loss of $20,000 and cash of $40,000 9 ered A business person starts a retail company by contributing $100,000 cash. The company then buys inventory for $90,000, has sales of $150,000, cost of goods sold of $80,000, salaries of $30,000, rental of $12,000, advertising expenses of $8,000 and equipment purchases of $40,000. All of the transactions, except the purchase of equipment, are for cash. The financial statements of the company would show ed out of Flag estion Select one: a. Profit of $20,000, cash of $30,000, and equity of $100,000 b. Profit of $20,000, cash of $110,000, and equity of $120,000 c. Profit of $10,000, cash of $110,000, and equity of $120,000 d. Loss of $70,000, cash of $110,000, and equity of $30,000 Previous page Next page Chapter 2: Self-test Jump to... Chapter 4: Self-test - Week Introduction to Accounting A transaction to record the purchase of an asset on credit would involve Select one: of a. Increasing assets and increasing expenses b. Increasing assets and decreasing profit c. Increasing assets and increasing accounts payable d. Decreasing assets and increasing accounts payable son 8 ret wered A retail business had cash of $15,000 and inventory of $70,000 on hand on January 1. On January 7, it sold half of the inventory on credit for $50,000 and collected half of this amount on January 26. The financial statements of the business would show rked out of Flag uestion Select one: a. Profit of $15,000 and cash of $40,000 b. Profit of $15,000 and cash of $65,000 c. Profit of $50,000 and cash of $65,000 d. Loss of $20,000 and cash of $40,000 A business starts a retail company by contributing $100.000 cash The QSOO14:20 b. Profit of $38,000, cash of $33,000, and shareholders' equity of $63,000 c. Profit of $65,000, cash of $3,000, and shareholders' equity of $38,000 d. Profit of $63,000, cash of $33,000, and shareholders' equity of $38,000 3 A statement of financial position shows liabilities of $125,000 and assets of $240,000. The statement of comprehensive income shows income of $80,000 and expenses of $35,000. Capital is red d out of Select one: lag ction a. $45.000 b. $115,000 c. $160,000 d. $365,000 Next page Chapter 2: Self-test Jump to... Chapter 4: Self-test - ODD14:20 A new retail business has sales of $100,000, cost of goods sold of $35,000, salaries of $15,000, rental of $4,000, and advertising of $8,000. All of the income and expenses have been paid out of the owner's initial capital of $25,000. In addition, the business paid cash of $30,000 for inventory (which remains unsold) and purchased equipment for $20,000. The financial statements of the business would show ut of Select one a. Profit of $38,000, cash of $13,000, and shareholders' equity of $25,000 b. Profit of $38,000, cash of $33,000, and shareholders' equity of $63,000 c. Profit of $65,000, cash of $3,000, and shareholders' equity of $38,000 d. Profit of $63,000, cash of $33,000, and shareholders' equity of $38,000 Destion 3 ot yet nswered Marked out of 1.00 A statement of financial position shows liabilities of $125,000 and assets of $240,000. The statement of comprehensive income shows income of $80,000 and expenses of $35,000. Capital is Select one: P Flag question a. $45,000 b. $115,000 c. $160,000 d. $365,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started