Answered step by step

Verified Expert Solution

Question

1 Approved Answer

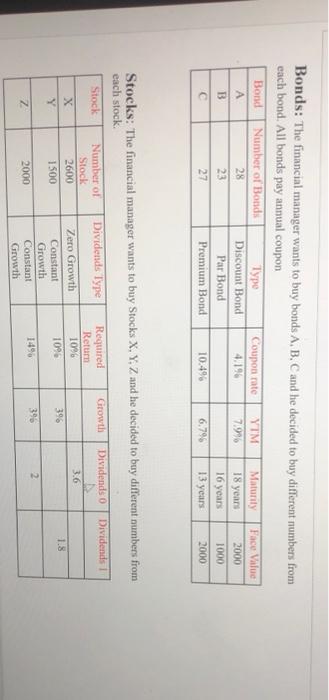

answer plz Bonds: The financial manager wants to buy bonds A, B, C and he decided to buy different numbers from each bond. All bonds

answer plz

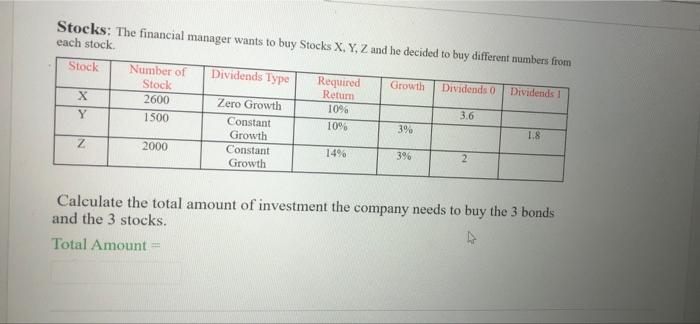

Bonds: The financial manager wants to buy bonds A, B, C and he decided to buy different numbers from each bond. All bonds pay annual coupon Bond Number of Bonds Typo Coupon rate YTM Maturity Face Value 28 Discount Bond 4.196 7.996 2000 B 23 Par Bond 1000 27 Premium Bond 10.496 6,796 2000 18 years 16 years 13 years Stocks: The financial manager wants to buy Stocks X, Y, Z and he decided to buy different numbers from each stock Stock Number of Dividends Type Required Growth Dividends o Dividends 1 Stock Return X 2600 Zero Growth 1096 3.6 Y 1500 Constant 1096 396 1.8 Growth 2000 Constant 396 2 Growth IN Stocks: The financial manager wants to buy Stocks X, Y, Z and he decided to buy different numbers from each stock Stock Number of Dividends Type Required Growth Stock Dividends o Dividends 1 Retum X 2600 Zero Growth 10% 3.6 Y 1500 Constant 10% 3% 1.8 Growth Z 2000 Constant 14% 3% 2 Growth Calculate the total amount of investment the company needs to buy the 3 bonds and the 3 stocks. Total Amount Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started