Answered step by step

Verified Expert Solution

Question

1 Approved Answer

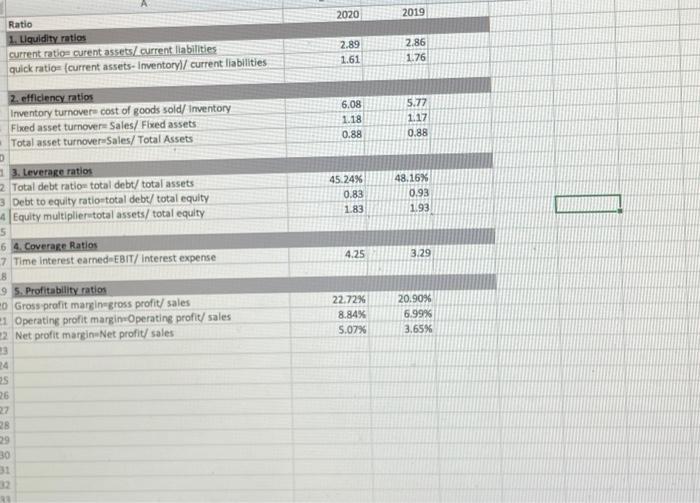

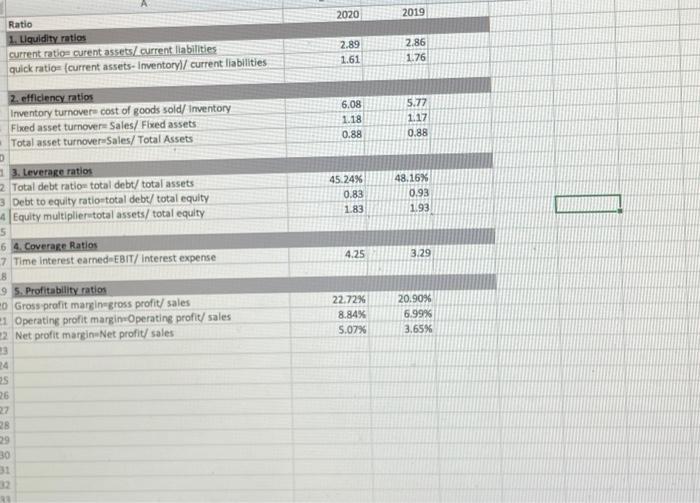

answer problems b and c 2020 2019 Ratio 1. Liquidity ratios current ratio- curent assets/ current liabilities quick ratior (current assets- Inventoryl/ current liabilities 2.89

answer problems b and c

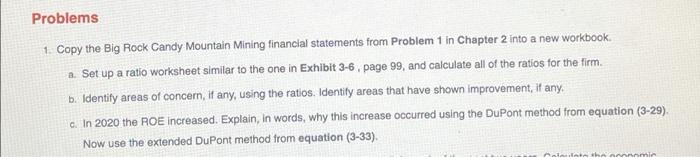

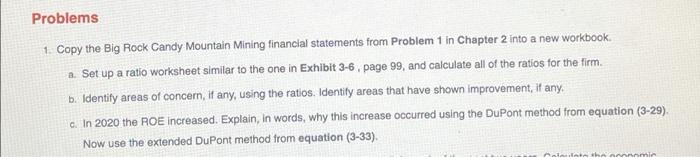

2020 2019 Ratio 1. Liquidity ratios current ratio- curent assets/ current liabilities quick ratior (current assets- Inventoryl/ current liabilities 2.89 1.61 2.86 1.76 6.08 1.18 0.88 5.77 1.17 0.88 D 1 45.24% 0.83 1.83 48.15% 0.93 193 2. efficiency ratios Inventory turnover cost of goods sold/ Inventory Fixed asset turnovere Sales/ Fixed assets Total asset turnover-Sales/Total Assets Leverage ratios 2 Total debt ratio total debt/ total assets 3 Debt to equity ratio total debt/total equity Equity multiplier total assets/total equity 5 64. Coverage Ratios 7 Time interest earned"EBIT/ interest expense 9 5. Profitability ratios - Gross profit margin-gross profit/ sales 1 Operating profit margin-Operating profit/ sales 2. Net profit margin.Net profit/ sales 4.25 3.29 8 22.72% 8.84% 5.07% 20.90% 6.99% 3.65% 14 95 26 27 28 29 30 31 2 Problems 1. Copy the Big Rock Candy Mountain Mining financial statements from Problem 1 in Chapter 2 into a new workbook. a. Set up a ratio worksheet similar to the one in Exhibit 3-6, page 99, and calculate all of the ratios for the firm. b. Identify areas of concern, if any, using the ratios. Identity areas that have shown improvement, if any. c. In 2020 the ROE Increased. Explain, in words, why this increase occurred using the DuPont method from equation (3-29). Now use the extended DuPont method from equation (3-33). mir

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started