Answered step by step

Verified Expert Solution

Question

1 Approved Answer

answer question 1, 3 and 4 only and all the information is included. ACCT24121BBF208 TAXATION INDIVIDUAL ASSIGNMENT 2 JUNE SEMESTER 2017 SUBMISSION DATE: 20.9. 2017

answer question 1, 3 and 4 only and all the information is included.

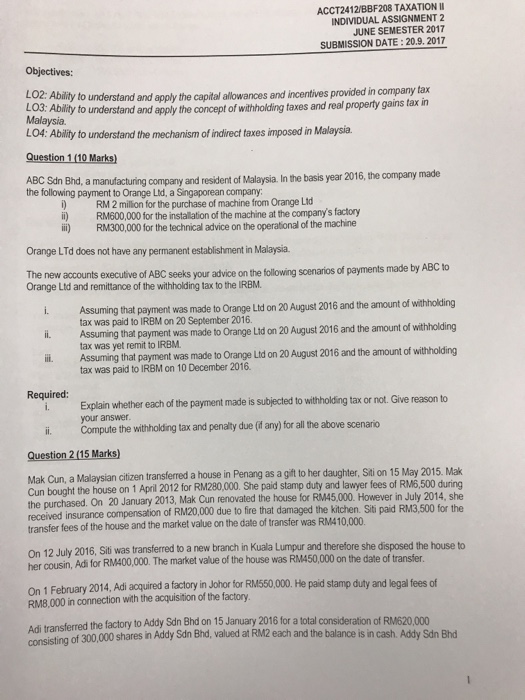

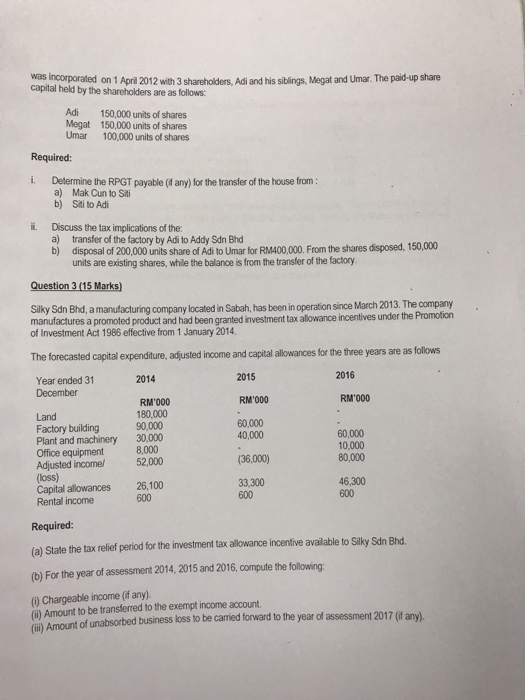

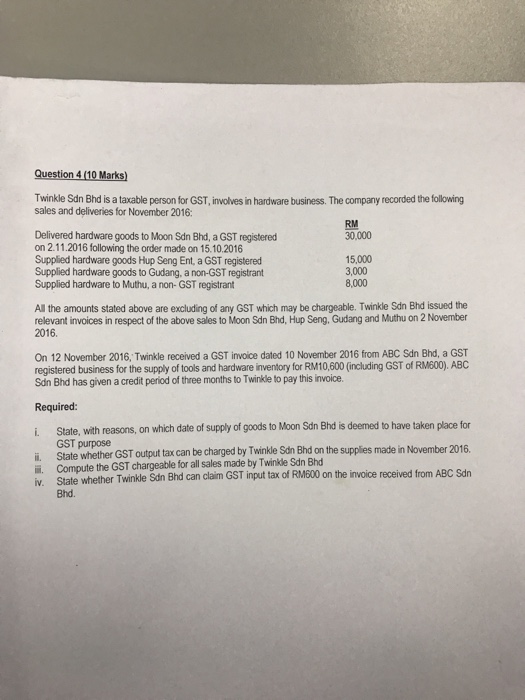

ACCT24121BBF208 TAXATION INDIVIDUAL ASSIGNMENT 2 JUNE SEMESTER 2017 SUBMISSION DATE: 20.9. 2017 Objectives: L 2: Ability to understand and apply the capital allowances and incentives provided in company tax LO:Ability to understand and apply the concept of withholding taxes and real property gains tax in Malaysia. L04. Ability to understand the mechanism of indirect taxes imposed in Malaysia. Question 1 (10 Marks ABC Sdn Bhd, a manufacturing company and resident of Malaysia. In the basis year 2016,the compary made the following payment to Orange Ltd, a Singaporean company )RM 2 million for the purchase of machine from Orange Ltd i RM600,000 for the installation of the machine at the company's factory l) RM300,000 for the technical advice on the operational of the machine Orange LTd does not have any permanent establishment in Malaysia. ABC to The new accounts executive of ABC seeks your advice on the following scenarios of payments made by Orange Ltd and remittance of the withholding tax to the IRBM Assuming that payment was made to Orange Ltd on 20 August 2016 and the amount of witholding tax was paid to IRBM on 20 September 2016 i. Assum ii. Assuming that payment was made to Orange Ltd on 20 August 2016 and the amount of withholding ing that payment was made to Orange Ltd on 20 August 2016 and the amount of withholding tax was yet remit to IRBM tax was paid to IRBM on 10 December 2016. Required: Explain whether each of the payment made is subjected to witholding tax or not. Give reason to your answer Compute the withholding tax and penalty due (if any) for all the above scenario ii Question 2(15 Marks) citizen transferred a house in Penang as a gift to her daughter, Siti on 15 May 2015. Mak Mak Cun, a Malaysian Cun bought the house on 1 April 2012 for RM280,000. She paid stamp duty and lawyer fees of RM6,500 during the purchased. On 20 January 2013, Mak Cun received insurance compensation of RM20,000 due to fire that damaged the kitchen. Sit transfer fees of the house and the market value on the date of transfer was RM410,000 renovated the house for RM45,000. However in July 2014, she paid RM3,500 for the July 2016, Siti was transferred to a new branch in Kuala Lumpur and therefore she disposed the house to On 12 her cousin, Adi for RM400,000. The market value of the house was RM450,000 on the date of transfer On 1 February 2014, Adi acquired a factory in Johor for RM550,000. He paid stamp duty and legal fees of RM8,000 in connection with the acquisition of the factory Adi transferred the factory to Addy Sdn Bhd on 15 January 2016 for a total consideration of RM620,000 consisting of 300,000 shares in Addy Sdn Bhd, valued at RM2 each and the balance is in cash. Addy Sdn Bhd ACCT24121BBF208 TAXATION INDIVIDUAL ASSIGNMENT 2 JUNE SEMESTER 2017 SUBMISSION DATE: 20.9. 2017 Objectives: L 2: Ability to understand and apply the capital allowances and incentives provided in company tax LO:Ability to understand and apply the concept of withholding taxes and real property gains tax in Malaysia. L04. Ability to understand the mechanism of indirect taxes imposed in Malaysia. Question 1 (10 Marks ABC Sdn Bhd, a manufacturing company and resident of Malaysia. In the basis year 2016,the compary made the following payment to Orange Ltd, a Singaporean company )RM 2 million for the purchase of machine from Orange Ltd i RM600,000 for the installation of the machine at the company's factory l) RM300,000 for the technical advice on the operational of the machine Orange LTd does not have any permanent establishment in Malaysia. ABC to The new accounts executive of ABC seeks your advice on the following scenarios of payments made by Orange Ltd and remittance of the withholding tax to the IRBM Assuming that payment was made to Orange Ltd on 20 August 2016 and the amount of witholding tax was paid to IRBM on 20 September 2016 i. Assum ii. Assuming that payment was made to Orange Ltd on 20 August 2016 and the amount of withholding ing that payment was made to Orange Ltd on 20 August 2016 and the amount of withholding tax was yet remit to IRBM tax was paid to IRBM on 10 December 2016. Required: Explain whether each of the payment made is subjected to witholding tax or not. Give reason to your answer Compute the withholding tax and penalty due (if any) for all the above scenario ii Question 2(15 Marks) citizen transferred a house in Penang as a gift to her daughter, Siti on 15 May 2015. Mak Mak Cun, a Malaysian Cun bought the house on 1 April 2012 for RM280,000. She paid stamp duty and lawyer fees of RM6,500 during the purchased. On 20 January 2013, Mak Cun received insurance compensation of RM20,000 due to fire that damaged the kitchen. Sit transfer fees of the house and the market value on the date of transfer was RM410,000 renovated the house for RM45,000. However in July 2014, she paid RM3,500 for the July 2016, Siti was transferred to a new branch in Kuala Lumpur and therefore she disposed the house to On 12 her cousin, Adi for RM400,000. The market value of the house was RM450,000 on the date of transfer On 1 February 2014, Adi acquired a factory in Johor for RM550,000. He paid stamp duty and legal fees of RM8,000 in connection with the acquisition of the factory Adi transferred the factory to Addy Sdn Bhd on 15 January 2016 for a total consideration of RM620,000 consisting of 300,000 shares in Addy Sdn Bhd, valued at RM2 each and the balance is in cash. Addy Sdn BhdStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started