Answered step by step

Verified Expert Solution

Question

1 Approved Answer

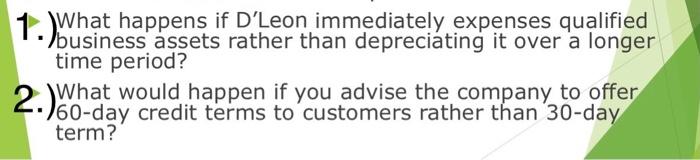

answer question 1 based on depeciation & 2 based on data below it 1.). What happens if D'Leon immediately expenses qualified business assets rather than

answer question 1 based on depeciation & 2 based on data below it

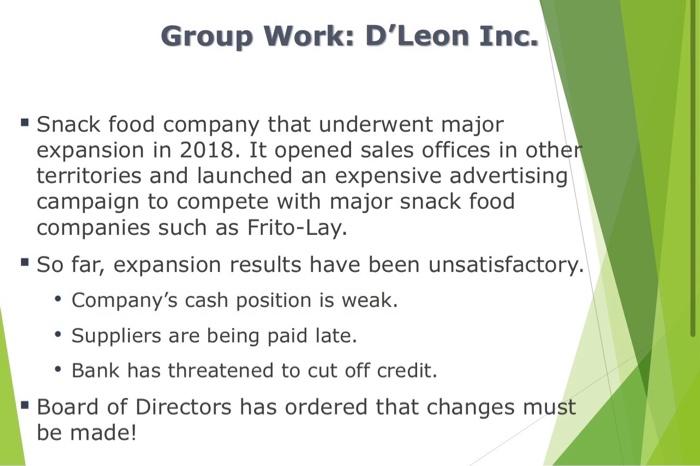

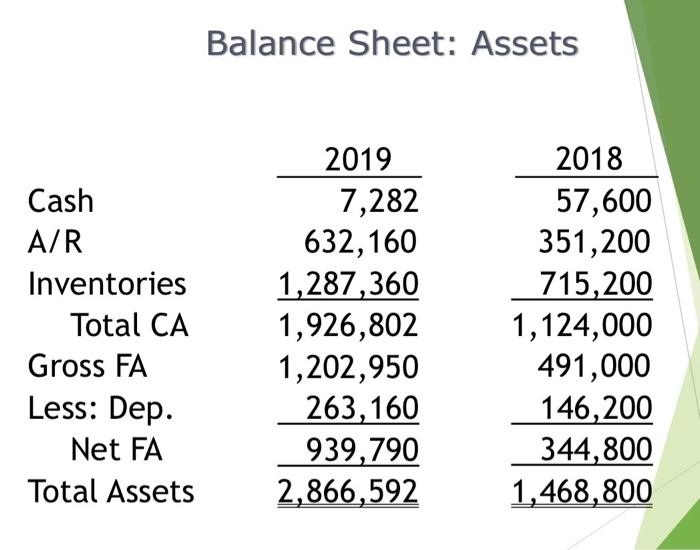

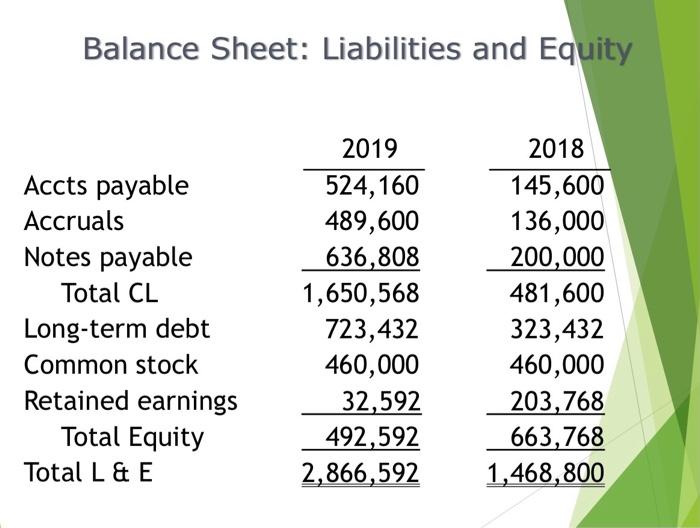

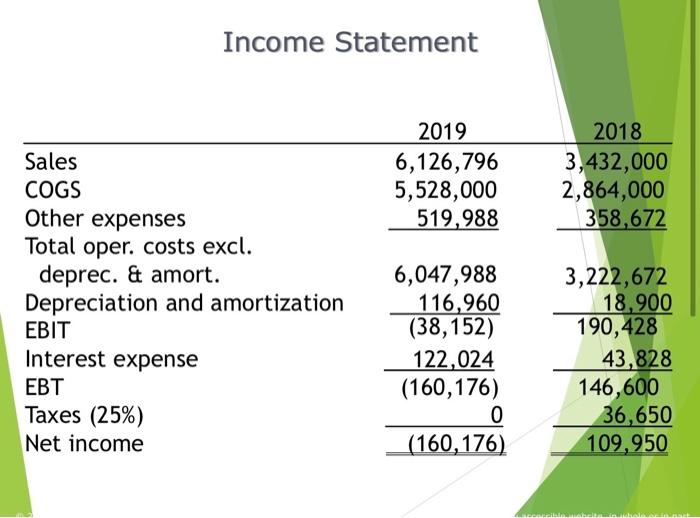

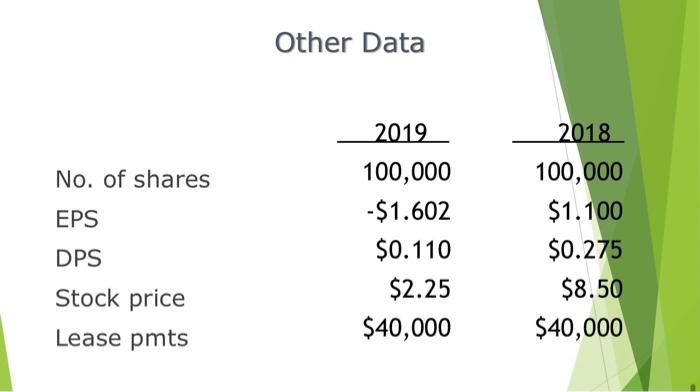

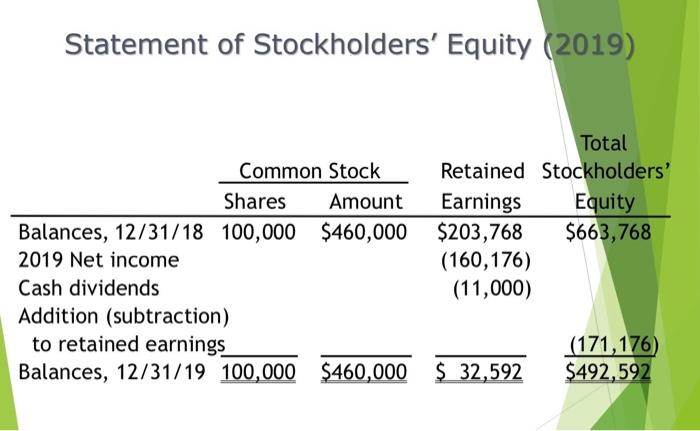

1.). What happens if D'Leon immediately expenses qualified business assets rather than depreciating it over a longer time period? 2.) What would happen if you advise the company to offer 160-day credit terms to customers rather than 30-day term? Group Work: D'Leon Inc. - Snack food company that underwent major expansion in 2018. It opened sales offices in other territories and launched an expensive advertising campaign to compete with major snack food companies such as Frito-Lay. So far, expansion results have been unsatisfactory. Company's cash position is weak. Suppliers are being paid late. Bank has threatened to cut off credit. - Board of Directors has ordered that changes must be made! Balance Sheet: Assets Cash A/R Inventories Total CA Gross FA Less: Dep. Net FA Total Assets 2019 7,282 632,160 1,287,360 1,926,802 1,202,950 263, 160 939,790 2,866,592 2018 57,600 351,200 715,200 1,124,000 491,000 146,200 344,800 1,468,800 Balance Sheet: Liabilities and Equity Accts payable Accruals Notes payable Total CL Long-term debt Common stock Retained earnings Total Equity Total L & E 2019 524,160 489,600 636,808 1,650,568 723,432 460,000 32,592 492,592 2,866,592 2018 145,600 136,000 200,000 481,600 323,432 460,000 203,768 663,768 1,468,800 Income Statement 2019 6,126,796 5,528,000 519,988 2018 3,432,000 2,864,000 358,672 Sales COGS Other expenses Total oper. costs excl. deprec. & amort. Depreciation and amortization EBIT Interest expense EBT Taxes (25%) Net income 6,047,988 116,960 (38,152) 122,024 (160,176) 0 (160,176) 3,222,672 18,900 190,428 43,828 146,600 36,650 109,950 Other Data 2018 No. of shares EPS 2019 100,000 -$1.602 $0.110 $2.25 $40,000 DPS 100,000 $1.100 $0.275 $8.50 $40,000 Stock price Lease pmts Statement of Stockholders' Equity (2019) Total Common Stock Retained Stockholders' Shares Amount Earnings Equity Balances, 12/31/18 100,000 $460,000 $203,768 $663,768 2019 Net income (160,176) Cash dividends (11,000) Addition (subtraction) to retained earnings (171,176) Balances, 12/31/19 100,000 $460,000 $ 32,592 $492,592 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started