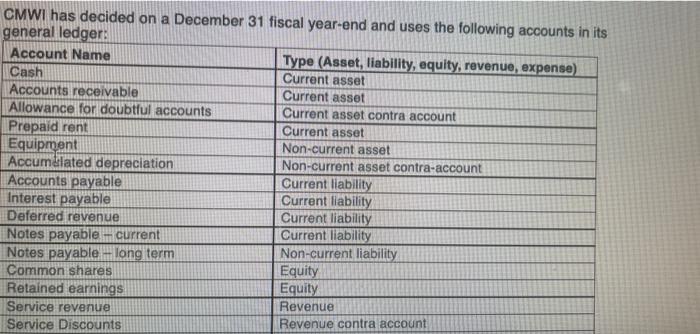

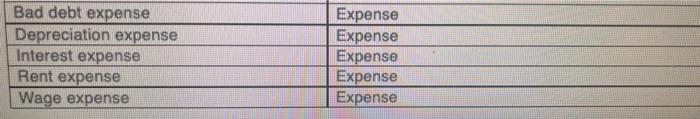

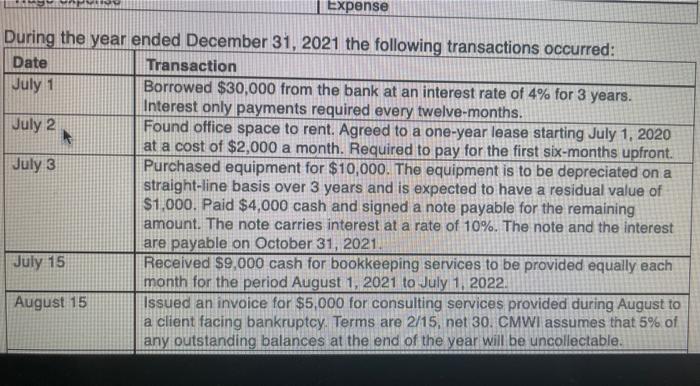

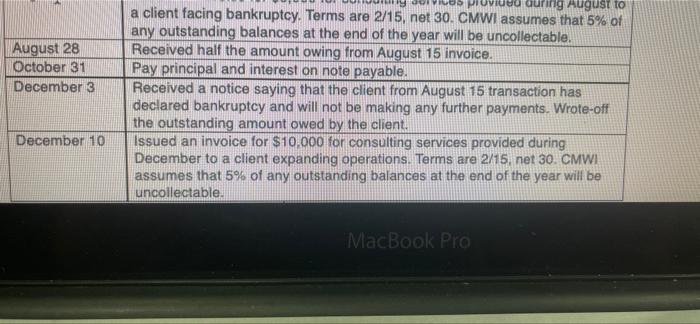

Answer Question 22 (14 points) If you would like to use a spreadsheet for this question, please click here to have a spreadsheet open in a new tab. Once you are finished, you will need to click the "Click here to save your work button. This will copy a link to your clipboard, which you can then paste into your answer field below, allowing your instructors to access your spreadsheet. Chen, Moore, & Wynes Inc. (hereafter "CMWI") was formed July 1, 2021. The company provides accounting and bookkeeping services to clients in the Waterloo region. Many of these customers are small, family-owned businesses. CMWI has decided on a December 31 fiscal year-end and uses the following accounts in its general ledger: Account Name Type (Asset, liability, equity, revenue, expense) Cash Current asset Accounts receivable Current asset Allowance for doubtful accounts Current asset contra account Prepaid rent Current asset Equipment Non-current asset Accumblated depreciation Non-current asset contra-account Accounts payable Current liability Interest payable Current liability Deferred revenue Current liability Notes payable current Current liability Notes payable - long term Non-current liability Common shares Equity Retained earnings Equity Service revenue Revenue Service Discounts Revenue contra account Bad debt expense Depreciation expense Interest expense Rent expense Wage expense Expense Expense Expense Expense Expense Expense During the year ended December 31, 2021 the following transactions occurred: Date Transaction July 1 Borrowed $30,000 from the bank at an interest rate of 4% for 3 years. Interest only payments required every twelve-months. July 2 Found office space to rent. Agreed to a one-year lease starting July 1, 2020 at a cost of $2,000 a month. Required to pay for the first six-months upfront. July 3 Purchased equipment for $10,000. The equipment is to be depreciated on a straight-line basis over 3 years and is expected to have a residual value of $1.000. Paid $4,000 cash and signed a note payable for the remaining amount. The note carries interest at a rate of 10%. The note and the interest are payable on October 31, 2021, July 15 Received $9,000 cash for bookkeeping services to be provided equally each month for the period August 1, 2021 to July 1, 2022. August 15 Issued an invoice for $5,000 for consulting services provided during August to a client facing bankruptcy. Terms are 2/15, net 30. CMWI assumes that 5% of any outstanding balances at the end of the year will be uncollectable. August 28 October 31 December 3 wa during August to a client facing bankruptcy. Terms are 2/15, net 30. CMWI assumes that 5% of any outstanding balances at the end of the year will be uncollectable. Received half the amount owing from August 15 invoice. Pay principal and interest on note payable. Received a notice saying that the client from August 15 transaction has declared bankruptcy and will not be making any further payments. Wrote-off the outstanding amount owed by the client. Issued an invoice for $10,000 for consulting services provided during December to a client expanding operations. Terms are 2/15. net 30. CMWI assumes that 5% of any outstanding balances at the end of the year will be uncollectable. December 10 MacBook Pro