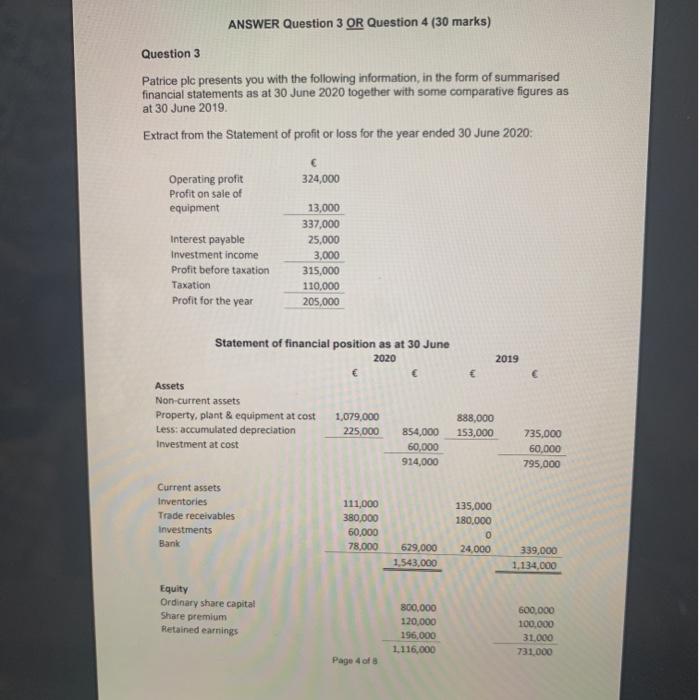

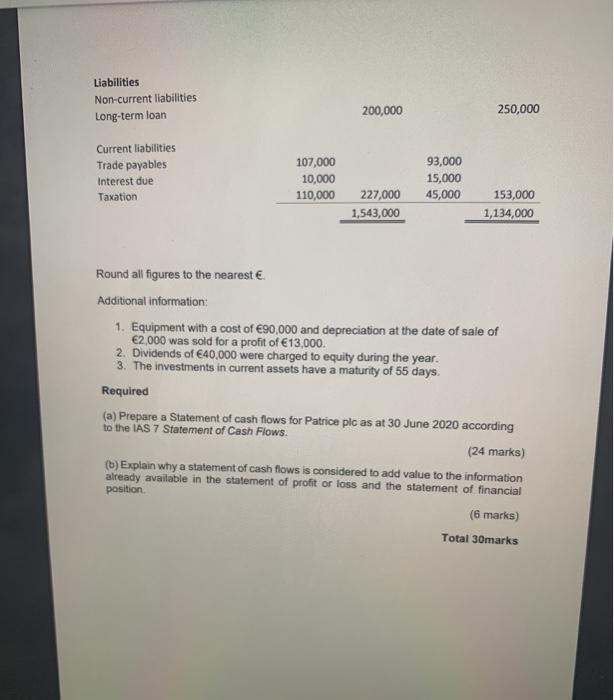

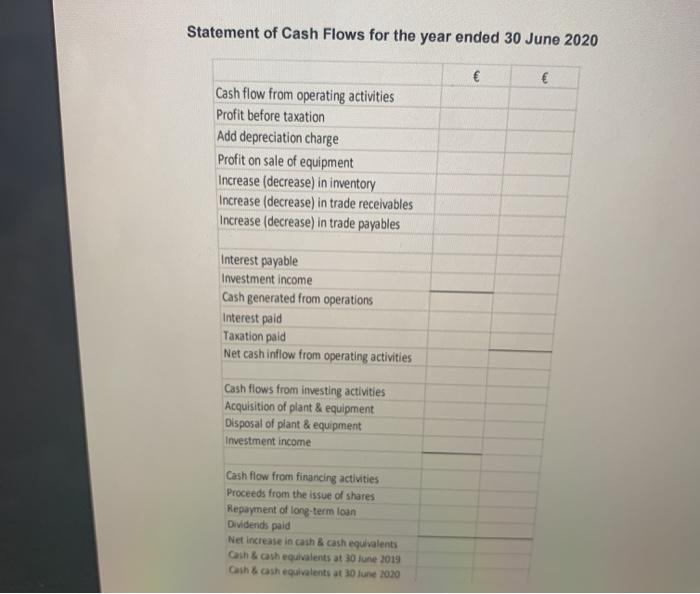

ANSWER Question 3 OR Question 4 (30 marks) Question 3 Patrice ple presents you with the following information, in the form of summarised financial statements as at 30 June 2020 together with some comparative figures as at 30 June 2019 Extract from the Statement of profit or loss for the year ended 30 June 2020: 324,000 Operating profit Profit on sale of equipment Interest payable Investment income Profit before taxation Taxation Profit for the year 13,000 337,000 25,000 3,000 315,000 110,000 205,000 Statement of financial position as at 30 June 2020 2019 Assets Non-current assets Property, plant & equipment at cost Less: accumulated depreciation Investment at cost 1,079,000 225.000 888,000 153,000 854,000 60,000 914,000 735,000 60.000 795,000 Current assets Inventories Trade receivables Investments Bank 111,000 380,000 60,000 78,000 135,000 180,000 0 24,000 629.000 1.543,000 339,000 1,134,000 Equity Ordinary share capital Share premium Retained earnings 800,000 120,000 196.000 1.116.000 600,000 100,000 31.000 731,000 Page 4 of 8 Liabilities Non-current liabilities Long-term loan 200,000 250,000 Current liabilities Trade payables Interest due Taxation 107,000 10,000 110,000 93,000 15,000 45,000 227,000 1,543,000 153,000 1,134,000 Round all figures to the nearest . Additional information: 1. Equipment with a cost of 90,000 and depreciation at the date of sale of 2,000 was sold for a profit of 13,000. 2. Dividends of 40.000 were charged to equity during the year. 3. The investments in current assets have a maturity of 55 days. Required (a) Prepare a Statement of cash flows for Patrice pic as at 30 June 2020 according to the IAS 7 Statement of Cash Flows. (24 marks) (b) Explain why a statement of cash flows is considered to add value to the information already available in the statement of profit or loss and the statement of financial position (6 marks) Total 30marks Statement of Cash Flows for the year ended 30 June 2020 Cash flow from operating activities Profit before taxation Add depreciation charge Profit on sale of equipment Increase (decrease) in inventory Increase (decrease) in trade receivables Increase (decrease) in trade payables Interest payable Investment income Cash generated from operations Interest paid Taxation paid Net cash inflow from operating activities Cash flows from investing activities Acquisition of plant & equipment Disposal of plant & equipment Investment income Cash flow from financing activities Proceeds from the issue of shares Repayment of long-term loan Dividends paid Net increase in cash & cash equivalents Cash & cash equivalents at 30 June 2019 Cash & cash equivalents at 30 June 2010