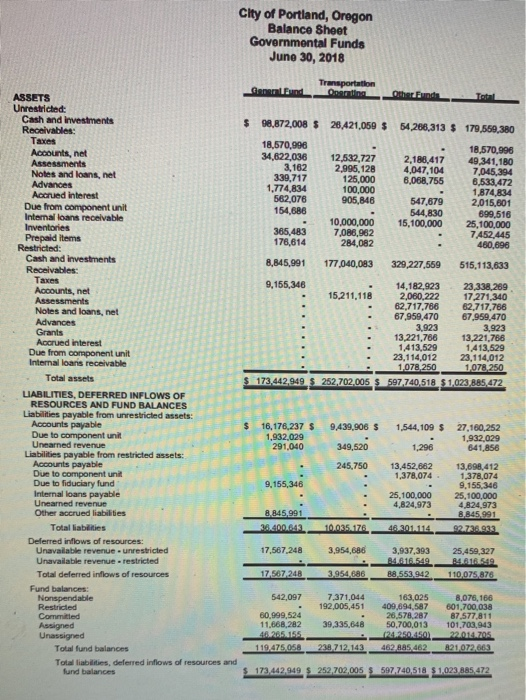

answer question #8 using the balance sheet

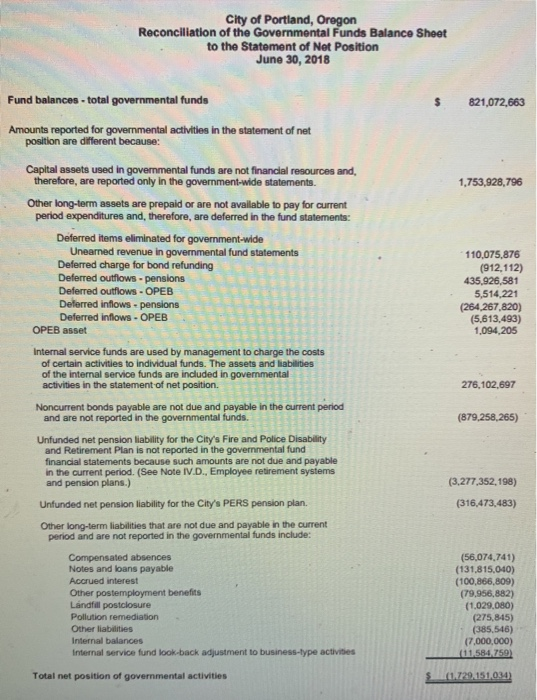

Governmental Funds. What basis of accounting used for the General Fund? What types of assets and liabilities are included on the governmental funds balance sheet? Identify which of the major funds, if applicable, are special revenue funds, debt service funds, capital projects funds, and permanent funds? Are you able to determine which funds are considered non- mjor? (Hint: look for supplementary information.) What fund balance categories are being 8. used? City of Portland, Oregon Governmental Funds June 30, 2018 ASSETS Unrestricted: Cash and investments 98,872.00828,421,059 $ 54268,313,55.380 Accounts, net 34,622,03612532,727 2,188,417 49.341,180 25,000 6,068,755 6,533,472 3,1822,995,128 4,047,104 339,717 Notes and loans, net Accrued interest Due from component unit 547,8792,015,801 699,516 10,000,000 15,100,000 25,100,000 7.452,445 544,830 Internal loans receivable Prepaid items Cash and investments 365,483 176,614 7,086,962 ,845,991177040,083 329,227,559 515,113,633 9,155,346 14,182,923 23,338,269 Accounts, net 15,211,118 2,060,222 17.271,340 82,717,76662,717,766 67,959,470 67,959,470 Notes and loans, net 13,221,768 13,221,766 Accrued interest Due from component unit Intermal loaris receivable 23,114,012 23,114,012 Total assets 173,442,949 $ 252,702,005 LIABILITIES, DEFERRED INFLOWS OF RESOURCES AND FUND BALANCES Accounts payable Unearned revenue Liabilities payable from unrestricted assets: $ 16,176,237 $ 9,439,906 $ 1,544,109$ 27,160,252 1,932,029 641,856 1,932,029 291,040349,520 Liabilities payable from restricted assets: 245,750 13,452,682 13,698,412 1,378,074 9,155,346 25,100,000 25,100,000 4,824,973 Due to component uni Internal loans payable Other accrued liabilities Total liabities 1,378,074 9,155,346 4,824,973 Deferred inflows of resources 3,954,688 unrestricted 17,567,248 3,937,393 25,459,327 -17.872439408 58005 Total deferred inflows of resources 542,097 7.371,044 8.076,166 192,005,451 409,694,587 601,700,038 87,577,811 11,668,282 39,335,648 50,700,013 101,703,943 60,999,524 .26,578,287 Total fund balances Total liablities, deferred inflows of resources and 173442,949 252,702,005 $ 597,740,518 $ 1,023 885472 City of Portland, Oregon Reconciliation of the Governmental Funds Balance Sheet to the Statement of Net Position June 30, 2018 Fund balances-total governmental funds 821,072,663 Amounts reported for governmental activities in the statement of net position are different because: Capital assets used in govemmental funds are not financial resources and, therefore, are reported only in the government-wide statements 1,753,928,796 Other long-term assets are prepaid or are not avallable to pay for current period expenditures and, therefore, are deferred in the fund statements: Deferred items eliminated for government-ide Unearned revenue in govenmental fund statements Deferred charge for bond refunding Deferred outflows - pensions Deferred outflows OPEB Deferred inflows pensions Deferred inflows-OPEB 110,075,876 (912,112) 435,926,581 5,514,221 (264,267,820) (5.613,493) ,094,205 OPEB asset Internal service funds are used by management to charge the costs of certain activities to individual funds. The assets and liabilities of the internal service funds are included in govenmenta activities in the statement of net position. 276,102,697 Noncurrent bonds payable are not due and payable in the current period and are not reported in the governmental funds. (879,258,265) Unfunded net pension liability for the City's Fire and Police Disability and Retirement Plan is not reported in the governmental fund financial statements because such amounts are not due and payable in the current period. (See Note IV.D., Employee retirement systems and pension plans.) (3,277,352,198) (316,473,483) Unfunded net pension liability for the City's PERS pension plan. Other long-term liabilities that are not due and payable in the current period and are not reported in the governmental funds include: (56.074,741) (131,815.040) (100,866,809) (79,956,882) 1.029.080) (275,845) (385,546) (7,000,000) Notes and loans payable Accrued interest Other postemployment benefits Landfill postclosure Pollution remediation Other liabilities Internal balances Internal service fund look-back adjustment to business-type activibes Total net position of governmental activities Governmental Funds. What basis of accounting used for the General Fund? What types of assets and liabilities are included on the governmental funds balance sheet? Identify which of the major funds, if applicable, are special revenue funds, debt service funds, capital projects funds, and permanent funds? Are you able to determine which funds are considered non- mjor? (Hint: look for supplementary information.) What fund balance categories are being 8. used? City of Portland, Oregon Governmental Funds June 30, 2018 ASSETS Unrestricted: Cash and investments 98,872.00828,421,059 $ 54268,313,55.380 Accounts, net 34,622,03612532,727 2,188,417 49.341,180 25,000 6,068,755 6,533,472 3,1822,995,128 4,047,104 339,717 Notes and loans, net Accrued interest Due from component unit 547,8792,015,801 699,516 10,000,000 15,100,000 25,100,000 7.452,445 544,830 Internal loans receivable Prepaid items Cash and investments 365,483 176,614 7,086,962 ,845,991177040,083 329,227,559 515,113,633 9,155,346 14,182,923 23,338,269 Accounts, net 15,211,118 2,060,222 17.271,340 82,717,76662,717,766 67,959,470 67,959,470 Notes and loans, net 13,221,768 13,221,766 Accrued interest Due from component unit Intermal loaris receivable 23,114,012 23,114,012 Total assets 173,442,949 $ 252,702,005 LIABILITIES, DEFERRED INFLOWS OF RESOURCES AND FUND BALANCES Accounts payable Unearned revenue Liabilities payable from unrestricted assets: $ 16,176,237 $ 9,439,906 $ 1,544,109$ 27,160,252 1,932,029 641,856 1,932,029 291,040349,520 Liabilities payable from restricted assets: 245,750 13,452,682 13,698,412 1,378,074 9,155,346 25,100,000 25,100,000 4,824,973 Due to component uni Internal loans payable Other accrued liabilities Total liabities 1,378,074 9,155,346 4,824,973 Deferred inflows of resources 3,954,688 unrestricted 17,567,248 3,937,393 25,459,327 -17.872439408 58005 Total deferred inflows of resources 542,097 7.371,044 8.076,166 192,005,451 409,694,587 601,700,038 87,577,811 11,668,282 39,335,648 50,700,013 101,703,943 60,999,524 .26,578,287 Total fund balances Total liablities, deferred inflows of resources and 173442,949 252,702,005 $ 597,740,518 $ 1,023 885472 City of Portland, Oregon Reconciliation of the Governmental Funds Balance Sheet to the Statement of Net Position June 30, 2018 Fund balances-total governmental funds 821,072,663 Amounts reported for governmental activities in the statement of net position are different because: Capital assets used in govemmental funds are not financial resources and, therefore, are reported only in the government-wide statements 1,753,928,796 Other long-term assets are prepaid or are not avallable to pay for current period expenditures and, therefore, are deferred in the fund statements: Deferred items eliminated for government-ide Unearned revenue in govenmental fund statements Deferred charge for bond refunding Deferred outflows - pensions Deferred outflows OPEB Deferred inflows pensions Deferred inflows-OPEB 110,075,876 (912,112) 435,926,581 5,514,221 (264,267,820) (5.613,493) ,094,205 OPEB asset Internal service funds are used by management to charge the costs of certain activities to individual funds. The assets and liabilities of the internal service funds are included in govenmenta activities in the statement of net position. 276,102,697 Noncurrent bonds payable are not due and payable in the current period and are not reported in the governmental funds. (879,258,265) Unfunded net pension liability for the City's Fire and Police Disability and Retirement Plan is not reported in the governmental fund financial statements because such amounts are not due and payable in the current period. (See Note IV.D., Employee retirement systems and pension plans.) (3,277,352,198) (316,473,483) Unfunded net pension liability for the City's PERS pension plan. Other long-term liabilities that are not due and payable in the current period and are not reported in the governmental funds include: (56.074,741) (131,815.040) (100,866,809) (79,956,882) 1.029.080) (275,845) (385,546) (7,000,000) Notes and loans payable Accrued interest Other postemployment benefits Landfill postclosure Pollution remediation Other liabilities Internal balances Internal service fund look-back adjustment to business-type activibes Total net position of governmental activities