Question

answer question a,c and d 2.Simon formed a parcel delivery business on 1 July 2021. On 1 July 2021, he purchased a delivery vehicle for

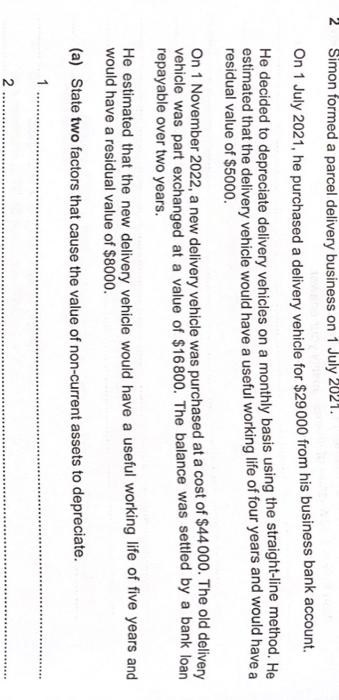

2.Simon formed a parcel delivery business on 1 July 2021.

2.Simon formed a parcel delivery business on 1 July 2021. On 1 July 2021, he purchased a delivery vehicle for $29000 from his business bank account.

He decided to depreciate delivery vehicles on a monthly basis using the straight-line method. He estimated that the delivery vehicle would have a useful working life of four years and would have a residual value of $5000.

On 1 November 2022, a new delivery vehicle was purchased at a cost of $44 000. The old delivery vehicle was part exchanged at a value of $16800. The balance was settled by a bank loan repayable over two years.

He estimated that the new delivery vehicle would have a useful working life of five years and would have a residual value of $8000.

(a) State two factors that cause the value of non-current assets to depreciate.

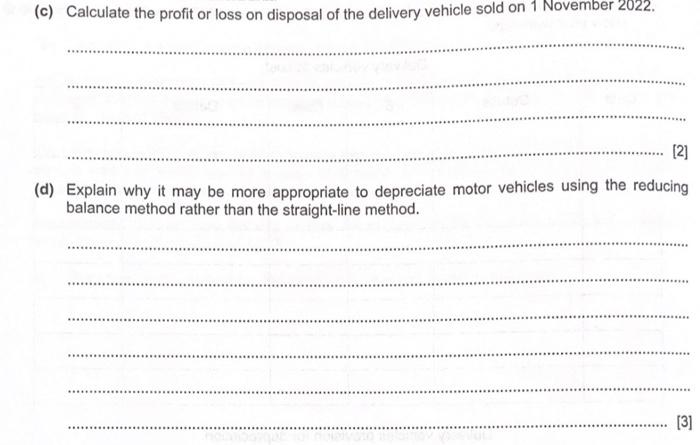

(c) Calculate the profit or loss on disposal of the delivery vehicle sold on 1 November 2022

(d) Explain why it may be more appropriate to depreciate motor vehicles using the reducing balance method rather than the straight-line method.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started