Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ANSWER question c only please Your friend Suxie has just started a new job as a salesperson for a range of financial products offered by

ANSWER question c only please

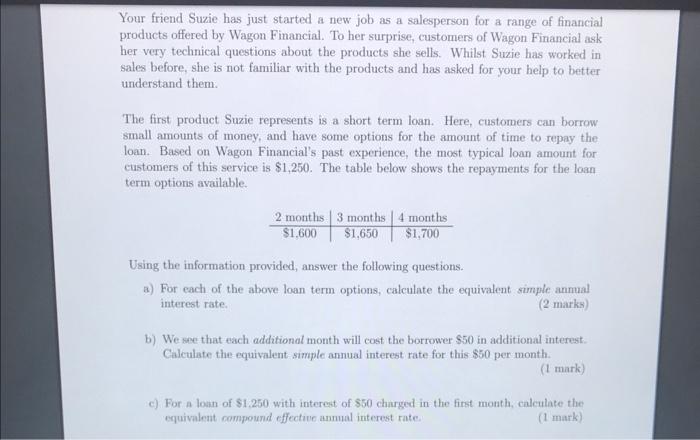

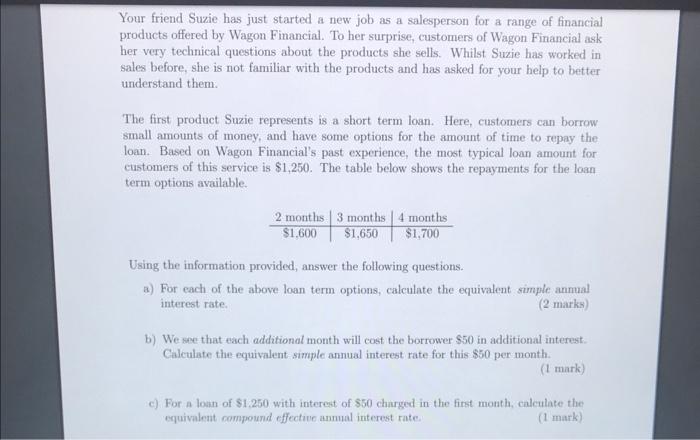

Your friend Suxie has just started a new job as a salesperson for a range of financial products offered by Wagon Financial. To her surprise, customers of Wagon Financial ask her very technical questions about the products she sells. Whilst Suzie has worked in sales before, she is not familiar with the products and has asked for your help to better understand them. The first product Suzie represents is a short term loan. Here, customers can borrow small amounts of money, and have some options for the amount of time to repay the loan. Based on Wagon Financial's past experience, the most typical loan amount for customers of this service is $1,250. The table below shows the repayments for the loan term options available. Using the information provided, answer the following questions. a) For each of the above loan term options, calculate the equivalent simple anmual interest rate. (2 marks) b) We see that each additional month will cost the borrower $50 in additional interest. Caleulate the equivalent simple annual interest rate for this $50 per month. (1 mark) c) For a loan of $1.250 with interest of $50 charged in the first month, calculate the equivalent compound effective annual interest rate. ( 1 mark)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started