Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ANSWER QUESTION (D) only!! ONLY NEED ANSWER TO (D)! A) 3C's current cost accounting system charges overhead to products based on direct labor cost using

ANSWER QUESTION (D) only!!

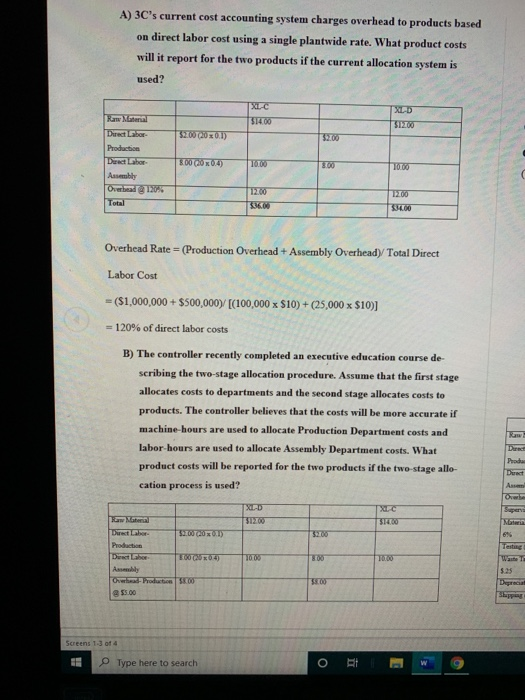

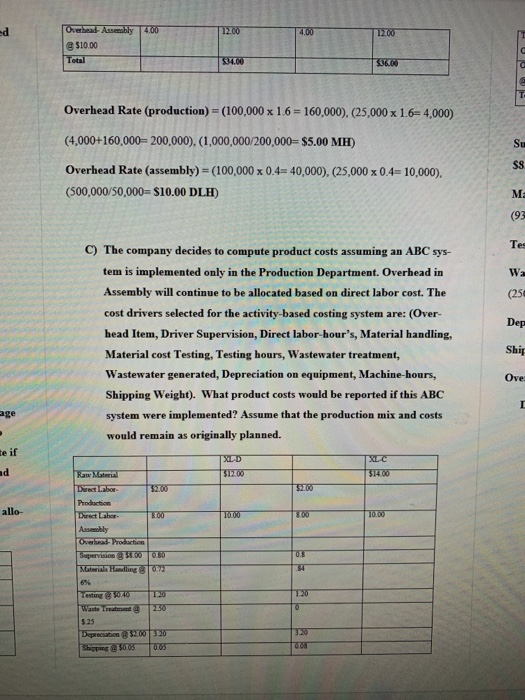

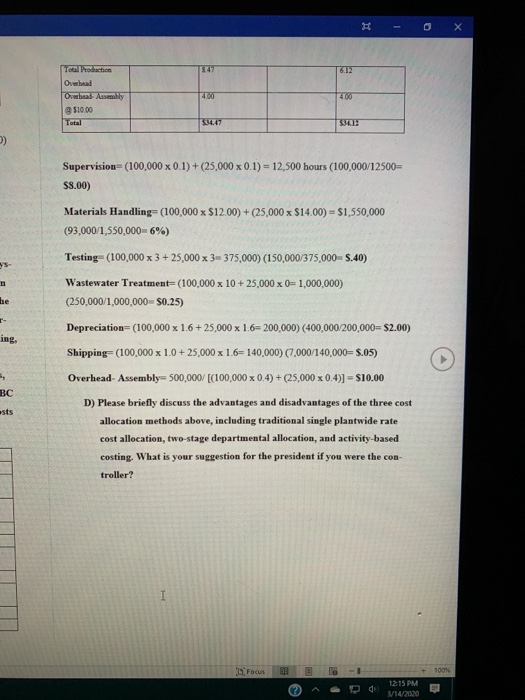

A) 3C's current cost accounting system charges overhead to products based on direct labor cost using a single plantwide rate. What product costs will it report for the two products if the current allocation system is used? 1900 2001) Raw Material Direct Labor Production Director Aby Orhad 130% 3 00 00 0.4) Overhead Rate = (Production Overhead + Assembly Overhead) Total Direct Labor Cost -($1,000,000 + $500,000) [(100,000 x $10) + (25,000 x $10) 120% of direct labor costs B) The controller recently completed an executive education course de scribing the two-stage allocation procedure. Assume that the first stage allocates costs to departments and the second stage allocates costs to products. The controller believes that the costs will be more accurate if machine bours are used to allocate Production Department costs and labor hours are used to allocate Assembly Department costs. What product costs will be reported for the two products if the two stage allo cation process is used? 150 COOL) Podari Ambly O dhodation SO 13.00 Type here to search o i w 4500 Overhead Assembly @$10.00 Total Overhead Rate (production) = (100,000 x 16 = 160,000). (25,000 x 1.6-4,000) (4,000+160,000=200,000). (1,000,000/200,000= $5.00 MH) Overhead Rate (assembly) (100,000 x 0.4= 40,000). (25,000 x 0.4=10,000). (500,000/50,000= $10.00 DLH) C) The company decides to compute product costs assuming an ABC sys- tem is implemented only in the Production Department. Overhead in Assembly will continue to be allocated based on direct labor cost. The cost drivers selected for the activity-based costing system are: (Over- head Item, Driver Supervision, Direct labor-hour's, Material handling, Material cost Testing, Testing hours, Wastewater treatment, Wastewater generated, Depreciation on equipment, Machine-hours, Shipping Weight). What product costs would be reported if this ABC system were implemented? Assume that the production mix and costs would remain as originally planned. Ship Ove age te if $12.00 314200 $200 Raw Me Dect Labor Production Direct Labor Assembly Co -Production Supervision 1.00 Material Handling 300 1000 0.5 00 0.2 50:40 Testing Wante Tre 120 550 2 Derecho $200320 Shipping 500S 00S Town Productos Overhead Overhead Assembly $10.00 Total Supervision=(100,000 x 0.1) + (25,000 x 0.1) = 12,500 hours (100,000/12500 $8.00) Materials Handling (100,000 x $12.00) + (25,000 x $14.00) = $1,550,000 (93,000/1,550,000=6%) Testing-(100,000 x 3 +25,000 x 3= 375,000) (150,000/375,000 $.40) Wastewater Treatment=(100,000 x 10 + 25,000 x 0= 1,000,000) (250,000/1,000,000 $0.25) Depreciation=(100,000 x 1.6 +25,000 x 1.6=200,000) (400,000/200,000= $2.00) Shipping (100,000 x 1.0+ 25.000 x 1.6= 140,000) (7,000/140,000= $.05) Overhead - Assembly=500,000/ [(100,000 x 0.4) + (25,000 x 0.4)] = $10.00 D) Please briefly discuss the advantages and disadvantages of the three cost allocation methods above, including traditional single plantwide rate cost allocation, two-stage departmental allocation, and activity-based costing. What is your suggestion for the president if you were the con- troller? D. Focus E lo - I 12:15 PM ONLY NEED ANSWER TO (D)!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started