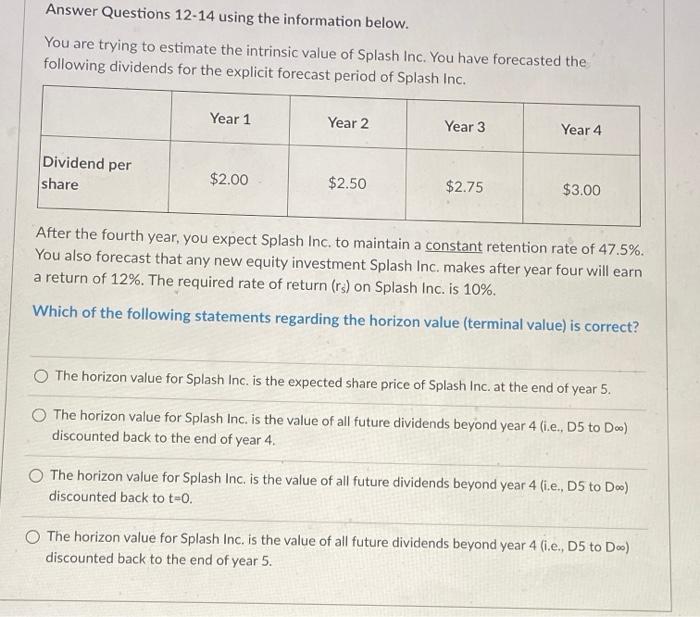

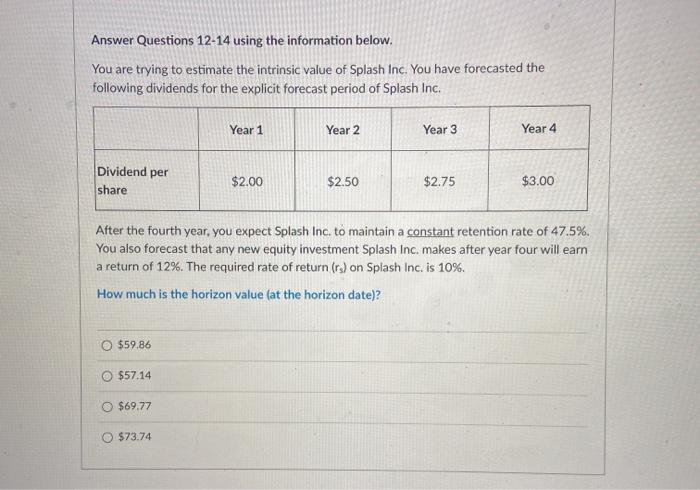

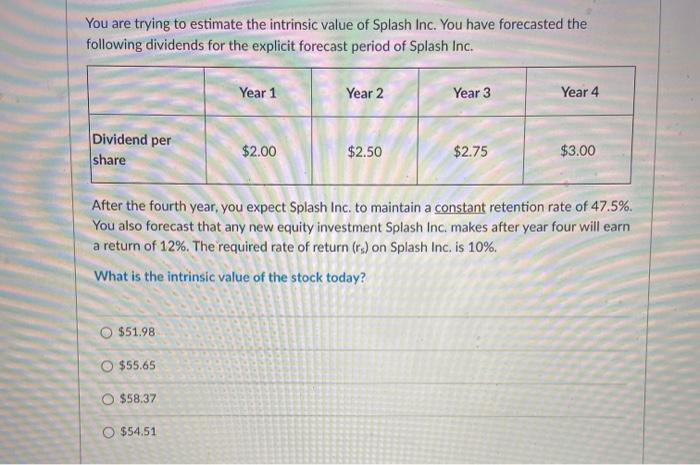

Answer Questions 12-14 using the information below. You are trying to estimate the intrinsic value of Splash Inc. You have forecasted the following dividends for the explicit forecast period of Splash Inc. Year 1 Year 2 Year 3 Year 4 Dividend per share $2.00 $2.50 $2.75 $3.00 After the fourth year, you expect Splash Inc. to maintain a constant retention rate of 47.5%. You also forecast that any new equity investment Splash Inc. makes after year four will earn a return of 12%. The required rate of return (rs) on Splash Inc. is 10%. Which of the following statements regarding the horizon value (terminal value) is correct? The horizon value for Splash Inc. is the expected share price of Splash Inc. at the end of year 5. The horizon value for Splash Inc. is the value of all future dividends beyond year 4 (i.e., D5 to Doo) discounted back to the end of year 4. The horizon value for Splash Inc. is the value of all future dividends beyond year 4 i.e., D5 to Doo) discounted back to t=0. The horizon value for Splash Inc. is the value of all future dividends beyond year 4 (i.e., D5 to Doo) discounted back to the end of year 5. Answer Questions 12-14 using the information below. You are trying to estimate the intrinsic value of Splash Inc. You have forecasted the following dividends for the explicit forecast period of Splash Inc. Year 1 Year 2 Year 3 Year 4 Dividend per $2.00 $2.50 $2.75 $3.00 share After the fourth year, you expect Splash Inc. maintain a constant retention of 47.5%. You also forecast that any new equity investment Splash Inc. makes after year four will earn a return of 12%. The required rate of return (r) on Splash Inc. is 10%. How much is the horizon value (at the horizon date)? $59.86 $57.14 $69.77 $73.74 You are trying to estimate the intrinsic value of Splash Inc. You have forecasted the following dividends for the explicit forecast period of Splash Inc. Year 1 Year 2 Year 3 Year 4 Dividend per share $2.00 $2.50 $2.75 $3.00 After the fourth year, you expect Splash Inc. to maintain a constant retention rate of 47.5%. You also forecast that any new equity investment Splash Inc makes after year four will earn a return of 12%. The required rate of return (r) on Splash Inc. is 10%. What is the intrinsic value of the stock today? O $51.98 O $55.65 O $58,37 O $54.51