Question: Answer questions 1-3 below and show your work. Introduction Nikita Vasiliev, a 25 year-old application developer, has little knowledge of personal finance. She pays her

Answer questions 1-3 below and show your work.

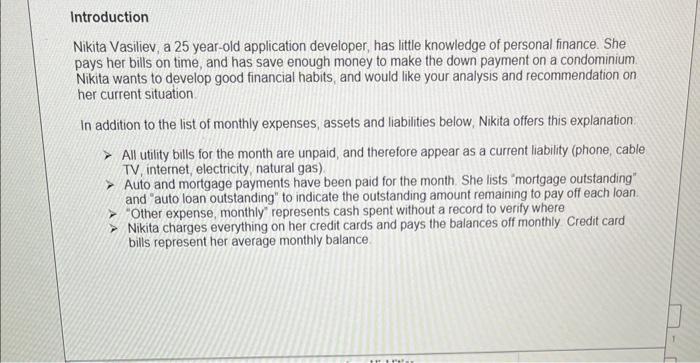

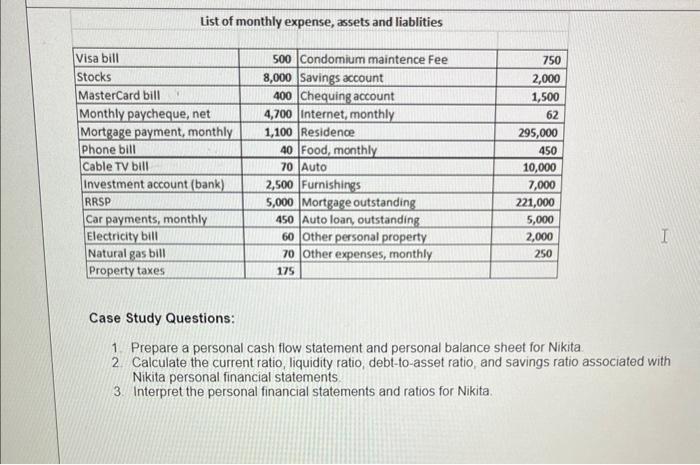

Introduction Nikita Vasiliev, a 25 year-old application developer, has little knowledge of personal finance. She pays her bills on time, and has save enough money to make the down payment on a condominium. Nikita wants to develop good financial habits, and would like your analysis and recommendation on her current situation. In addition to the list of monthly expenses, assets and liabilities below, Nikita offers this explanation All utility bills for the month are unpaid, and therefore appear as a current liability (phone, cable TV, internet, electricity, natural gas). > Auto and mortgage payments have been paid for the month. She lists "mortgage outstanding" and "auto loan outstanding" to indicate the outstanding amount remaining to pay off each loan. Other expense, monthly represents cash spent without a record to verify where Nikita charges everything on her credit cards and pays the balances off monthly Credit card bills represent her average monthly balance. In Tax

Step by Step Solution

3.40 Rating (156 Votes )

There are 3 Steps involved in it

Answer lets start by preparing Nikitas personal cash flow statement and personal balance sheet based on the information provided Personal Cash Flow St... View full answer

Get step-by-step solutions from verified subject matter experts