Answered step by step

Verified Expert Solution

Question

1 Approved Answer

answer questions 3&4 only additional information Questions 3 & 4 CASE 2A-12 Analysis of Mixed Costs in a Pricing Decision 02-11 Maria Chavez owns a

answer questions 3&4 only

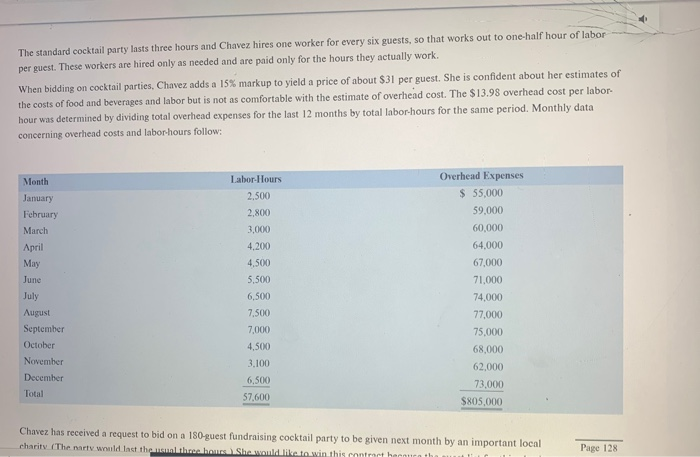

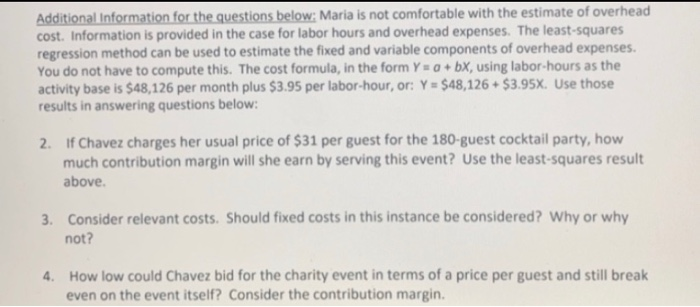

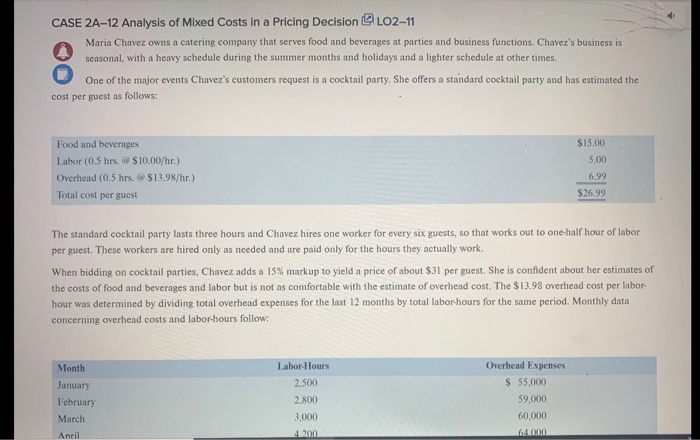

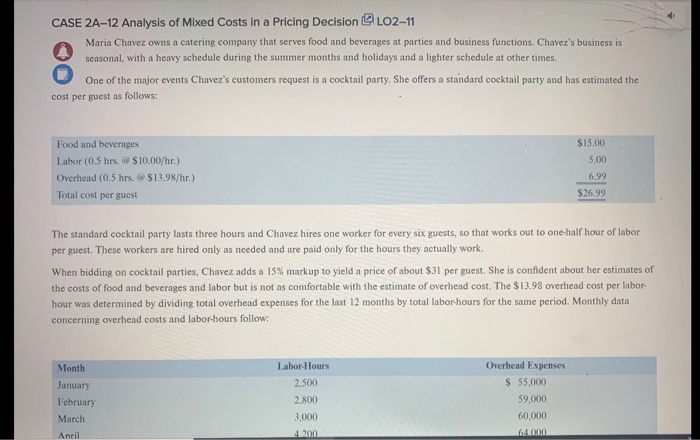

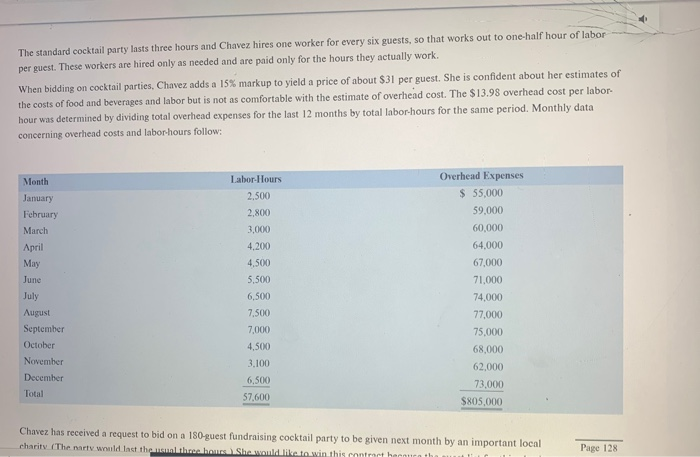

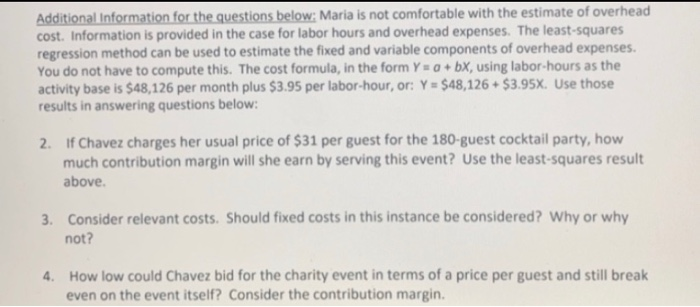

CASE 2A-12 Analysis of Mixed Costs in a Pricing Decision 02-11 Maria Chavez owns a catering company that serves food and beverages at parties and business functions. Chavez's business is seasonal, with a heavy schedule during the summer months and holidays and a lighter schedule at other times. One of the major events Chavez's customers request is a cocktail party. She offers a standard cocktail party and has estimated the cost per guest as follows: Food and beverages Labor (0.5 hrs $10.00/hr.) Overhead (0.5 hrs. @ $13.98/hr.) Total cost per guest $15.00 5.00 6.99 $26.99 The standard cocktail party lasts three hours and Chavez hires one worker for every six guests, so that works out to one-half hour of labor per guest. These workers are hired only as needed and are paid only for the hours they actually work. When bidding on cocktail parties, Chavez adds a 15% markup to yield a price of about $31 per guest. She is confident about her estimates of the costs of food and beverages and labor but is not as comfortable with the estimate of overhead cost. The $13.98 overhead cost per labor hour was determined by dividing total overhead expenses for the last 12 months by total labor-hours for the same period. Monthly data concerning overhead costs and labor hours follow: Month January February March Anril Labor Hours 2.500 2.800 3,000 4.200 Overhead Expenses $ 55,000 59.000 60,000 The standard cocktail party lasts three hours and Chavez hires one worker for every six guests, so that works out to one-half hour of labor per guest. These workers are hired only as needed and are paid only for the hours they actually work. When bidding on cocktail parties, Chavez adds a 15% markup to yield a price of about $31 per guest. She is confident about her estimates of the costs of food and beverages and labor but is not as comfortable with the estimate of overhead cost. The $13.98 overhead cost per labor hour was determined by dividing total overhead expenses for the last 12 months by total laborhours for the same period. Monthly data concerning overhead costs and labor hours follow: Month January Ichruary March April May June July August September October November December Total Labor Hours 2.500 2.800 3,000 4.200 4,500 5,500 6,500 7,500 7,000 4,500 3.100 Overhead Expenses $ 55,000 59,000 60,000 64,000 67,000 71,000 74,000 77.000 75.000 68.000 62,000 73.000 $805.000 65 57,600 Chavez has received a request to bid on a 180 guest fundraising cocktail party to be given next month by an important local charity. The art would let them the home Shode to win the entract Additional Information for the questions below: Maria is not comfortable with the estimate of overhead cost. Information is provided in the case for labor hours and overhead expenses. The least-squares regression method can be used to estimate the fixed and variable components of overhead expenses. You do not have to compute this. The cost formula, in the form Y=0+ bx, using labor-hours as the activity base is $48,126 per month plus $3.95 per labor-hour, or: Y = $48,126 + $3.95X. Use those results in answering questions below: 2. If Chavez charges her usual price of $31 per guest for the 180-guest cocktail party, how much contribution margin will she earn by serving this event? Use the least squares result above. 3. Consider relevant costs. Should fixed costs in this instance be considered? Why or why not? 4. How low could Chavez bid for the charity event in terms of a price per guest and still break even on the event itself? Consider the contribution margin additional information

Questions 3 & 4

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started