answer questions 8-10

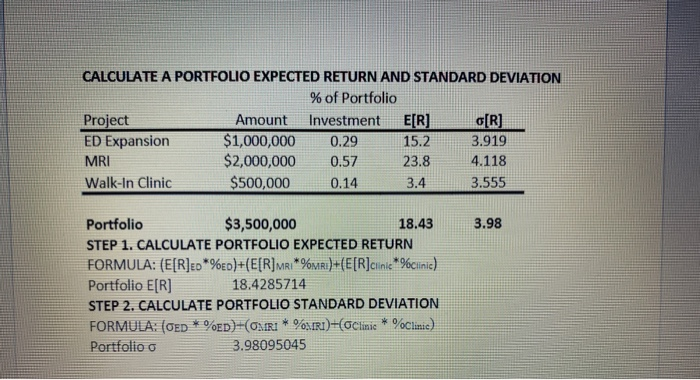

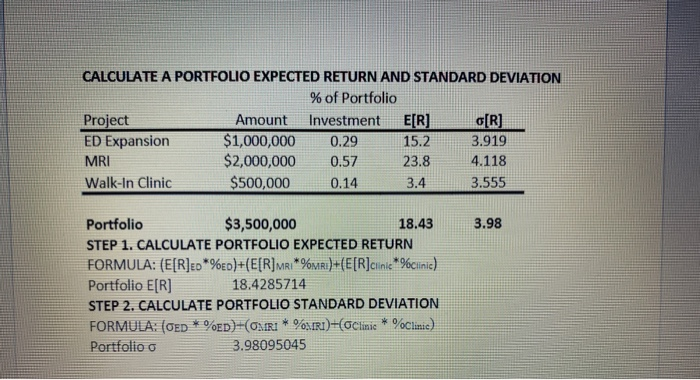

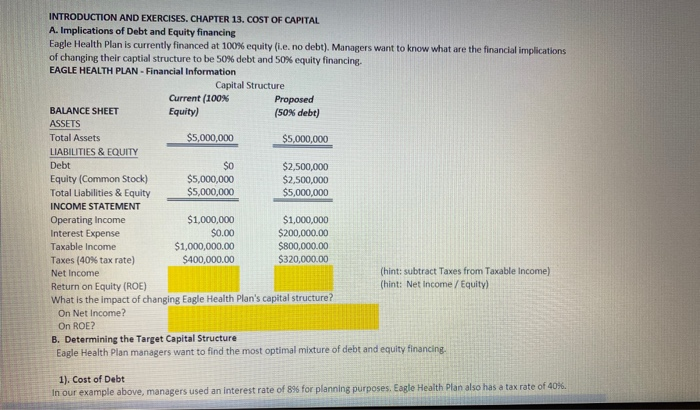

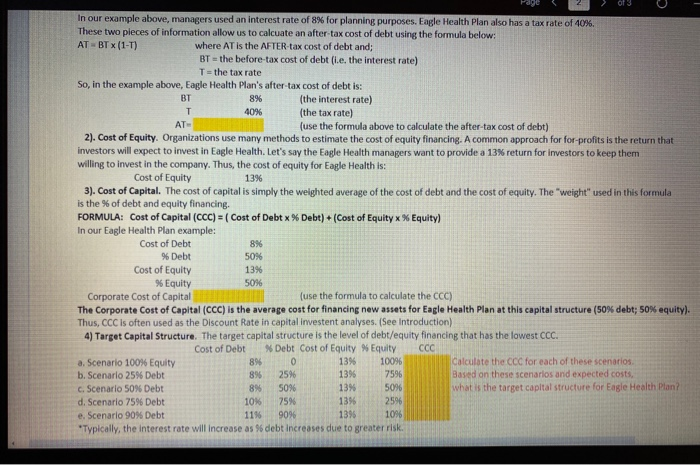

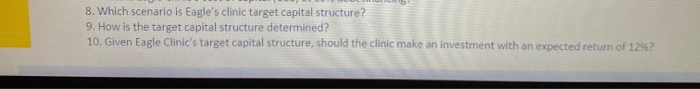

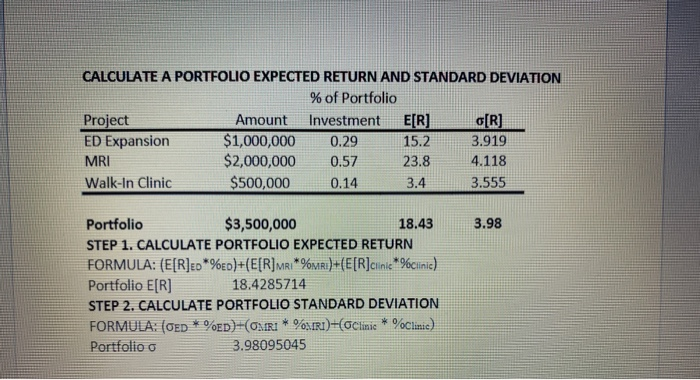

CALCULATE A PORTFOLIO EXPECTED RETURN AND STANDARD DEVIATION % of Portfolio Project Amount Investment E[R] [R] ED Expansion $1,000,000 0.29 1 5.2 3.919 MRI $2,000,000 0.57 23.8 4.118 Walk-In Clinic $500,000 0.14 3.4 3.555 3.98 Portfolio $3,500,000 18.43 STEP 1. CALCULATE PORTFOLIO EXPECTED RETURN FORMULA: (E[R]ED*%ED)+(E[R]MRI* %MRI)+(E[R]clinic*%clinic) Portfolio E[R] 18.4285714 STEP 2. CALCULATE PORTFOLIO STANDARD DEVIATION FORMULA: (OED * %ED)+(OXIRI * %RI)+(Clinic * Clinic) Portfolio o 3.98095045 INTRODUCTION AND EXERCISES. CHAPTER 13. COST OF CAPITAL A. Implications of Debt and Equity financing Eagle Health Plan is currently financed at 100% equity (l.e. no debt). Managers want to know what are the financial implications of changing their captial structure to be 50% debt and 50% equity financing EAGLE HEALTH PLAN - Financial Information Capital Structure Current (100% Proposed BALANCE SHEET Equity) (50% debt) ASSETS Total Assets $5,000,000 $5,000,000 LIABILITIES & EQUITY Debt $2,500,000 Equity (Common Stock) $5,000,000 $2,500,000 Total Liabilities & Equity $5,000,000 $5,000,000 INCOME STATEMENT Operating Income $1,000,000 $1,000,000 Interest Expense $0.00 $200,000.00 Taxable income $1,000,000.00 $800,000.00 Taxes (40% tax rate) $400,000.00 $320,000.00 Net Income (hint: subtract Taxes from Taxable income) Return on Equity (ROE) (hint: Net Income / Equity) What is the impact of changing Eagle Health Plan's capital structure? On Net Income? On ROE? B. Determining the Target Capital Structure Eagle Health Plan managers want to find the most optimal mixture of debt and equity financing 1). Cost of Debt In our example above, managers used an interest rate of 896 for planning purposes. Earle Health Plan also has a tax rate of 40%. - 8% Page 2 of 3 In our example above, managers used an interest rate of 8% for planning purposes. Eagle Health Plan also has a tax rate of 40%. These two pieces of information allow us to calcuate an after tax cost of debt using the formula below: ATBT (1-T) where AT is the AFTER-tax cost of debt and; BT = the before-tax cost of debt (.e. the interest rate) T= the tax rate So, in the example above, Eagle Health Plan's after tax cost of debt is: BT (the interest rate) 40% (the tax rate) (use the formula above to calculate the after-tax cost of debt) 2). Cost of Equity. Organizations use many methods to estimate the cost of equity financing. A common approach for for-profits is the return that Investors will expect to invest in Eagle Health. Let's say the Eagle Health managers want to provide a 13% return for investors to keep them willing to invest in the company. Thus, the cost of equity for Eagle Health is: Cost of Equity 13% 3). Cost of Capital. The cost of capital is simply the weighted average of the cost of debt and the cost of equity. The "weight" used in this formula is the % of debt and equity financing. FORMULA: Cost of Capital (CCC) = (Cost of Debtx % Debt) + (Cost of Equity X Equity) In our Eagle Health Plan example: Cost of Debt % Debt 50% Cost of Equity 13% % Equity 5096 Corporate Cost of Capital (use the formula to calculate the CCC) The Corporate Cost of Capital (CCC) is the average cost for financing new assets for Eagle Health Plan at this capital structure (50% debt; 50% equity). Thus, CCC is often used as the Discount Rate in capital investent analyses. (See Introduction) 4) Target Capital Structure. The target capital structure is the level of debt/equity financing that has the lowest CCC. Cost of Debt Debt Cost of Equity % Equity CCC a. Scenario 100% Equity 8960 1396 10096 Calculate the CCC for each of these scenarios b. Scenario 25% Debt 896 25% 7596 Based on these scenarios and expected costs, c. Scenario 50% Debt 8% 50% 5096 what is the target capital structure for Eagle Health Plan? d. Scenario 7596 Debt 10% 2596 e. Scenario 90% Debt 1156 90% 1398 10% *Typically, the interest rate will increase as % debt increases due to greater risk. 75% 139 8. Which scenario is Eagle's clinic target capital structure? 9. How is the target capital structure determined? 10. Given Eagle Clinic's target capital structure, should the clinic make an investment with an expected return of 12%