Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Answer Questions 9 & 11 only! At what price does Martha expect to sell the stock for in six years if she faces an opportunity

Answer Questions 9 & 11 only!

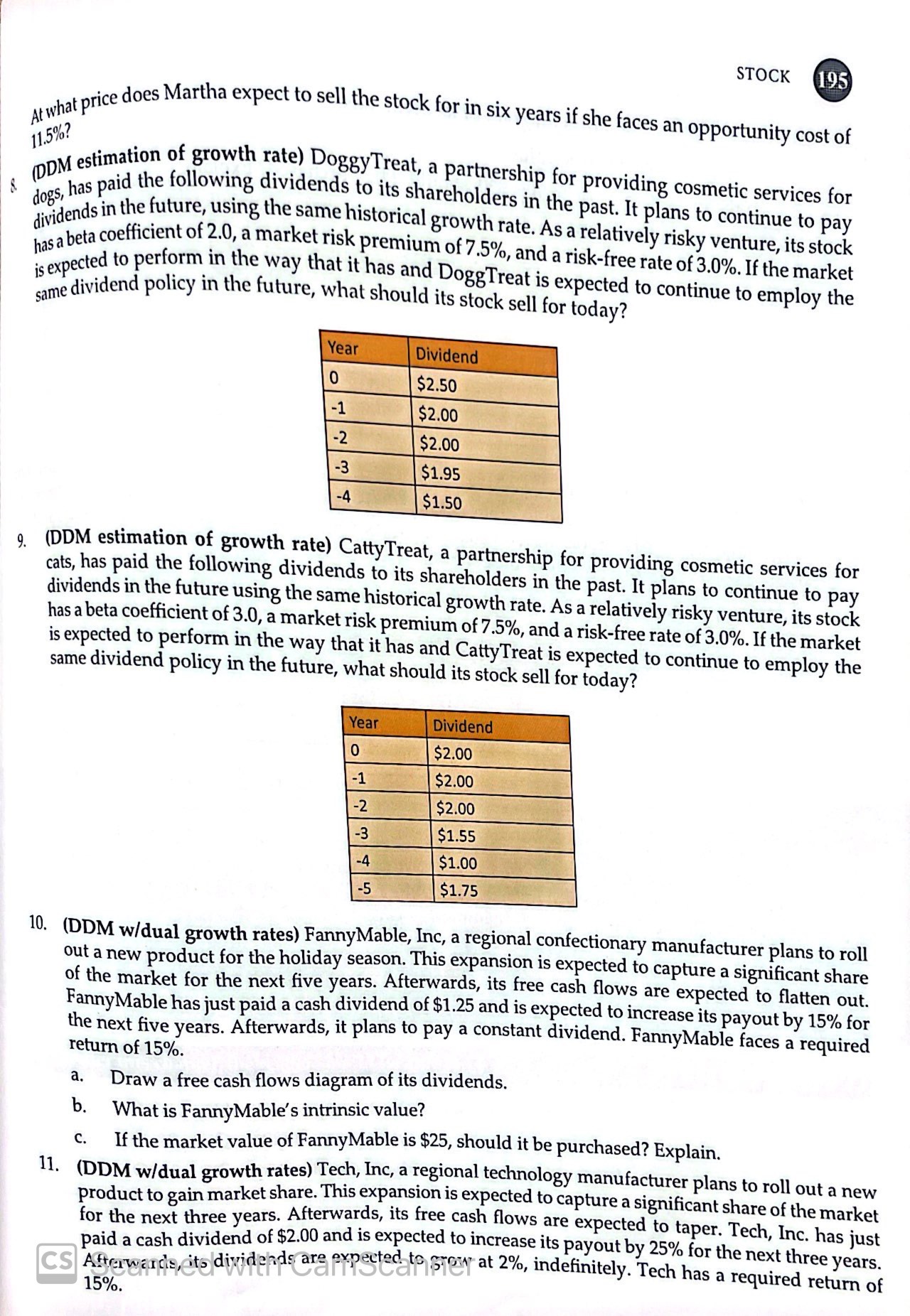

At what price does Martha expect to sell the stock for in six years if she faces an opportunity cost of 11.5% ? DDM estimation of growth rate) DoggyTreat, a partnership for providing cosmetic services for dogs, has paid the following dividends to its shareholders in the past. It plans to continue to pay dividends in the future, using the same historical growth rate. As a relatively risky venture, its stock has a beta coefficient of 2.0, a market risk premium of 7.5%, and a risk-free rate of 3.0%. If the market is expected to perform in the way that it has and DoggTreat is expected to continue to employ the same dividend policy in the future, what should its stock sell for today? 9. (DDM estimation of growth rate) CattyTreat, a partnership for providing cosmetic services for cats, has paid the following dividends to its shareholders in the past. It plans to continue to pay dividends in the future using the same historical growth rate. As a relatively risky venture, its stock has a beta coefficient of 3.0 , a market risk premium of 7.5%, and a risk-free rate of 3.0%. If the market is expected to perform in the way that it has and CattyTreat is expected to continue to employ the same dividend policy in the future, what should its stock sell for today? 10. (DDM w/dual growth rates) FannyMable, Inc, a regional confectionary manufacturer plans to roll out a new product for the holiday season. This expansion is expected to capture a significant share of the market for the next five years. Afterwards, its free cash flows are expected to flatten out. FannyMable has just paid a cash dividend of $1.25 and is expected to increase its payout by 15% for the next five years. Afterwards, it plans to pay a constant dividend. FannyMable faces a required return of 15%. a. Draw a free cash flows diagram of its dividends. b. What is FannyMable's intrinsic value? c. If the market value of FannyMable is $25, should it be purchased? Explain. 11. (DDM w/dual growth rates) Tech, Inc, a regional technology manufacturer plans to roll out a new product to gain market share. This expansion is expected to capture a significant share of the market for the next three years. Afterwards, its free cash flows are expected to taper. Tech, Inc. has just paid a cash dividend of $2.00 and is expected to increase its payout by 25% for the next three years. Afterwarchs,itodividesds are expected to rois at 2%, indefinitely. Tech has a required return ofStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started