Question

Answer questions AFTER completing form 11 and BEFORE doing form 12 How many forms have you recorded in the Purchases Journal? 2) In the Purchase

Answer questions AFTER completing form 11 and BEFORE doing form 12

- How many forms have you recorded in the Purchases Journal?

2) In the Purchase Journal, what account did you use for the entry you should have in the Other section (far right on the page Account DR column - this one does not label itself as other but it is where we put things where the debit cannot fit in a different labeled column)?

3) How many forms have you recorded in the Cash Receipts Journal?

4) In the Cash Receipts Journal, what account did you use on the far left for line 1 (CR 101)?

5) In the Cash Receipts Journal, what account did you use on the far left for line 2 (CR 102)?

6) In the Cash Receipts Journal, what amount do you have in the Merch Inv Cr/COGS Dr column for line 3 (CR 103 we get this number by taking the things we have sold and recording them in the merchandise inventory subsidiary and determining OUR COST based on FIFO watch the video in Blackboard)?

7) In the Cash Payments Journal, what account did you use on the far left for check (hint: when should it be an account name from the chart of accounts and when should it be a business name? As a reference refer to Chapter 5 examples of special journals) -

1001

1002

1003

1004

1005

1006

8) What is your current cash balance in the checkbook? (There are 2 possible answers I will accept for this.)

Reminders (Hints):

Did you compare the appearance of your journals to the examples in chapter 5 to make sure they look similar?

Did you make sure you always used the one column in each journal that had to get used (varies by journal)?

Did you make sure that as you completed each form you used equal debits and credits?

Did you make sure that after first recording it in the appropriate journal you then checked to see if you used a column that had the header shaded? If it was shaded did you then take the information and also record it in the appropriate location?

Did you make sure of account titles by using the chart of accounts?

Did you think about the rules of when something is an expense? When it is an asset? If it would be a current asset or a property, plant and equipment asset?

Once you get feedback be sure and go back in and change anything that is indicated as incorrect.

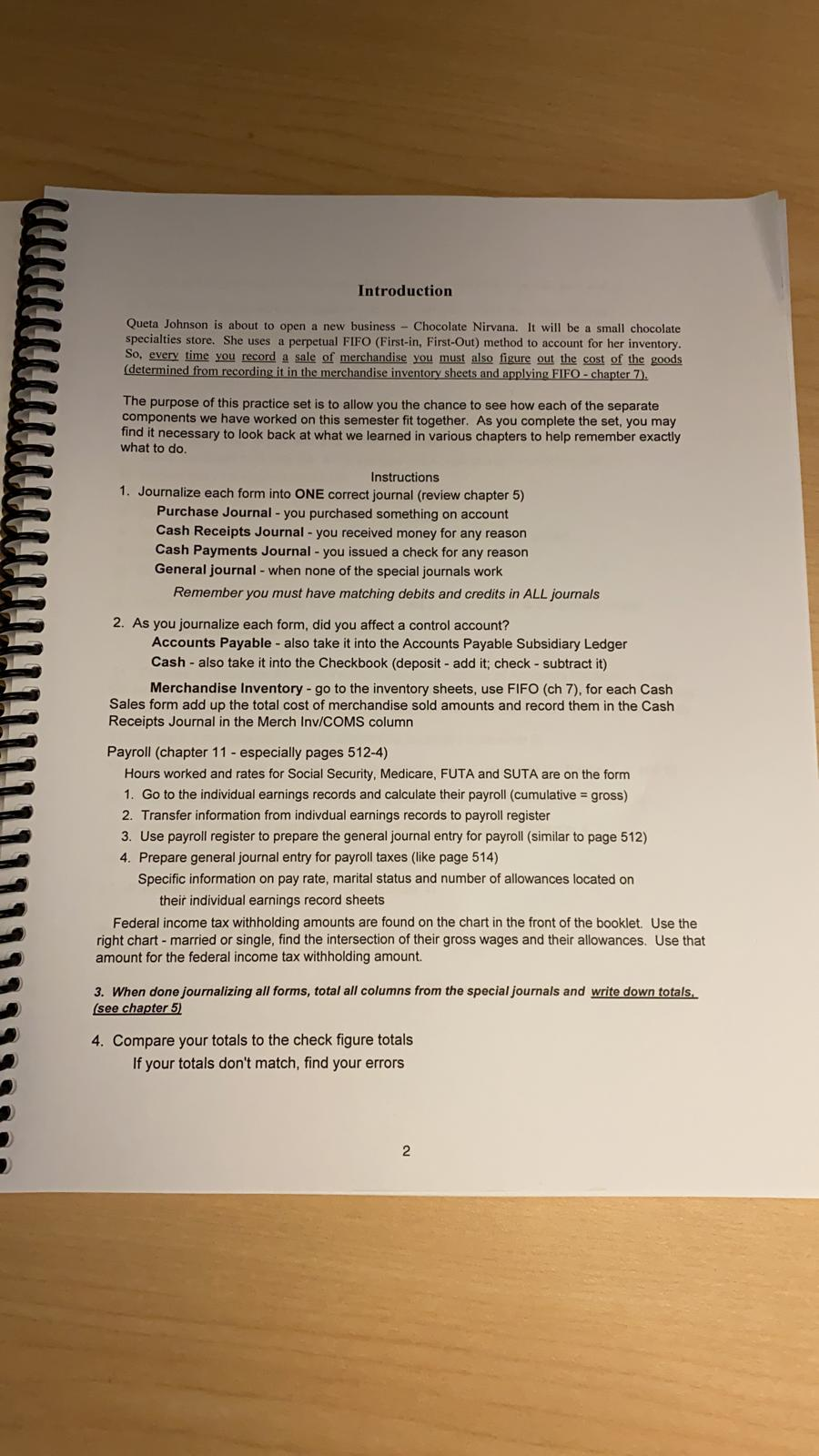

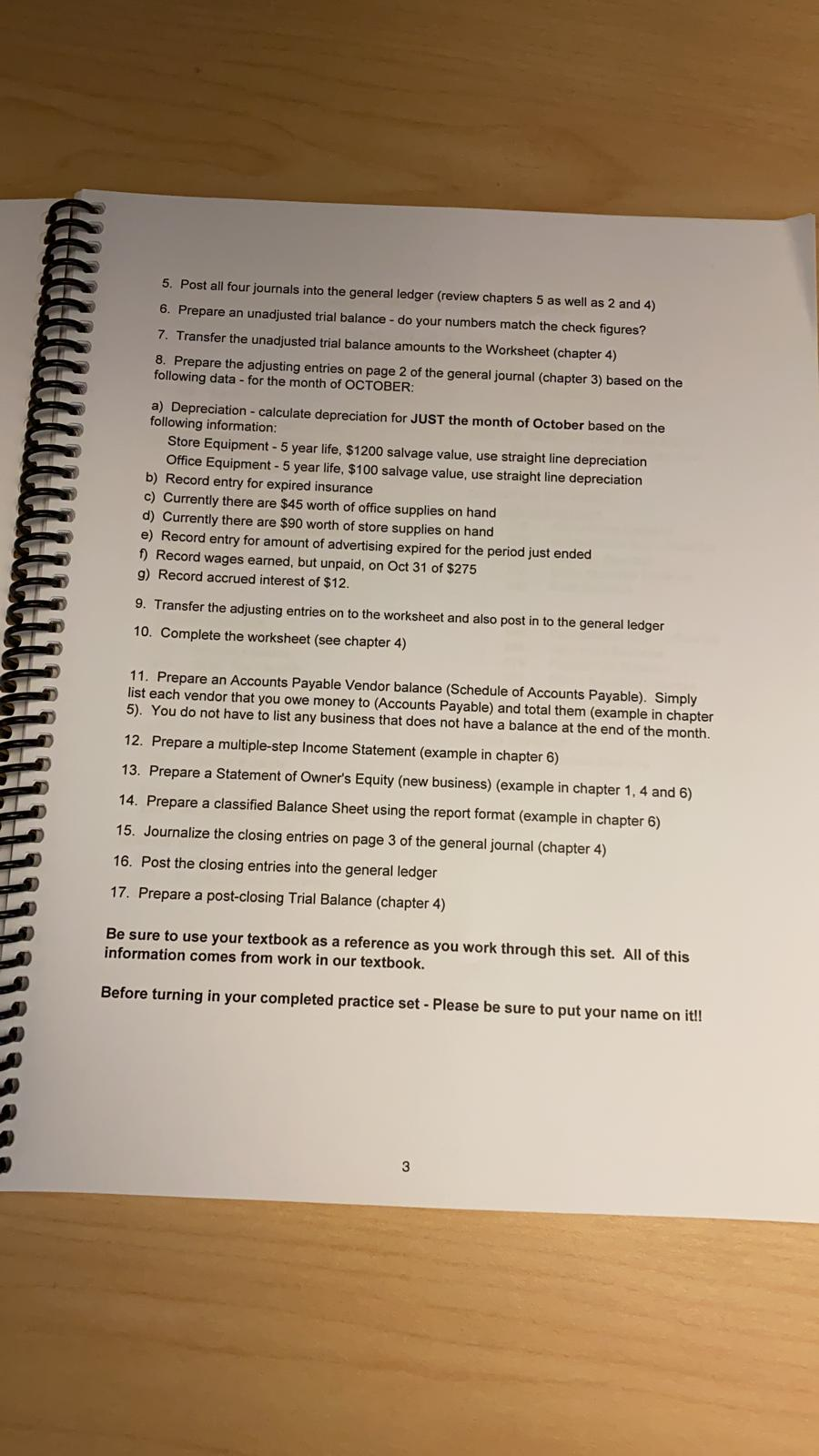

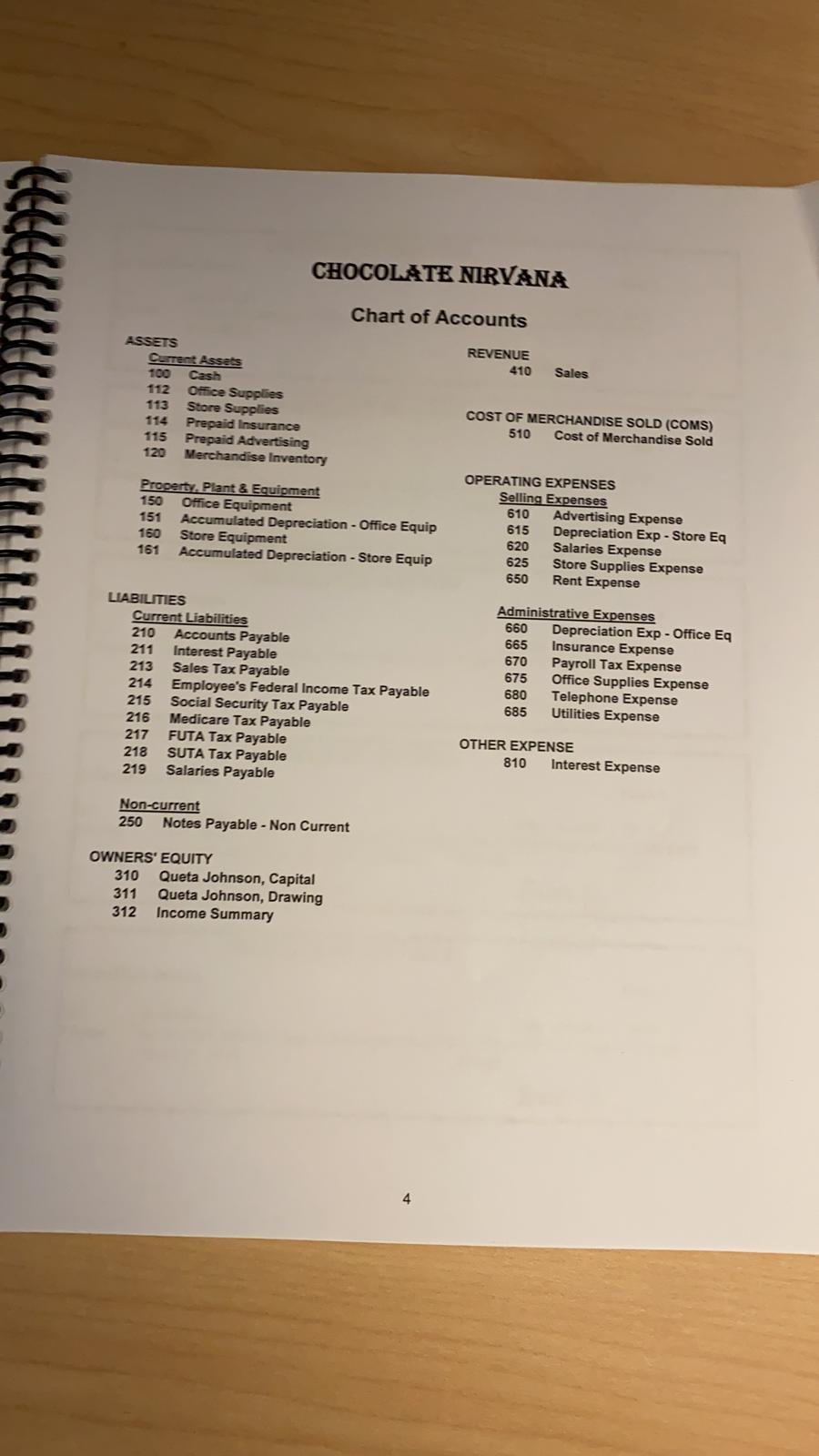

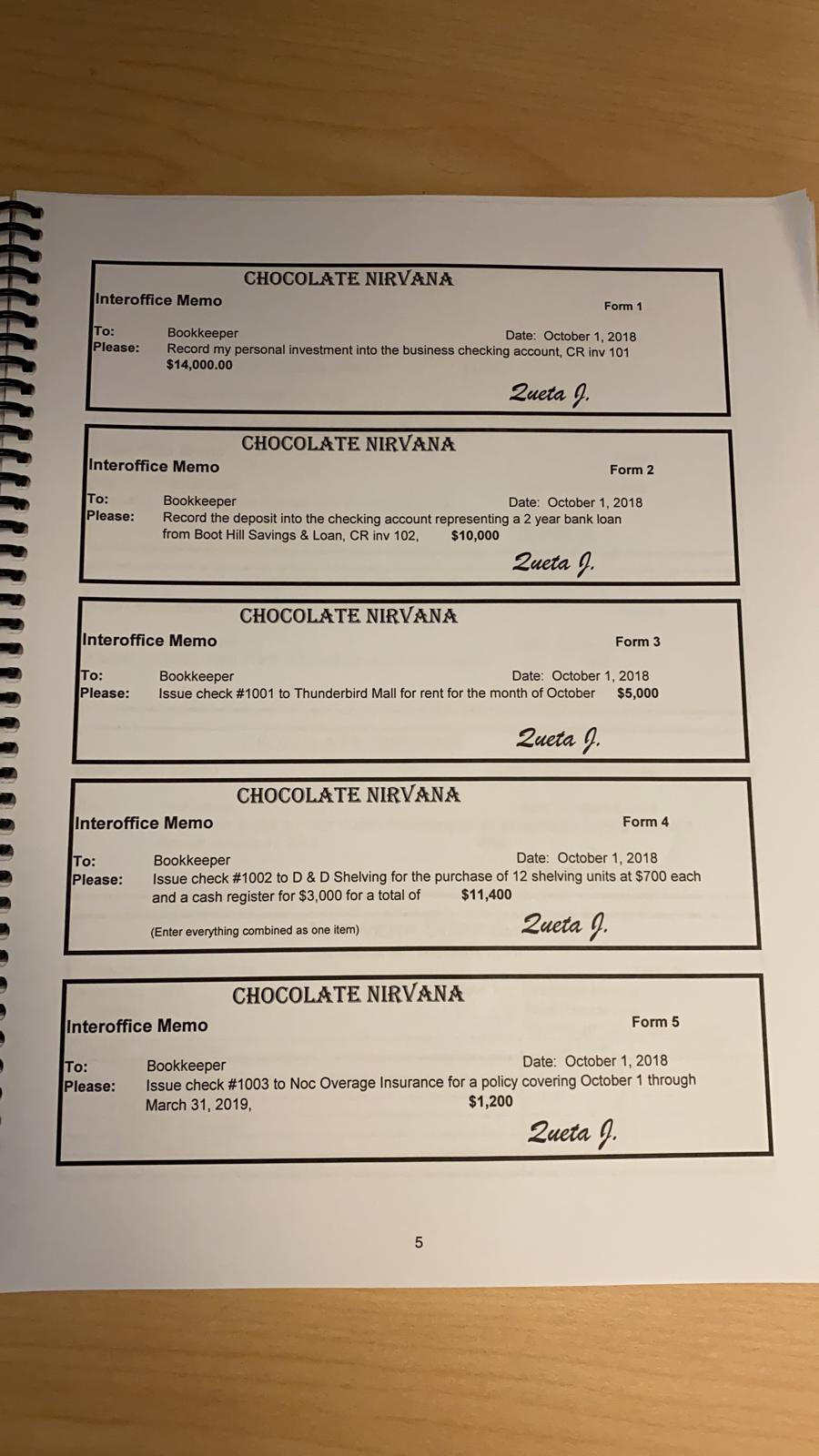

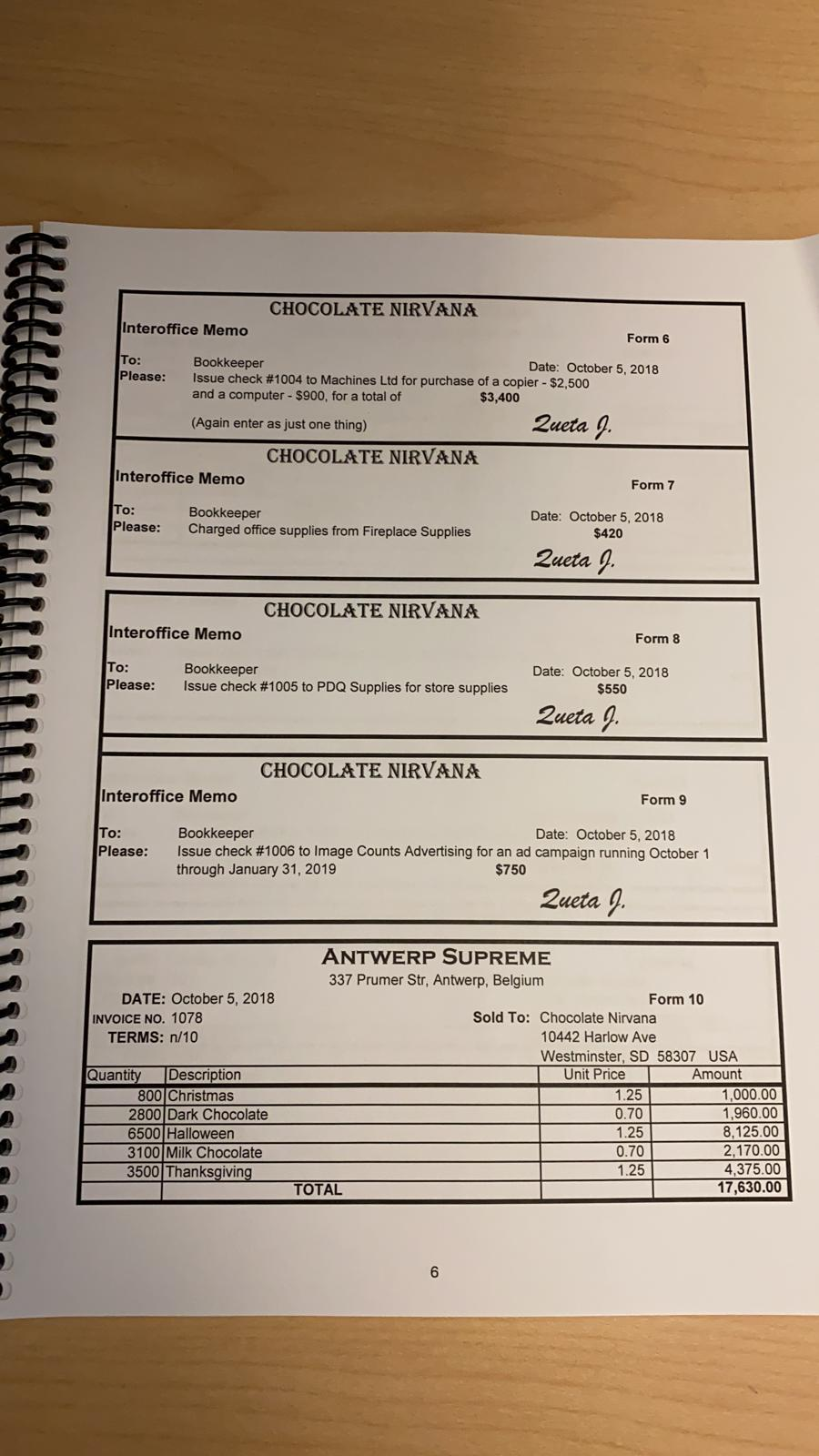

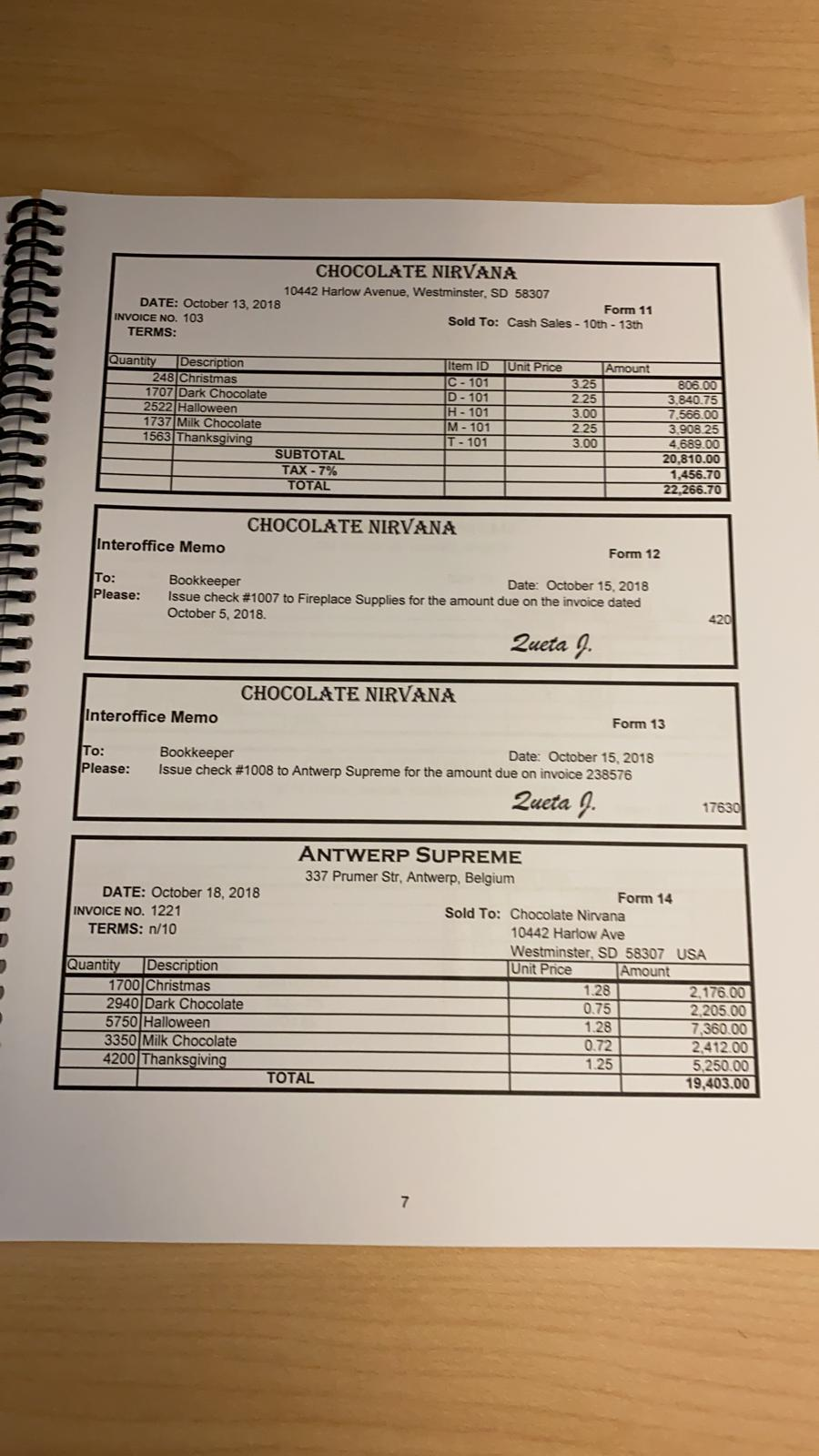

Introduction Queta Johnson is about to open a new business - Chocolate Nirvana. It will be a small chocolate specialties store. She uses a perpetual FIFO (First-in, First-Out) method to account for her inventory. So, every time you record a sale of merchandise you must also figure out the cost of the goods (determined from recording it in the merchandise inventory sheets and applying FIFO - chapter 7). The purpose of this practice set is to allow you the chance to see how each of the separate components we have worked on this semester fit together. As you complete the set, you may find it necessary to look back at what we learned in various chapters to help remember exactly what to do. Instructions 1. Journalize each form into ONE correct journal (review chapter 5) Purchase Journal - you purchased something on account Cash Receipts Journal - you received money for any reason Cash Payments Journal - you issued a check for any reason General journal - when none of the special journals work Remember you must have matching debits and credits in ALL journals 2. As you journalize each form, did you affect a control account? Accounts Payable - also take it into the Accounts Payable Subsidiary Ledger Cash - also take it into the Checkbook (deposit - add it; check - subtract it) Merchandise Inventory - go to the inventory sheets, use FIFO (ch 7), for each Cash Sales form add up the total cost of merchandise sold amounts and record them in the Cash Receipts Journal in the Merch Inv/COMS column NIISSSS Payroll (chapter 11 - especially pages 512-4) Hours worked and rates for Social Security, Medicare, FUTA and SUTA are on the form 1. Go to the individual earnings records and calculate their payroll (cumulative = gross) 2. Transfer information from indivdual earnings records to payroll register 3. Use payroll register to prepare the general journal entry for payroll (similar to page 512) 4. Prepare general journal entry for payroll taxes (like page 514) Specific information on pay rate, marital status and number of allowances located on their individual earnings record sheets Federal income tax withholding amounts are found on the chart in the front of the booklet. Use the right chart - married or single, find the intersection of their gross wages and their allowances. Use that amount for the federal income tax withholding amount. 3. When done journalizing all forms, total all columns from the special journals and write down totals. (see chapter 5) 4. Compare your totals to the check figure totals If your totals don't match, find your errors 5. Post all four journals into the general ledger (review chapters 5 as well as 2 and 4) 6. Prepare an unadjusted trial balance - do your numbers match the check figures? 7. Transfer the unadjusted trial balance amounts to the Worksheet (chapter 4) 8. Prepare the adjusting entries on page 2 of the general journal (chapter 3) based on the following data - for the month of OCTOBER: a) Depreciation - calculate depreciation for JUST the month of October based on the following information: Store Equipment - 5 year life, $1200 salvage value, use straight line depreciation Office Equipment - 5 year life, $100 salvage value, use straight line depreciation b) Record entry for expired insurance c) Currently there are $45 worth of office supplies on hand d) Currently there are $90 worth of store supplies on hand e) Record entry for amount of advertising expired for the period just ended f) Record wages earned, but unpaid, on Oct 31 of $275 9) Record accrued interest of $12. 9. Transfer the adjusting entries on to the worksheet and also post in to the general ledger 10. Complete the worksheet (see chapter 4) 11. Prepare an Accounts Payable Vendor balance (Schedule of Accounts Payable). Simply list each vendor that you owe money to (Accounts Payable) and total them (example in chapter 5). You do not have to list any business that does not have a balance at the end of the month. 12. Prepare a multiple-step Income Statement (example in chapter 6) 13. Prepare a Statement of Owner's Equity (new business) (example in chapter 1.4 and 6) 14. Prepare a classified Balance Sheet using the report format (example in chapter 6) 15. Journalize the closing entries on page 3 of the general journal (chapter 4) 16. Post the closing entries into the general ledger 17. Prepare a post-closing Trial Balance (chapter 4) Be sure to use your textbook as a reference as you work through this set. All of this information comes from work in our textbook. Before turning in your completed practice set - Please be sure to put your name on it!! CHOCOLATE NIRVANA Chart of Accounts REVENUE 410 Sales ASSETS Current Assets 100 Cash 112 Office Supplies 113 Store Supplies 114 Prepaid Insurance 115 Prepaid Advertising 120 Merchandise Inventory COST OF MERCHANDISE SOLD (COMS) 510 Cost of Merchandise Sold Property. Plant & Equipment 150 Office Equipment 151 Accumulated Depreciation - Office Equip 160 Store Equipment 161 Accumulated Depreciation - Store Equip OPERATING EXPENSES Selling Expenses 610 Advertising Expense 615 Depreciation Exp - Store Eq 620 Salaries Expense 625 Store Supplies Expense 650 Rent Expense LIABILITIES Current Liabilities 210 Accounts Payable 211 Interest Payable 213 Sales Tax Payable 214 Employee's Federal Income Tax Payable 215 Social Security Tax Payable 216 Medicare Tax Payable 217 FUTA Tax Payable 218 SUTA Tax Payable 219 Salaries Payable Administrative Expenses 660 Depreciation Exp - Office Eq 665 Insurance Expense 670 Payroll Tax Expense 675 Office Supplies Expense 680 Telephone Expense 685 Utilities Expense OTHER EXPENSE 810 Interest Expense Non-current 250 Notes Payable - Non Current OWNERS' EQUITY 310 Queta Johnson, Capital 311 Queta Johnson, Drawing 312 Income Summary CHOCOLATE NIRVANA Interoffice Memo Form 1 To: Please: Bookkeeper Date: October 1, 2018 Record my personal investment into the business checking account, CR inv 101 $14,000.00 Queta 9. CHOCOLATE NIRVANA Interoffice Memo Form 2 To: Please: Bookkeeper Date: October 1, 2018 Record the deposit into the checking account representing a 2 year bank loan from Boot Hill Savings & Loan, CR inv 102, $10,000 Queta . CHOCOLATE NIRVANA Interoffice Memo Form 3 To: Please: Bookkeeper Date: October 1, 2018 Issue check #1001 to Thunderbird Mall for rent for the month of October $5,000 Queta 9. CHOCOLATE NIRVANA Interoffice Memo Form 4 To: Please: Bookkeeper Date: October 1, 2018 Issue check #1002 to D & D Shelving for the purchase of 12 shelving units at $700 each and a cash register for $3,000 for a total of $11,400 (Enter everything combined as one item) Queta J. CHOCOLATE NIRVANA Interoffice Memo Form 5 To: Please: Bookkeeper Date: October 1, 2018 Issue check #1003 to Noc Overage Insurance for a policy covering October 1 through March 31, 2019, $1,200 Queta . 5 CHOCOLATE NIRVANA Interoffice Memo Form 6 To: Please: Bookkeeper Date: October 5, 2018 Issue check #1004 to Machines Ltd for purchase of a copier - $2,500 and a computer - $900, for a total of $3,400 (Again enter as just one thing) Queta . CHOCOLATE NIRVANA Interoffice Memo Form 7 To: Please: Bookkeeper Charged office supplies from Fireplace Supplies Date: October 5, 2018 $420 Queta 7. CHOCOLATE NIRVANA Interoffice Memo Form 8 To: Please: Bookkeeper Issue check #1005 to PDQ Supplies for store supplies Date: October 5, 2018 $550 Queta CHOCOLATE NIRVANA Interoffice Memo Form 9 To: Please: Bookkeeper Date: October 5, 2018 Issue check #1006 to Image Counts Advertising for an ad campaign running October 1 through January 31, 2019 $750 Queta 9. DATE: October 5, 2018 INVOICE NO. 1078 TERMS: n/10 Quantity Description 800 Christmas 2800 Dark Chocolate 6500 Halloween 3100 Milk Chocolate 3500 Thanksgiving ANTWERP SUPREME 337 Prumer Str, Antwerp, Belgium Form 10 Sold To: Chocolate Nirvana 10442 Harlow Ave Westminster, SD 58307 USA Unit Price Amount 1.25 1,000.00 0.70 1,960.00 1.25 8,125.00 70 2,170.00 1.25 4,375.00 TOTAL 17,630.00 CHOCOLATE NIRVANA 10442 Harlow Avenue, Westminster, SD 58307 DATE: October 13, 2018 Form 11 INVOICE NO. 103 Sold To: Cash Sales - 10th - 13th TERMS: Unit Price Amount Quantity Description 248 Christmas 1707 Dark Chocolate 2522 Halloween 1737 Milk Chocolate 1563 Thanksgiving Item ID C - 101 D-101 H-101 M-101 T-101 3.25 2.25 3.00 2.25 3.00 806.00 3.840.75 7.566.00 3.908 25 4.689.00 20.810.00 1,456.70 22,266.70 SUBTOTAL TAX - 7% TOTAL CHOCOLATE NIRVANA Interoffice Memo Form 12 To: Please: Bookkeeper Date: October 15, 2018 Issue check #1007 to Fireplace Supplies for the amount due on the invoice dated October 5, 2018 Queta . CHOCOLATE NIRVANA Interoffice Memo Form 13 To: Please: Bookkeeper Date: October 15, 2018 Issue check #1008 to Antwerp Supreme for the amount due on invoice 238576 Queta . 17630 DATE: October 18, 2018 INVOICE NO. 1221 TERMS: n/10 Quantity Description 1700 Christmas 2940 Dark Chocolate 5750 Halloween 3350 Milk Chocolate 4200 Thanksgiving ANTWERP SUPREME 337 Prumer Str, Antwerp, Belgium Form 14 Sold To: Chocolate Nirvana 10442 Harlow Ave Westminster, SD 58307 USA Unit Price Amount 1.28 2,176.00 0.75 2.205.00 1.28 7,360.00 0.72 2.412.00 1.25 5.250.00 TOTAL 19,403.00 Introduction Queta Johnson is about to open a new business - Chocolate Nirvana. It will be a small chocolate specialties store. She uses a perpetual FIFO (First-in, First-Out) method to account for her inventory. So, every time you record a sale of merchandise you must also figure out the cost of the goods (determined from recording it in the merchandise inventory sheets and applying FIFO - chapter 7). The purpose of this practice set is to allow you the chance to see how each of the separate components we have worked on this semester fit together. As you complete the set, you may find it necessary to look back at what we learned in various chapters to help remember exactly what to do. Instructions 1. Journalize each form into ONE correct journal (review chapter 5) Purchase Journal - you purchased something on account Cash Receipts Journal - you received money for any reason Cash Payments Journal - you issued a check for any reason General journal - when none of the special journals work Remember you must have matching debits and credits in ALL journals 2. As you journalize each form, did you affect a control account? Accounts Payable - also take it into the Accounts Payable Subsidiary Ledger Cash - also take it into the Checkbook (deposit - add it; check - subtract it) Merchandise Inventory - go to the inventory sheets, use FIFO (ch 7), for each Cash Sales form add up the total cost of merchandise sold amounts and record them in the Cash Receipts Journal in the Merch Inv/COMS column NIISSSS Payroll (chapter 11 - especially pages 512-4) Hours worked and rates for Social Security, Medicare, FUTA and SUTA are on the form 1. Go to the individual earnings records and calculate their payroll (cumulative = gross) 2. Transfer information from indivdual earnings records to payroll register 3. Use payroll register to prepare the general journal entry for payroll (similar to page 512) 4. Prepare general journal entry for payroll taxes (like page 514) Specific information on pay rate, marital status and number of allowances located on their individual earnings record sheets Federal income tax withholding amounts are found on the chart in the front of the booklet. Use the right chart - married or single, find the intersection of their gross wages and their allowances. Use that amount for the federal income tax withholding amount. 3. When done journalizing all forms, total all columns from the special journals and write down totals. (see chapter 5) 4. Compare your totals to the check figure totals If your totals don't match, find your errors 5. Post all four journals into the general ledger (review chapters 5 as well as 2 and 4) 6. Prepare an unadjusted trial balance - do your numbers match the check figures? 7. Transfer the unadjusted trial balance amounts to the Worksheet (chapter 4) 8. Prepare the adjusting entries on page 2 of the general journal (chapter 3) based on the following data - for the month of OCTOBER: a) Depreciation - calculate depreciation for JUST the month of October based on the following information: Store Equipment - 5 year life, $1200 salvage value, use straight line depreciation Office Equipment - 5 year life, $100 salvage value, use straight line depreciation b) Record entry for expired insurance c) Currently there are $45 worth of office supplies on hand d) Currently there are $90 worth of store supplies on hand e) Record entry for amount of advertising expired for the period just ended f) Record wages earned, but unpaid, on Oct 31 of $275 9) Record accrued interest of $12. 9. Transfer the adjusting entries on to the worksheet and also post in to the general ledger 10. Complete the worksheet (see chapter 4) 11. Prepare an Accounts Payable Vendor balance (Schedule of Accounts Payable). Simply list each vendor that you owe money to (Accounts Payable) and total them (example in chapter 5). You do not have to list any business that does not have a balance at the end of the month. 12. Prepare a multiple-step Income Statement (example in chapter 6) 13. Prepare a Statement of Owner's Equity (new business) (example in chapter 1.4 and 6) 14. Prepare a classified Balance Sheet using the report format (example in chapter 6) 15. Journalize the closing entries on page 3 of the general journal (chapter 4) 16. Post the closing entries into the general ledger 17. Prepare a post-closing Trial Balance (chapter 4) Be sure to use your textbook as a reference as you work through this set. All of this information comes from work in our textbook. Before turning in your completed practice set - Please be sure to put your name on it!! CHOCOLATE NIRVANA Chart of Accounts REVENUE 410 Sales ASSETS Current Assets 100 Cash 112 Office Supplies 113 Store Supplies 114 Prepaid Insurance 115 Prepaid Advertising 120 Merchandise Inventory COST OF MERCHANDISE SOLD (COMS) 510 Cost of Merchandise Sold Property. Plant & Equipment 150 Office Equipment 151 Accumulated Depreciation - Office Equip 160 Store Equipment 161 Accumulated Depreciation - Store Equip OPERATING EXPENSES Selling Expenses 610 Advertising Expense 615 Depreciation Exp - Store Eq 620 Salaries Expense 625 Store Supplies Expense 650 Rent Expense LIABILITIES Current Liabilities 210 Accounts Payable 211 Interest Payable 213 Sales Tax Payable 214 Employee's Federal Income Tax Payable 215 Social Security Tax Payable 216 Medicare Tax Payable 217 FUTA Tax Payable 218 SUTA Tax Payable 219 Salaries Payable Administrative Expenses 660 Depreciation Exp - Office Eq 665 Insurance Expense 670 Payroll Tax Expense 675 Office Supplies Expense 680 Telephone Expense 685 Utilities Expense OTHER EXPENSE 810 Interest Expense Non-current 250 Notes Payable - Non Current OWNERS' EQUITY 310 Queta Johnson, Capital 311 Queta Johnson, Drawing 312 Income Summary CHOCOLATE NIRVANA Interoffice Memo Form 1 To: Please: Bookkeeper Date: October 1, 2018 Record my personal investment into the business checking account, CR inv 101 $14,000.00 Queta 9. CHOCOLATE NIRVANA Interoffice Memo Form 2 To: Please: Bookkeeper Date: October 1, 2018 Record the deposit into the checking account representing a 2 year bank loan from Boot Hill Savings & Loan, CR inv 102, $10,000 Queta . CHOCOLATE NIRVANA Interoffice Memo Form 3 To: Please: Bookkeeper Date: October 1, 2018 Issue check #1001 to Thunderbird Mall for rent for the month of October $5,000 Queta 9. CHOCOLATE NIRVANA Interoffice Memo Form 4 To: Please: Bookkeeper Date: October 1, 2018 Issue check #1002 to D & D Shelving for the purchase of 12 shelving units at $700 each and a cash register for $3,000 for a total of $11,400 (Enter everything combined as one item) Queta J. CHOCOLATE NIRVANA Interoffice Memo Form 5 To: Please: Bookkeeper Date: October 1, 2018 Issue check #1003 to Noc Overage Insurance for a policy covering October 1 through March 31, 2019, $1,200 Queta . 5 CHOCOLATE NIRVANA Interoffice Memo Form 6 To: Please: Bookkeeper Date: October 5, 2018 Issue check #1004 to Machines Ltd for purchase of a copier - $2,500 and a computer - $900, for a total of $3,400 (Again enter as just one thing) Queta . CHOCOLATE NIRVANA Interoffice Memo Form 7 To: Please: Bookkeeper Charged office supplies from Fireplace Supplies Date: October 5, 2018 $420 Queta 7. CHOCOLATE NIRVANA Interoffice Memo Form 8 To: Please: Bookkeeper Issue check #1005 to PDQ Supplies for store supplies Date: October 5, 2018 $550 Queta CHOCOLATE NIRVANA Interoffice Memo Form 9 To: Please: Bookkeeper Date: October 5, 2018 Issue check #1006 to Image Counts Advertising for an ad campaign running October 1 through January 31, 2019 $750 Queta 9. DATE: October 5, 2018 INVOICE NO. 1078 TERMS: n/10 Quantity Description 800 Christmas 2800 Dark Chocolate 6500 Halloween 3100 Milk Chocolate 3500 Thanksgiving ANTWERP SUPREME 337 Prumer Str, Antwerp, Belgium Form 10 Sold To: Chocolate Nirvana 10442 Harlow Ave Westminster, SD 58307 USA Unit Price Amount 1.25 1,000.00 0.70 1,960.00 1.25 8,125.00 70 2,170.00 1.25 4,375.00 TOTAL 17,630.00 CHOCOLATE NIRVANA 10442 Harlow Avenue, Westminster, SD 58307 DATE: October 13, 2018 Form 11 INVOICE NO. 103 Sold To: Cash Sales - 10th - 13th TERMS: Unit Price Amount Quantity Description 248 Christmas 1707 Dark Chocolate 2522 Halloween 1737 Milk Chocolate 1563 Thanksgiving Item ID C - 101 D-101 H-101 M-101 T-101 3.25 2.25 3.00 2.25 3.00 806.00 3.840.75 7.566.00 3.908 25 4.689.00 20.810.00 1,456.70 22,266.70 SUBTOTAL TAX - 7% TOTAL CHOCOLATE NIRVANA Interoffice Memo Form 12 To: Please: Bookkeeper Date: October 15, 2018 Issue check #1007 to Fireplace Supplies for the amount due on the invoice dated October 5, 2018 Queta . CHOCOLATE NIRVANA Interoffice Memo Form 13 To: Please: Bookkeeper Date: October 15, 2018 Issue check #1008 to Antwerp Supreme for the amount due on invoice 238576 Queta . 17630 DATE: October 18, 2018 INVOICE NO. 1221 TERMS: n/10 Quantity Description 1700 Christmas 2940 Dark Chocolate 5750 Halloween 3350 Milk Chocolate 4200 Thanksgiving ANTWERP SUPREME 337 Prumer Str, Antwerp, Belgium Form 14 Sold To: Chocolate Nirvana 10442 Harlow Ave Westminster, SD 58307 USA Unit Price Amount 1.28 2,176.00 0.75 2.205.00 1.28 7,360.00 0.72 2.412.00 1.25 5.250.00 TOTAL 19,403.00

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started