Answered step by step

Verified Expert Solution

Question

1 Approved Answer

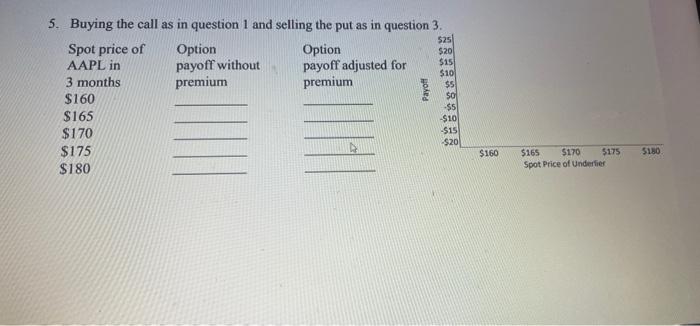

Answer questions pleaseeeee 5. Buying the call as in question 1 and selling the put as in question 3. Spot price of Option 525 Option

Answer questions pleaseeeee

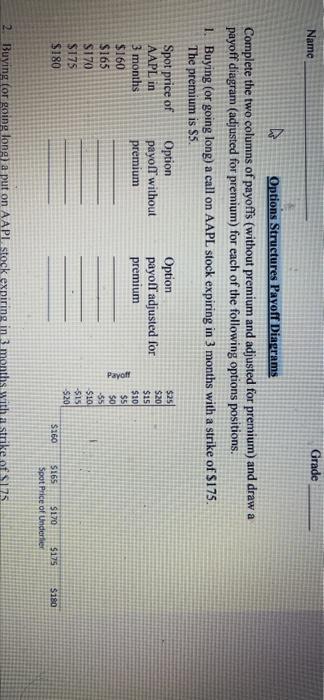

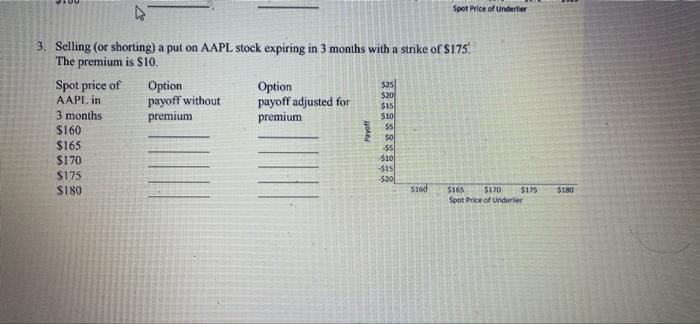

5. Buying the call as in question 1 and selling the put as in question 3. Spot price of Option 525 Option $200 AAPL in payoff without payoff adjusted for $15 3 months premium $10 premium $5 $160 $0 $165 $5 $10 $170 -$15 $175 $20 $180 Payoff $160 $180 $165 $170 $175 Spot Price of Underfier Name Grade Options Structures Payoff Diagrams Complete the two columns of payoffs (without premium and adjusted for premium) and draw a payoff diagram (adjusted for premium) for each of the following options positions. 1. Buying (or going long) a call on AAPL stock expiring in 3 months with a strike of $175. The premium is $5. Spot price of Option Option AAPL in payoff without payoff adjusted for 3 months premium premium $160 $165 $170 $175 $180 Payoff $25 $20 $15 $10 $5 SO -55 $10 -$15 -$20 $160 $180 S165 $170 $175 Spot Price of Undertier 2 Buying for going long) a put on AAPL stock expiring in 3 months with a S125 Spot Price of underlier $20 $15 3. Selling (or shorting) a put on AAPL stock expiring in 3 months with a strike of $175. a The premium is $10. Spot price of Option Option $25 AAPL in payoff without payoff adjusted for 3 months premium premium $160 1 $165 $170 S175 S180 $160 Spot Price of Underlier 1 s % % $10 -$15 520 $165 5170 $175 $180 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started