Answered step by step

Verified Expert Solution

Question

1 Approved Answer

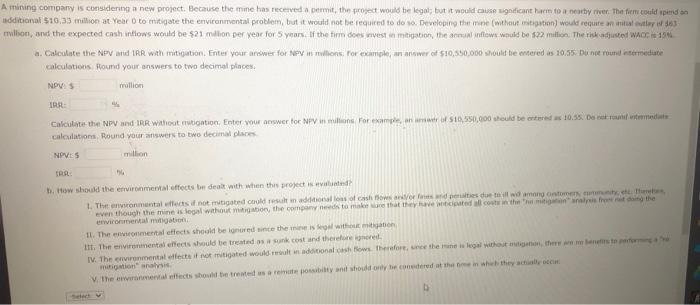

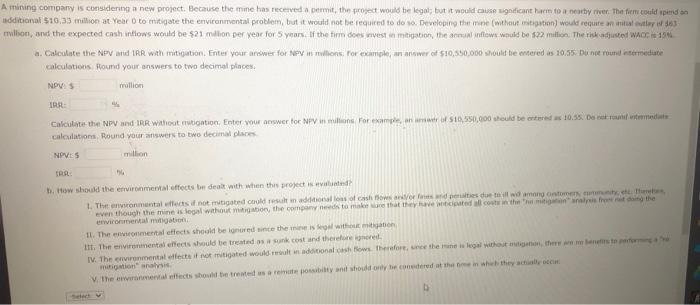

Answer quickly and correctly for thumbs up! A mining company is considering a new project. Because theme has received a permit, the project would be

Answer quickly and correctly for thumbs up!

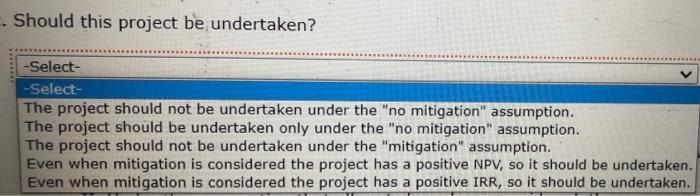

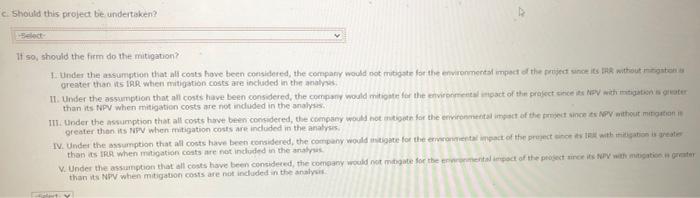

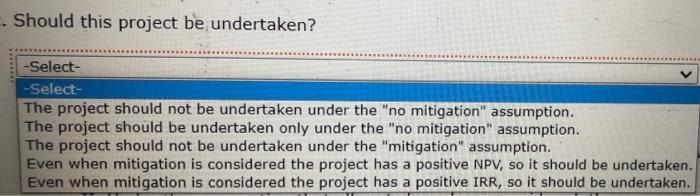

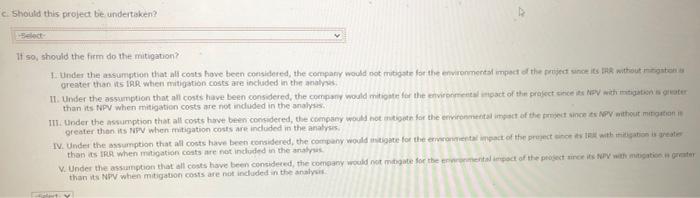

A mining company is considering a new project. Because theme has received a permit, the project would be legal; but it would cause significant harm to a nearby river. The firm could spend on additional $10,33 million at Year Oto mitigate the environmental problem, but it would not be required to do so. Developing the mine (without gon) would require a 63 million, and the expected cash untiows would be $21 million per yene for 5 years of the fim dos mvest in mitigation, the annual inflows would be $22 million. The rise ajusted Acc 19 a. Calculate the NPV and IRR wth mitigation. Enter your arewer for Nepy in melon, por example, wwer of $10,550,000 should he entered as 10.55. Du nee round intermediate calculations. Round your answers to two decimal places NOUS mullion IRR: Calculate the NPV and IRR without ration, Enter your answer for NPV in millions For example of 51,550,000 should be entered u 10.55. Der med calculations, Round your answers to two decimal places NPVES million TRAL th. How should the environmental effects be dealt with when this project is ved 1. Thronmental lects not mitigated could result in ons of cash vor des de tamang otomen met e even though the time as legal without mitigation, the company to make that they have cited all cost in the heart the environmental mugation 11. The comment efects should be incredince their without II. The environmental effects should be treated as un cost and therefore IV. The environmental efecto mitigated woulderult in additional cash flow. Therefore, we the new legal without the best mitigation V the mental efects should be treated as a reability and shoid only the comedered at there whetheach . Should this project be undertaken? -Select- -Select- The project should not be undertaken under the "no mitigation" assumption. The project should be undertaken only under the "no mitigation" assumption. The project should not be undertaken under the "mitigation" assumption. Even when mitigation is considered the project has a positive NPV, so it should be undertaken. Even when mitigation is considered the project has a positive IRR, so it should be undertaken. c. Should this project be undertaken? act It so, should the fim do the mitigation? Under the assumption that all costs have been considered the company would not mitigate for the environmental impact of the princis RR without not greater than its IRR when mitigation costs are included in the analys II. Under the assumption that all costs have been considered, the company would mitigate for the environmental impact of the project in PV with station ser than its NPV when mitigation costs are not induded in the analysis II. Under the assumption that all costs have been considered, the company would not initiate for the environmental impact of the sincet NPV without mon greater than its NPV when mitigation costs are included in the analysis IV. Under the assumption that all costs have been considered, the company would note for the moment pact of the proper with nation is great than IRR when mitigation costs are not included in the analys V. Under the assumption that all costs have been considered the company would not bogate for the mental impact of the projects with mattis greater than its NPV when mitigation costs are not included in the analysis +

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started