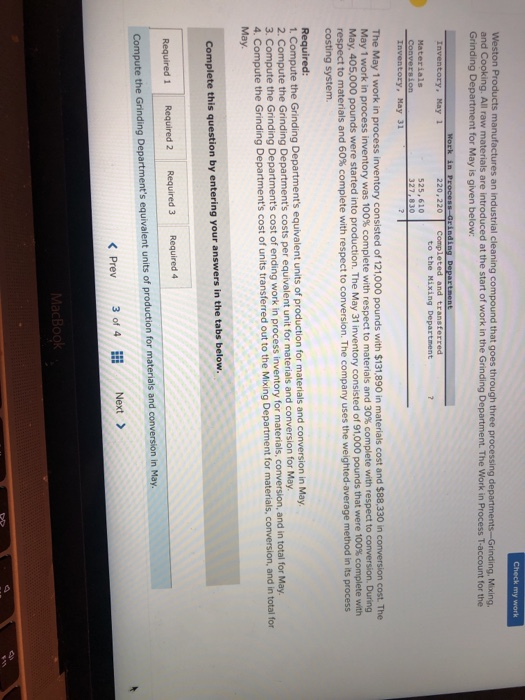

answer required 1-4

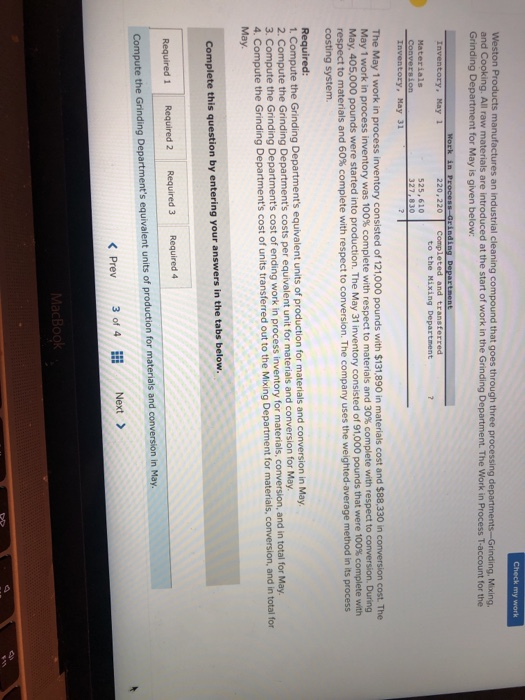

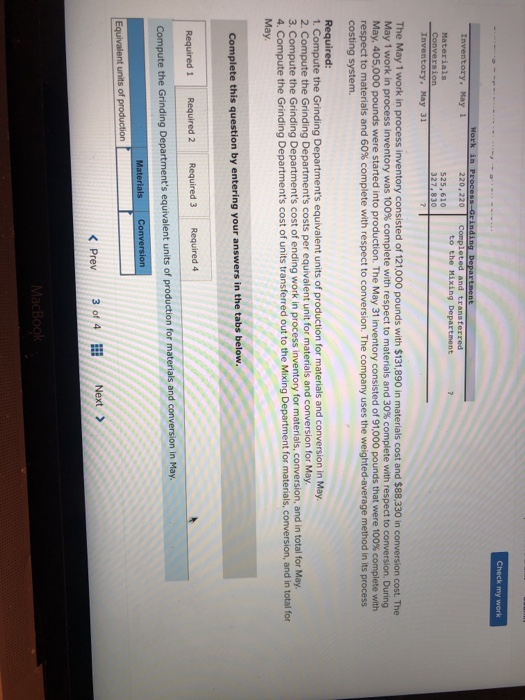

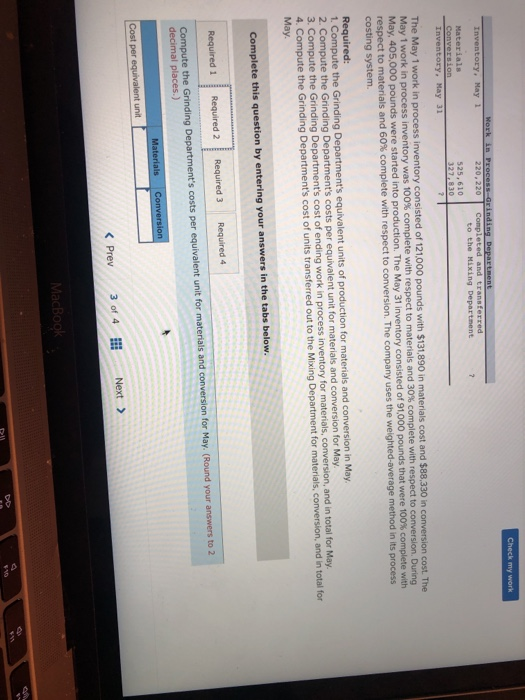

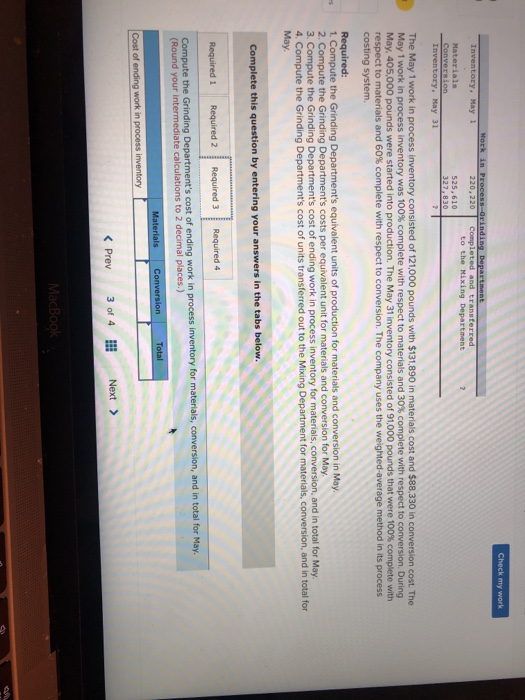

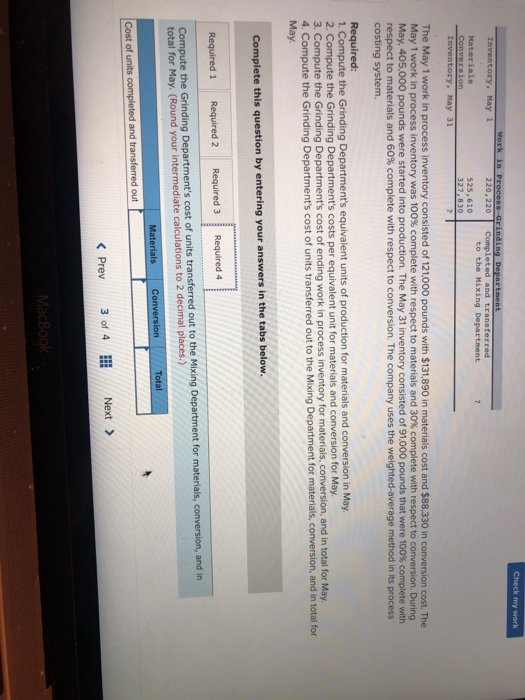

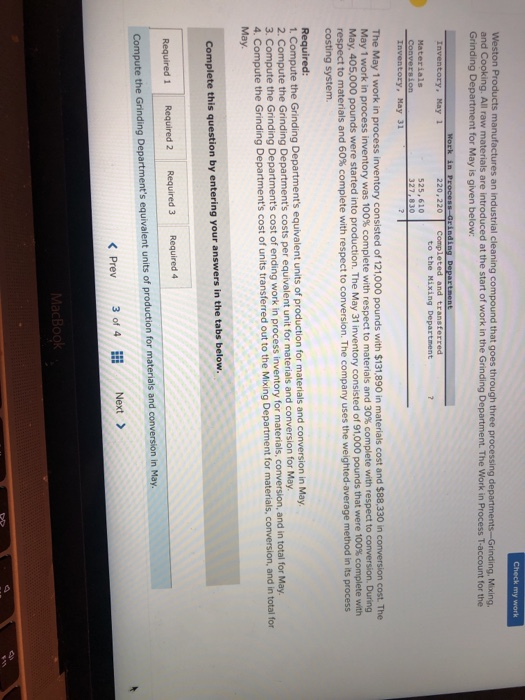

Weston Products manufactures an industrial cleaning compound that goes through three processing departments-Grinding, Mixing and Cooking. All raw materials are introduced at the start of work in the Grinding Department. The Work in Process T-account for the Grinding Department for May is given below: 220,220 Completed and transferred to the Mixing Department Materials 525,610 327,830 Conversion Inventory, Hay 31 The May 1 work in process inventory consisted of 121,000 pounds with $131,890 in materials cost and $88,330 in conversion cost. The May 1 work in process inventory was 100% complete with respect to materials and 30% complete with respect to conversion. During May, 405,000 pounds were started into production. The May 31 inventory consisted of 91,000 pounds that were 100% complete with respect to materials and 60% complete with respect to conversion. The company uses the weighted-average method in its process costing system. Required: the Grinding Department's equivalent units of production for materials and conversion in May inding Department's costs per equivalent unit for materials and conversion for May. 2. Compute the Gr the Grinding Department's cost of ending work in process inventory for materials, conversion, and in total for May 4. Compute the Grinding Departme May nt's cost of units transferred out to the Mixing Department for materials, conversion, and in total for Complete this question by entering your answers in the tabs below Required 1 Required 2 Required 3 Required 4 Compute the Grinding Department's equivalent units of production for materials and conversion in May Next K Prev 3 of 4 to the Mixing 525, 610 of 121,000 pounds with $131,890 in m s cost and $88,330 in conversion cost. The May 1 work in process inventory was 100% complete with r The May 31 inventory consisted of 91,000 pounds that were 100% complete with method in its process respect to materials and 60% complete with respect to conversion. The company uses the costing system. s, conversion, and in total for the of Check my work 220,220Completed and transferred to the Hixing Department 525,610 in process inventory consisted of 121,000 pounds with $131,890 in materials cost and $88.330 in conversion process inventory was 100% complete with respect to materials and 30% complete with rthe respect to conversion. During May, 405,000 pounds were started into production. The May 31 inventory consisted of 91,000 pounds that respect to materials and 60% complete with respect to c costing system. onversion. The company uses the weighted-average method in its process Required 1. Compute the Grinding Department's equivalent units of production for materials and conversion in May 2. Compute the Grinding Department's costs per equivalent unit for materials and conversion for May 3. Compute the Grinding Department's cost of ending work in process inventory for materials, conversion, and in total for May 4. Compute the Grinding Department's cost of units transferred out to the Mixing Department for materials, conversion, and in total for May. Complete this question by entering your answers in the tabs below. Compute the Grinding Department's costs per equivalent unit for materials and conversion for May. (Round your answers to 2 decimal places.) Next > 3 of 4 30, 41