answer requirement 2:

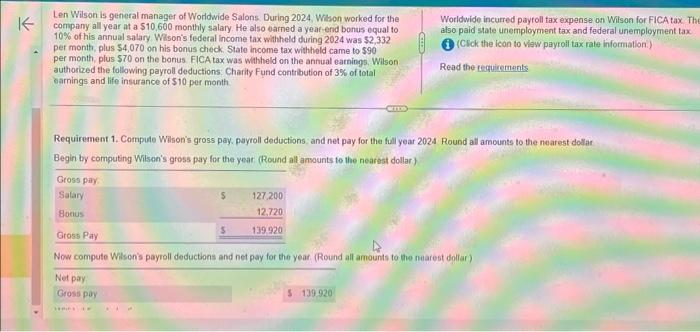

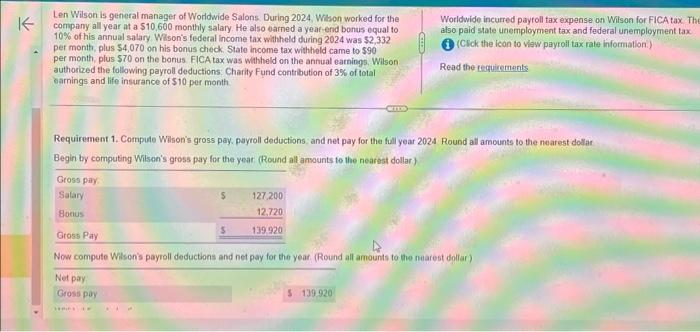

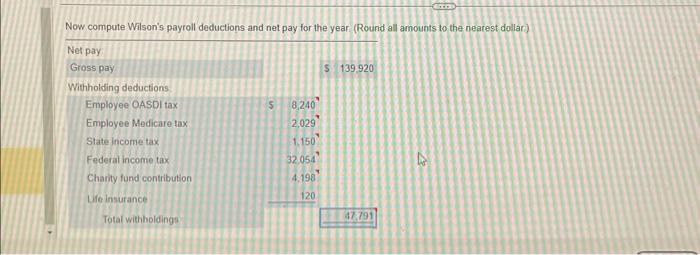

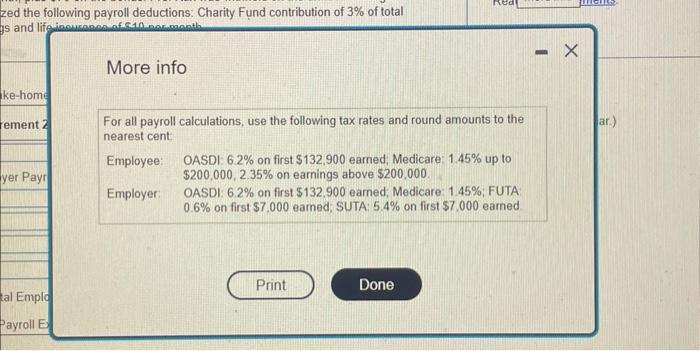

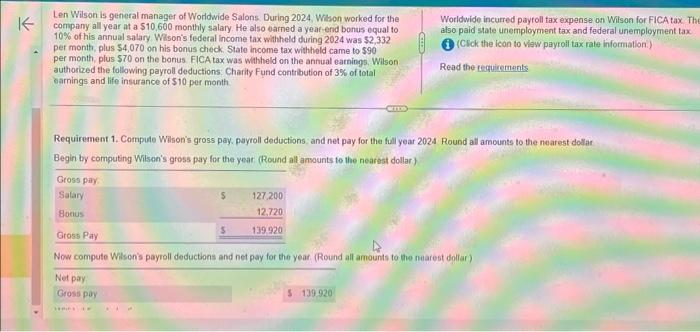

Len Wilson is general manager of Wordwide Salons. During 2024. Wison worked for the Worldwide incurred payroll tax expense on Wilson for FiCA tax The company all year at a $10,600 monthly salary. He also earned a yeat-end bonus equal to 10% of his annual salary. Wison's federal lincome tax withheld during 2024 was $2.332 also paid state unemployment tax and federal unemployment tax. per monti, plus $4,070 on his bonus check. State income tax withlield came to $90 (1. (Cick the icon to vlaw payroll tax rale information.) per month. plus $70 on the bonus FICA tax was witheld on the annual earnings. Witson authorized the following payroll deductions: Charity Fund contribution of 3% of total earnings and life insurance of $10 per month Requirement 1. Compude Wison's gross pay. payroll deductions, and net pay for the full year 2024 Round all amounts to the nearest dodlar Begin by computing Witson's gross pay for the yeat (Round all ansounts to the nearest dollar) Now compute Wilson's payroll deductbons and net pay for the year. (Round all arnounts to the nearest dollar) Now compute Wilson's payroll deductions and net pay for the year (Round all amounts to the nearest dollar) Len Wilson is general manager of Worldwide Salons. During 2024, Wilson worked for the Worldwide incurred payroll tax expense on Wilson for F company all year at a $10,600 monthly salary. He also earned a year-end bonus equal to also paid state unemployment tax and federal unemploy 10% of his annual salary. Wilsoris federal income tax withheld during 2024 was $2,332 per month. plus $4.070 on his bonus check State income tax withheld came to $90 ( (Click the icon to view payroll tax rafe information) per month, plus $70 on the bonus. FICA tax was withheld on the annual earnings Wilson authorized the following payroll deductions. Charily Fund contribution of 3% of total eamings and life insurance of $10 per month. Requirement 2. Compute Worldwide's total 2024 payroll tax expense for Wison. (Round all amounts to the nearest dollar) More info For all payroll calculations, use the following tax rates and round amounts to the nearest cent Employee: OASDI: 6.2% on first \$132,900 earned, Medicare: 1.45% up to $200,000,2.35% on earnings above $200,000. Employer: OASDI: 6.2% on first $132.900 eamed; Medicare: 1.45%; FUTA 0.6% on first $7.000 eamed; SUTA: 5.4% on first $7.000 eamed