Answered step by step

Verified Expert Solution

Question

1 Approved Answer

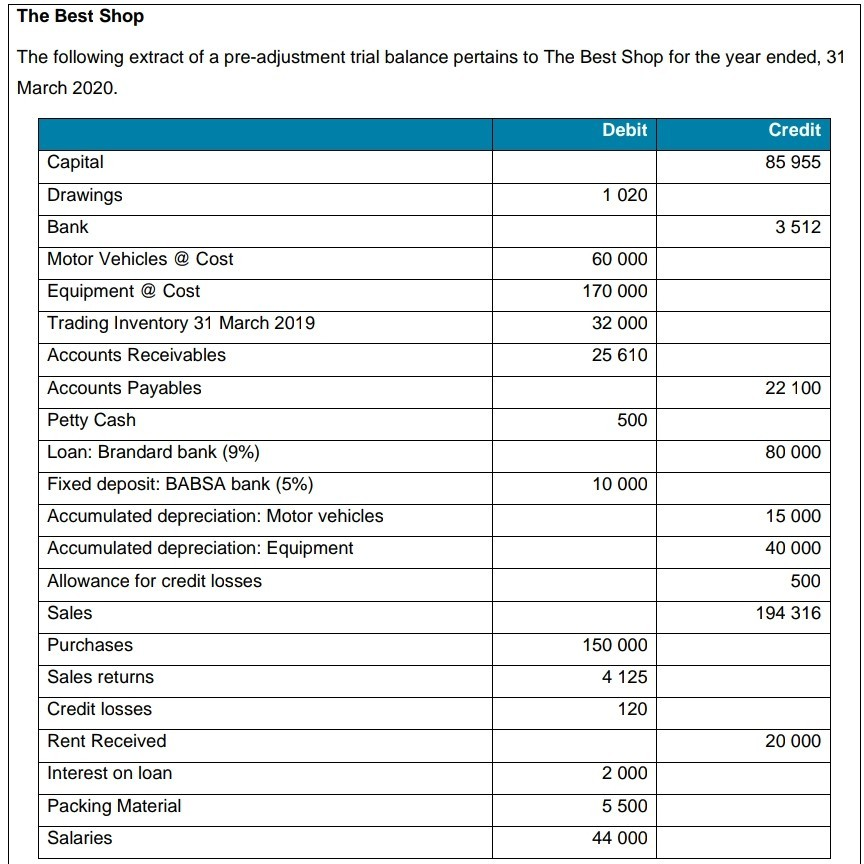

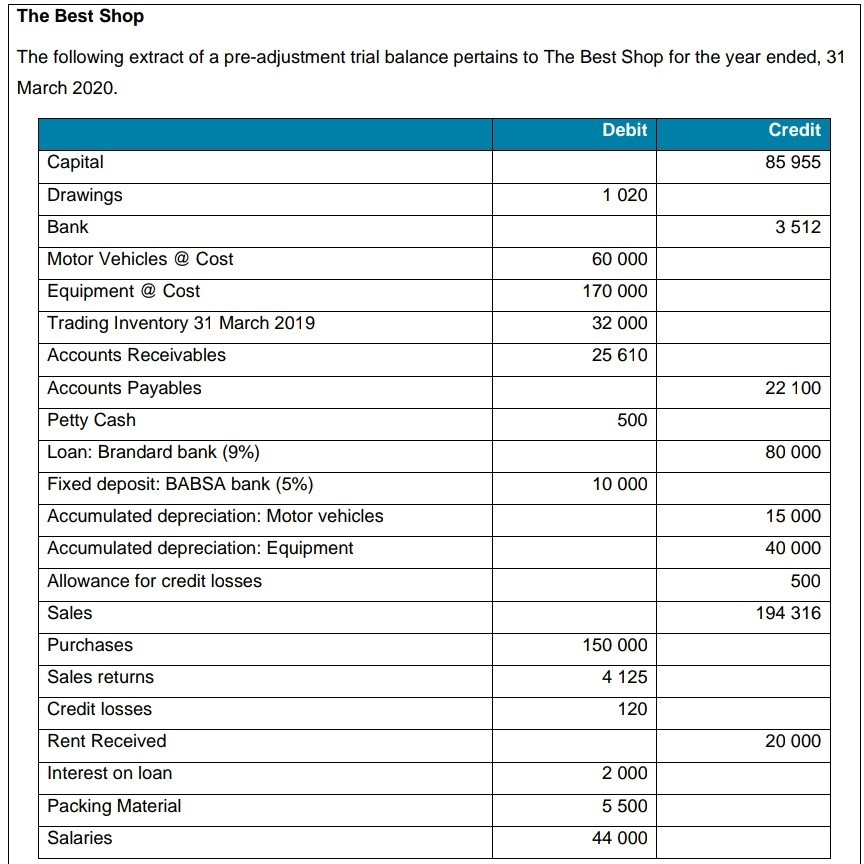

Answer sheet for 3.1 & 3.2 The Best Shop The following extract of a pre-adjustment trial balance pertains to The Best Shop for the year

Answer sheet for 3.1 & 3.2

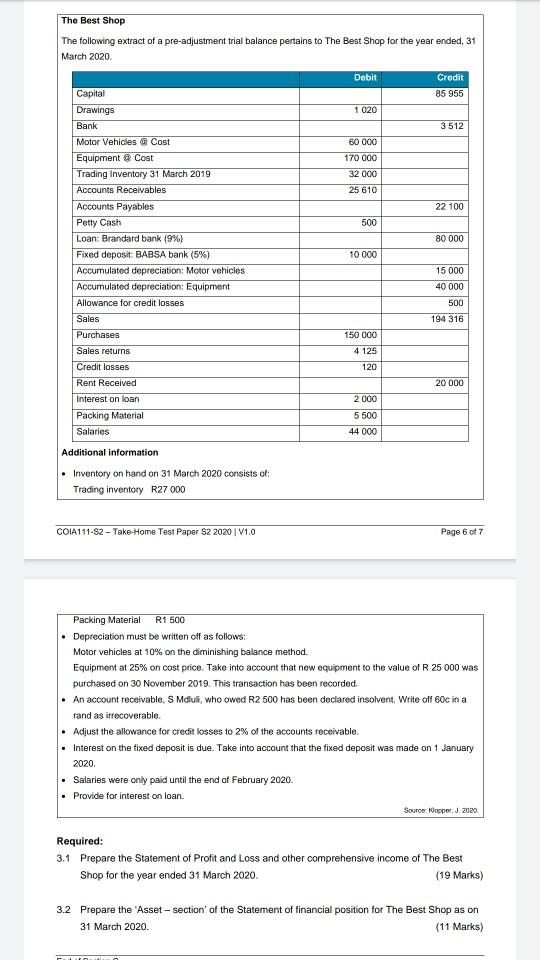

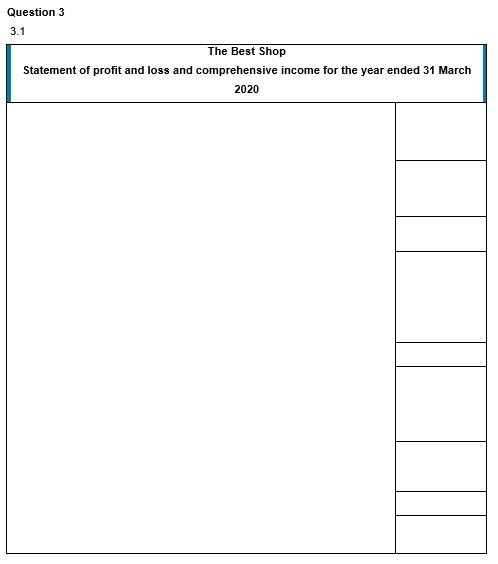

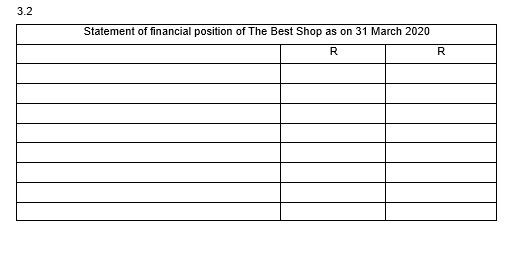

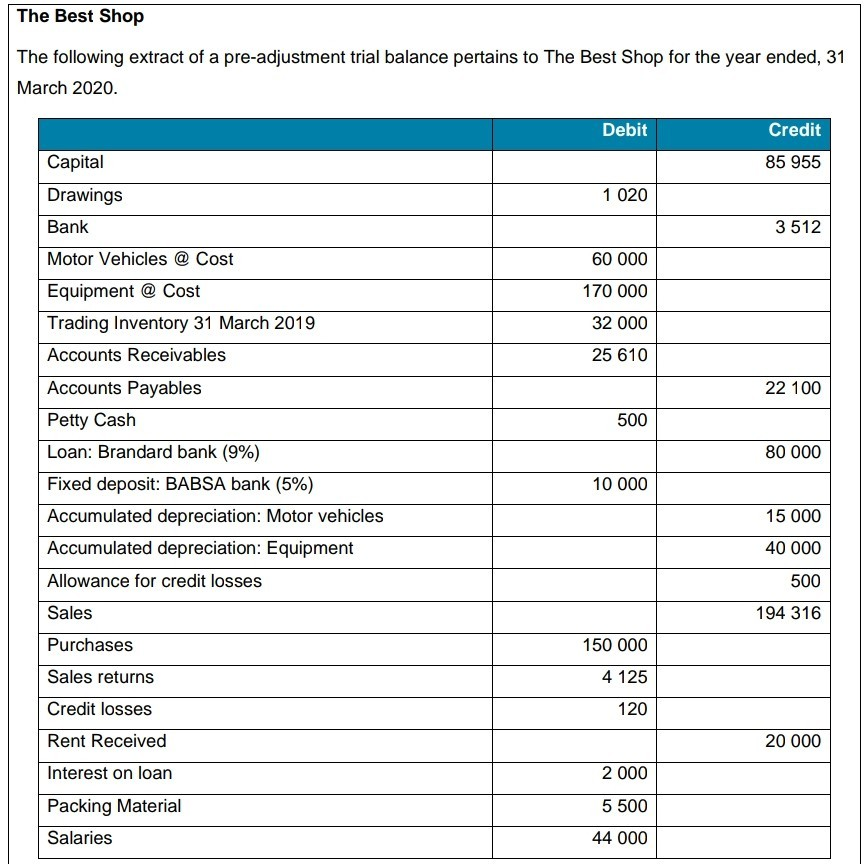

The Best Shop The following extract of a pre-adjustment trial balance pertains to The Best Shop for the year ended, 31 March 2020 Debit Credit 85 955 1 020 3512 60 000 170 000 32 000 25 610 22 100 500 80 000 10 000 Capital Drawings Bank Motor Vehicles Cost Equipment @ Cost Trading Inventory 31 March 2019 Accounts Receivables Accounts Payables Petty Cash Loan: Brandard bank (9%) Fixed deposit: BABSA bank (5%) Accumulated depreciation: Motor vehicles Accumulated depreciation: Equipment Allowance for credit losses Sales Purchases Sales returns Credit losses Rent Received Interest on loan Packing Material Salaries 15 000 40 000 500 194 316 150 000 4 125 120 20 000 2 000 5 500 44 000 Additional information Inventory on hand on 31 March 2020 consists of: Trading inventory R27 000 COIA111-S2 - Take-Home Test Paper S2 2020 V1.0 Page 6 of 7 Packing Material R1 500 Depreciation must be written off as follows: Motor vehicles at 10% on the diminishing balance method. Equipment at 25% on cost price. Take into account that new equipment to the value of R25 000 was purchased on 30 November 2019. This transaction has been recorded. An account receivable, S Mclus, who owed R2 500 has been declared insolvent. Write off 60c in a rand as irrecoverable. Adjust the allowance for credit losses to 2% of the accounts receivable. Interest on the fixed deposit is due. Take into account that the fixed deposit was made on 1 January 2020 Salaries were only paid until the end of February 2020. Provide for interest on loan. Source: Klopper, J. 2020 Required: 3.1 Prepare the Statement of Profit and Loss and other comprehensive income of The Best Shop for the year ended 31 March 2020. (19 Marks) 3.2 Prepare the 'Asset - section of the Statement of financial position for The Best Shop as on 31 March 2020. (11 Marks) Question 3 3.1 The Best Shop Statement of profit and loss and comprehensive income for the year ended 31 March 2020 3.2 Statement of financial position of The Best Shop as on 31 March 2020 R R The Best Shop The following extract of a pre-adjustment trial balance pertains to The Best Shop for the year ended, 31 March 2020. Debit Credit 85 955 Capital Drawings 1 020 Bank 3 512 60 000 170 000 32 000 25 610 22 100 500 Motor Vehicles @ Cost Equipment @ Cost Trading Inventory 31 March 2019 Accounts Receivables Accounts Payables Petty Cash Loan: Brandard bank (9%) Fixed deposit: BABSA bank (5%) Accumulated depreciation: Motor vehicles Accumulated depreciation: Equipment Allowance for credit losses Sales 80 000 10 000 15 000 40 000 500 194 316 Purchases 150 000 Sales returns 4 125 120 Credit losses Rent Received 20 000 2 000 Interest on loan Packing Material Salaries 5 500 44 000 Question 3 3.1 The Best Shop Statement of profit and loss and comprehensive income for the year ended 31 March 2020 The Best Shop The following extract of a pre-adjustment trial balance pertains to The Best Shop for the year ended, 31 March 2020 Debit Credit 85 955 1 020 3512 60 000 170 000 32 000 25 610 22 100 500 80 000 10 000 Capital Drawings Bank Motor Vehicles Cost Equipment @ Cost Trading Inventory 31 March 2019 Accounts Receivables Accounts Payables Petty Cash Loan: Brandard bank (9%) Fixed deposit: BABSA bank (5%) Accumulated depreciation: Motor vehicles Accumulated depreciation: Equipment Allowance for credit losses Sales Purchases Sales returns Credit losses Rent Received Interest on loan Packing Material Salaries 15 000 40 000 500 194 316 150 000 4 125 120 20 000 2 000 5 500 44 000 Additional information Inventory on hand on 31 March 2020 consists of: Trading inventory R27 000 COIA111-S2 - Take-Home Test Paper S2 2020 V1.0 Page 6 of 7 Packing Material R1 500 Depreciation must be written off as follows: Motor vehicles at 10% on the diminishing balance method. Equipment at 25% on cost price. Take into account that new equipment to the value of R25 000 was purchased on 30 November 2019. This transaction has been recorded. An account receivable, S Mclus, who owed R2 500 has been declared insolvent. Write off 60c in a rand as irrecoverable. Adjust the allowance for credit losses to 2% of the accounts receivable. Interest on the fixed deposit is due. Take into account that the fixed deposit was made on 1 January 2020 Salaries were only paid until the end of February 2020. Provide for interest on loan. Source: Klopper, J. 2020 Required: 3.1 Prepare the Statement of Profit and Loss and other comprehensive income of The Best Shop for the year ended 31 March 2020. (19 Marks) 3.2 Prepare the 'Asset - section of the Statement of financial position for The Best Shop as on 31 March 2020. (11 Marks) The Best Shop The following extract of a pre-adjustment trial balance pertains to The Best Shop for the year ended, 31 March 2020 Debit Credit 85 955 1 020 3512 60 000 170 000 32 000 25 610 22 100 500 80 000 10 000 Capital Drawings Bank Motor Vehicles Cost Equipment @ Cost Trading Inventory 31 March 2019 Accounts Receivables Accounts Payables Petty Cash Loan: Brandard bank (9%) Fixed deposit: BABSA bank (5%) Accumulated depreciation: Motor vehicles Accumulated depreciation: Equipment Allowance for credit losses Sales Purchases Sales returns Credit losses Rent Received Interest on loan Packing Material Salaries 15 000 40 000 500 194 316 150 000 4 125 120 20 000 2 000 5 500 44 000 Additional information Inventory on hand on 31 March 2020 consists of: Trading inventory R27 000 COIA111-S2 - Take-Home Test Paper S2 2020 V1.0 Page 6 of 7 Packing Material R1 500 Depreciation must be written off as follows: Motor vehicles at 10% on the diminishing balance method. Equipment at 25% on cost price. Take into account that new equipment to the value of R25 000 was purchased on 30 November 2019. This transaction has been recorded. An account receivable, S Mclus, who owed R2 500 has been declared insolvent. Write off 60c in a rand as irrecoverable. Adjust the allowance for credit losses to 2% of the accounts receivable. Interest on the fixed deposit is due. Take into account that the fixed deposit was made on 1 January 2020 Salaries were only paid until the end of February 2020. Provide for interest on loan. Source: Klopper, J. 2020 Required: 3.1 Prepare the Statement of Profit and Loss and other comprehensive income of The Best Shop for the year ended 31 March 2020. (19 Marks) 3.2 Prepare the 'Asset - section of the Statement of financial position for The Best Shop as on 31 March 2020. (11 Marks) Question 3 3.1 The Best Shop Statement of profit and loss and comprehensive income for the year ended 31 March 2020 3.2 Statement of financial position of The Best Shop as on 31 March 2020 R R The Best Shop The following extract of a pre-adjustment trial balance pertains to The Best Shop for the year ended, 31 March 2020. Debit Credit 85 955 Capital Drawings 1 020 Bank 3 512 60 000 170 000 32 000 25 610 22 100 500 Motor Vehicles @ Cost Equipment @ Cost Trading Inventory 31 March 2019 Accounts Receivables Accounts Payables Petty Cash Loan: Brandard bank (9%) Fixed deposit: BABSA bank (5%) Accumulated depreciation: Motor vehicles Accumulated depreciation: Equipment Allowance for credit losses Sales 80 000 10 000 15 000 40 000 500 194 316 Purchases 150 000 Sales returns 4 125 120 Credit losses Rent Received 20 000 2 000 Interest on loan Packing Material Salaries 5 500 44 000 Question 3 3.1 The Best Shop Statement of profit and loss and comprehensive income for the year ended 31 March 2020 The Best Shop The following extract of a pre-adjustment trial balance pertains to The Best Shop for the year ended, 31 March 2020 Debit Credit 85 955 1 020 3512 60 000 170 000 32 000 25 610 22 100 500 80 000 10 000 Capital Drawings Bank Motor Vehicles Cost Equipment @ Cost Trading Inventory 31 March 2019 Accounts Receivables Accounts Payables Petty Cash Loan: Brandard bank (9%) Fixed deposit: BABSA bank (5%) Accumulated depreciation: Motor vehicles Accumulated depreciation: Equipment Allowance for credit losses Sales Purchases Sales returns Credit losses Rent Received Interest on loan Packing Material Salaries 15 000 40 000 500 194 316 150 000 4 125 120 20 000 2 000 5 500 44 000 Additional information Inventory on hand on 31 March 2020 consists of: Trading inventory R27 000 COIA111-S2 - Take-Home Test Paper S2 2020 V1.0 Page 6 of 7 Packing Material R1 500 Depreciation must be written off as follows: Motor vehicles at 10% on the diminishing balance method. Equipment at 25% on cost price. Take into account that new equipment to the value of R25 000 was purchased on 30 November 2019. This transaction has been recorded. An account receivable, S Mclus, who owed R2 500 has been declared insolvent. Write off 60c in a rand as irrecoverable. Adjust the allowance for credit losses to 2% of the accounts receivable. Interest on the fixed deposit is due. Take into account that the fixed deposit was made on 1 January 2020 Salaries were only paid until the end of February 2020. Provide for interest on loan. Source: Klopper, J. 2020 Required: 3.1 Prepare the Statement of Profit and Loss and other comprehensive income of The Best Shop for the year ended 31 March 2020. (19 Marks) 3.2 Prepare the 'Asset - section of the Statement of financial position for The Best Shop as on 31 March 2020. (11 Marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started