Question

Answer should be in below format PART A: Decision Variables You will use the following decision variables: x ij is the supply from S i

Answer should be in below format

PART A: Decision Variables

You will use the following decision variables:

- xij is the supply from Si to Dj, where

| S1 | S2 | S3 | S4 | S5 | S6 | S7 |

| RAG supply | Peabody supply | American supply | Consol supply | Cyprus supply | Addington Supply | Waterloo Supply |

And

| D1 | D2 | D3 | D4 | D5 |

| Miami Fort 5 Demand | Miami Fort 7 Demand | Beckjord 1 Demand | East Bend 1 Demand | Zimmer 1 Demand |

PART B: Formulation

- Objective Function: Explain briefly what it is that you are maximizing followed by the algebraic expression. This is a large expression arrange it so it is readable.

- Against each constraint, give a label at the extreme right. The label should give some idea to the reader the relevance of the constraint. Note that there are two sets of constraints group them accordingly.

- Keep the labels in Red to separate them from the algebraic expressions

PART C: Solution

- Optimum Objective Function Value:

PART D (Eight questions an all):

Question 1

What is the total cost ($ / ton) for the coal delivered at D3 from S1? Show your computation.

Question 2

Determine the total cost of coal ($ / ton) from each mining company to each generating unit.

Just write down the costs in the table below.

| SOURCE | DESTINATION | ||||

| Miami Fort # 5 | Miami Fort # 7 | Beckjord | East Bend | Zimmer | |

| RAG | |||||

| Peabody | |||||

| American | |||||

| Consol | |||||

| Cyprus | |||||

| Addington | |||||

| Waterloo |

Question 3

Complete the table below which informs how much coal must be shipped from each mining company to each generating unit.

| SOURCE | DESTINATION | ||||

| Miami Fort # 5 | Miami Fort # 7 | Beckjord | East Bend | Zimmer | |

| RAG | |||||

| Peabody | |||||

| American | |||||

| Consol | |||||

| Cyprus | |||||

| Addington | |||||

| Waterloo |

Question 4

The table below represents the average cost of coal in cents per million BTUs for each generating unit (a measure of the cost of fuel for the generating units). Complete the table.

| Miami Fort # 5 | Miami Fort # 7 | Beckjord | East Bend | Zimmer | |

| Avg cost cents per million BTUs |

Question 5

The table below represents the average number of BTUs per pound of coal received at each generating unit (a measure of the energy efficiency of the coal received at each unit). Complete the table.

| Miami Fort # 5 | Miami Fort # 7 | Beckjord | East Bend | Zimmer | |

| Avg number of BTUs per pound of coal received |

Question 6

Suppose that Duke Energy can purchase an additional 80,000 tons of coal from American Coal Sales as an all or nothing deal for $35 per ton. Should Duke Energy purchase the additional 80,000 tons of coal? Explain why Duke should or should not by referring to the Sensitivity Report (in your Excel file). A complete explanation is required.

Question 7

Suppose that Duke Energy learns that the energy content of the coal from Cyprus Amax is actually 13,000 BTUs per pound. Should Duke Energy revise its procurement plan?

There will be another sheet in your Excel file with the new data. Copy the solution into this table.

| SOURCE | DESTINATION | ||||

| Miami Fort # 5 | Miami Fort # 7 | Beckjord | East Bend | Zimmer | |

| RAG | |||||

| Peabody | |||||

| American | |||||

| Consol | |||||

| Cyprus | |||||

| Addington | |||||

| Waterloo |

Question 8

Duke Energy has learned from its trading group that Duke Energy can sell 50,000 megawatt-hours of electricity over the grid (to other electricity suppliers) at a price of $30 per megawatt-hour. Should Duke Energy sell the electricity? If so, which generating units should produce the additional electricity? A complete explanation is required.

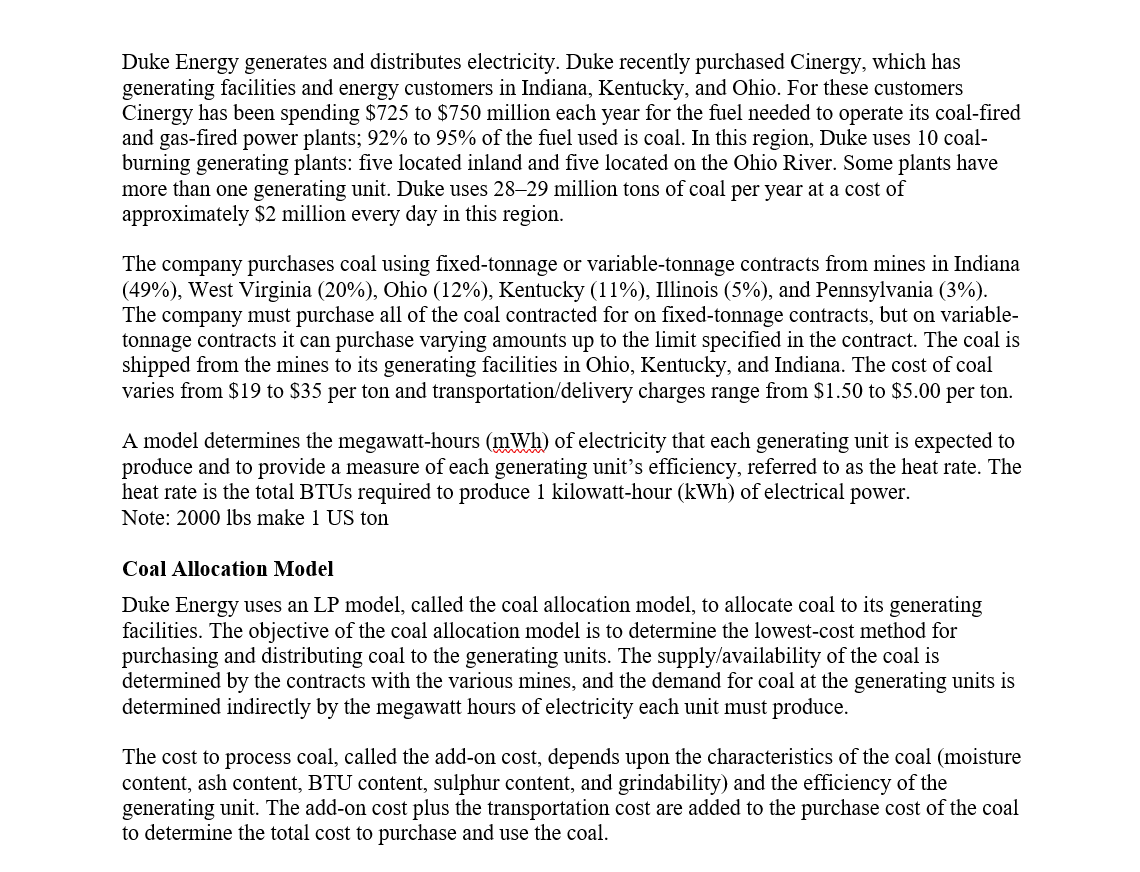

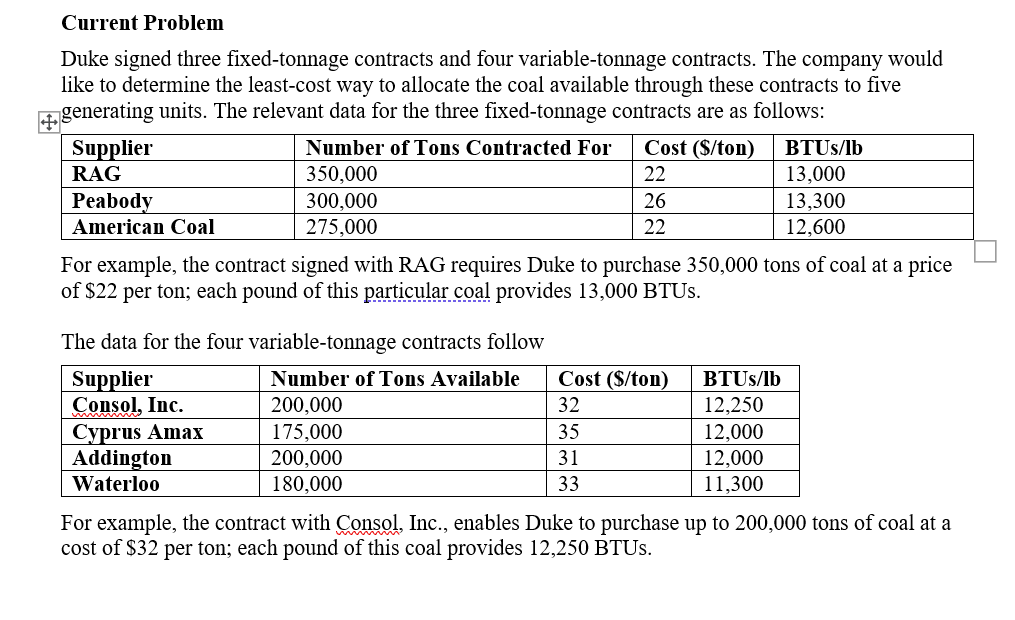

Duke Energy generates and distributes electricity. Duke recently purchased Cinergy, which has generating facilities and energy customers in Indiana, Kentucky, and Ohio. For these customers Cinergy has been spending $725 to $750 million each year for the fuel needed to operate its coal-fired and gas-fired power plants; 92% to 95% of the fuel used is coal. In this region, Duke uses 10 coalburning generating plants: five located inland and five located on the Ohio River. Some plants have more than one generating unit. Duke uses 28-29 million tons of coal per year at a cost of approximately $2 million every day in this region. The company purchases coal using fixed-tonnage or variable-tonnage contracts from mines in Indiana (49%), West Virginia (20\%), Ohio (12\%), Kentucky (11\%), Illinois (5\%), and Pennsylvania (3\%). The company must purchase all of the coal contracted for on fixed-tonnage contracts, but on variabletonnage contracts it can purchase varying amounts up to the limit specified in the contract. The coal is shipped from the mines to its generating facilities in Ohio, Kentucky, and Indiana. The cost of coal varies from $19 to $35 per ton and transportation/delivery charges range from $1.50 to $5.00 per ton. A model determines the megawatt-hours ( mWh ) of electricity that each generating unit is expected to produce and to provide a measure of each generating unit's efficiency, referred to as the heat rate. The heat rate is the total BTUs required to produce 1 kilowatt-hour (kWh) of electrical power. Note: 2000 lbs make 1 US ton Coal Allocation Model Duke Energy uses an LP model, called the coal allocation model, to allocate coal to its generating facilities. The objective of the coal allocation model is to determine the lowest-cost method for purchasing and distributing coal to the generating units. The supply/availability of the coal is determined by the contracts with the various mines, and the demand for coal at the generating units is determined indirectly by the megawatt hours of electricity each unit must produce. The cost to process coal, called the add-on cost, depends upon the characteristics of the coal (moisture content, ash content, BTU content, sulphur content, and grindability) and the efficiency of the generating unit. The add-on cost plus the transportation cost are added to the purchase cost of the coal to determine the total cost to purchase and use the coal. Current Problem Duke signed three fixed-tonnage contracts and four variable-tonnage contracts. The company would like to determine the least-cost way to allocate the coal available through these contracts to five generating units. The relevant data for the three fixed-tonnage contracts are as follows: For example, the contract signed with RAG requires Duke to purchase 350,000 tons of coal at a price of \$22 per ton; each pound of this particular coal provides 13,000 BTUs. The data for the four variable-tonnage contracts follow For example, the contract with Consol, Inc., enables Duke to purchase up to 200,000 tons of coal at a cost of $32 per ton; each pound of this coal provides 12,250 BTUs. The number of megawatt-hours of electricity that each generating unit must produce and the heat rat provided are as follows: For example, Miami Fort 5 must produce 550,000 megawatt-hours of electricity, and 10,500 BTUs are needed to produce each kilowatt-hour. The transportation cost and the add-on cost in dollars per ton are shown here: Duke Energy generates and distributes electricity. Duke recently purchased Cinergy, which has generating facilities and energy customers in Indiana, Kentucky, and Ohio. For these customers Cinergy has been spending $725 to $750 million each year for the fuel needed to operate its coal-fired and gas-fired power plants; 92% to 95% of the fuel used is coal. In this region, Duke uses 10 coalburning generating plants: five located inland and five located on the Ohio River. Some plants have more than one generating unit. Duke uses 28-29 million tons of coal per year at a cost of approximately $2 million every day in this region. The company purchases coal using fixed-tonnage or variable-tonnage contracts from mines in Indiana (49%), West Virginia (20\%), Ohio (12\%), Kentucky (11\%), Illinois (5\%), and Pennsylvania (3\%). The company must purchase all of the coal contracted for on fixed-tonnage contracts, but on variabletonnage contracts it can purchase varying amounts up to the limit specified in the contract. The coal is shipped from the mines to its generating facilities in Ohio, Kentucky, and Indiana. The cost of coal varies from $19 to $35 per ton and transportation/delivery charges range from $1.50 to $5.00 per ton. A model determines the megawatt-hours ( mWh ) of electricity that each generating unit is expected to produce and to provide a measure of each generating unit's efficiency, referred to as the heat rate. The heat rate is the total BTUs required to produce 1 kilowatt-hour (kWh) of electrical power. Note: 2000 lbs make 1 US ton Coal Allocation Model Duke Energy uses an LP model, called the coal allocation model, to allocate coal to its generating facilities. The objective of the coal allocation model is to determine the lowest-cost method for purchasing and distributing coal to the generating units. The supply/availability of the coal is determined by the contracts with the various mines, and the demand for coal at the generating units is determined indirectly by the megawatt hours of electricity each unit must produce. The cost to process coal, called the add-on cost, depends upon the characteristics of the coal (moisture content, ash content, BTU content, sulphur content, and grindability) and the efficiency of the generating unit. The add-on cost plus the transportation cost are added to the purchase cost of the coal to determine the total cost to purchase and use the coal. Current Problem Duke signed three fixed-tonnage contracts and four variable-tonnage contracts. The company would like to determine the least-cost way to allocate the coal available through these contracts to five generating units. The relevant data for the three fixed-tonnage contracts are as follows: For example, the contract signed with RAG requires Duke to purchase 350,000 tons of coal at a price of \$22 per ton; each pound of this particular coal provides 13,000 BTUs. The data for the four variable-tonnage contracts follow For example, the contract with Consol, Inc., enables Duke to purchase up to 200,000 tons of coal at a cost of $32 per ton; each pound of this coal provides 12,250 BTUs. The number of megawatt-hours of electricity that each generating unit must produce and the heat rat provided are as follows: For example, Miami Fort 5 must produce 550,000 megawatt-hours of electricity, and 10,500 BTUs are needed to produce each kilowatt-hour. The transportation cost and the add-on cost in dollars per ton are shown hereStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started