Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Answer the 3 questions and use the data attached. what more information do you need? the data is provided for number 2 Use financial statement

Answer the 3 questions and use the data attached.

what more information do you need? the data is provided for number 2

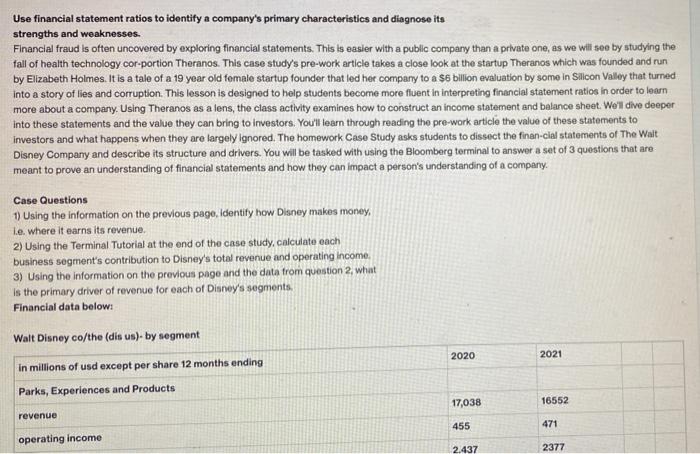

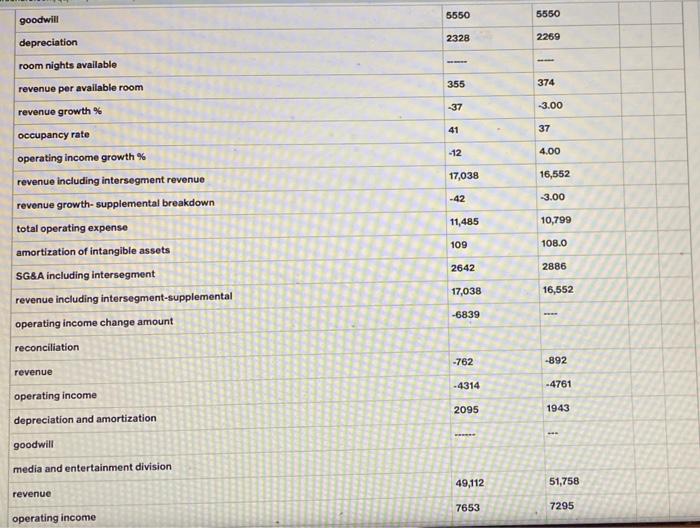

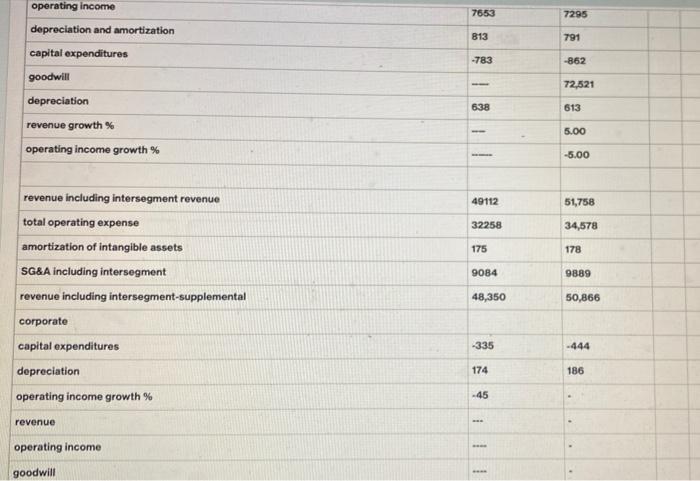

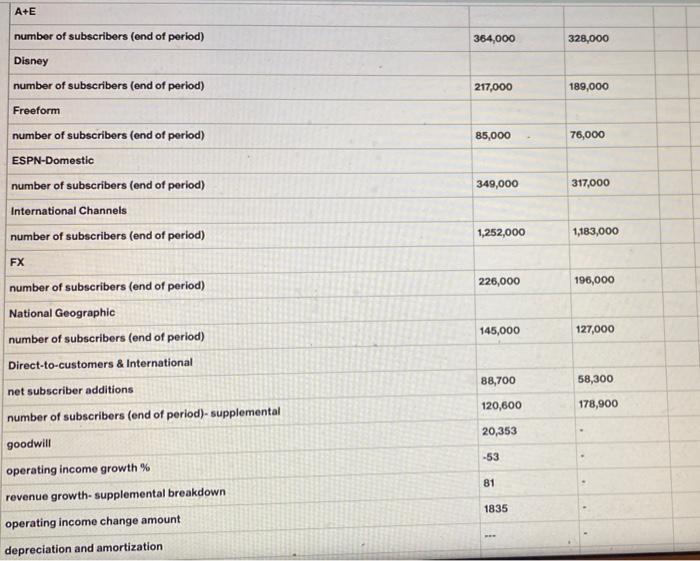

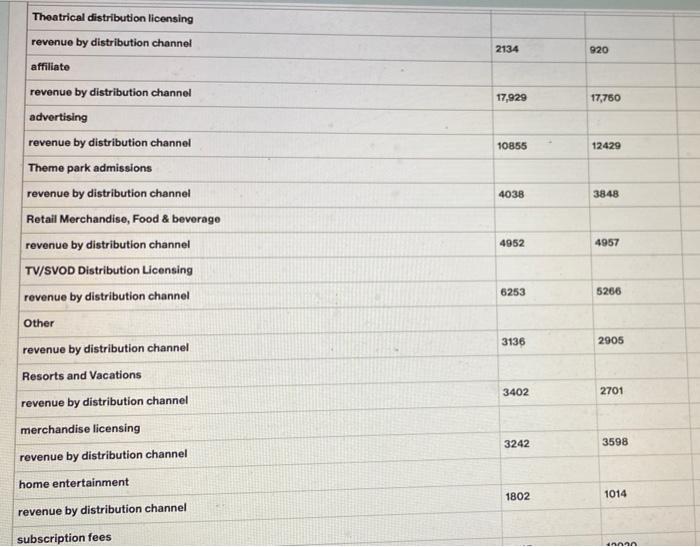

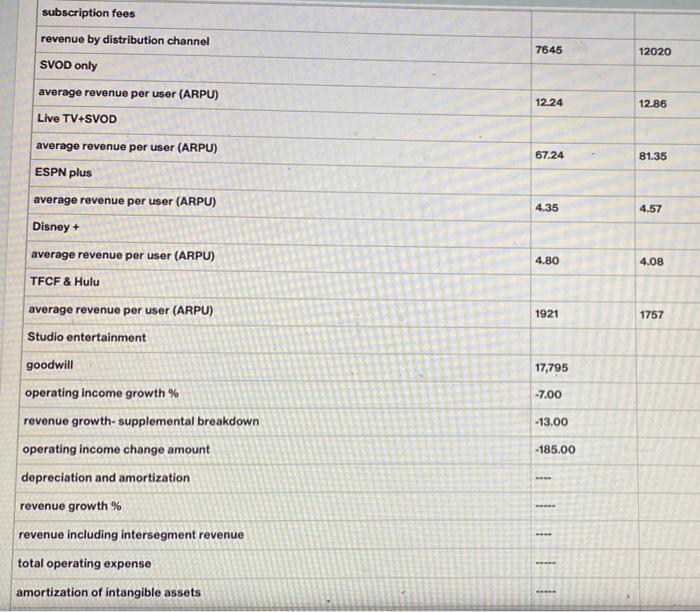

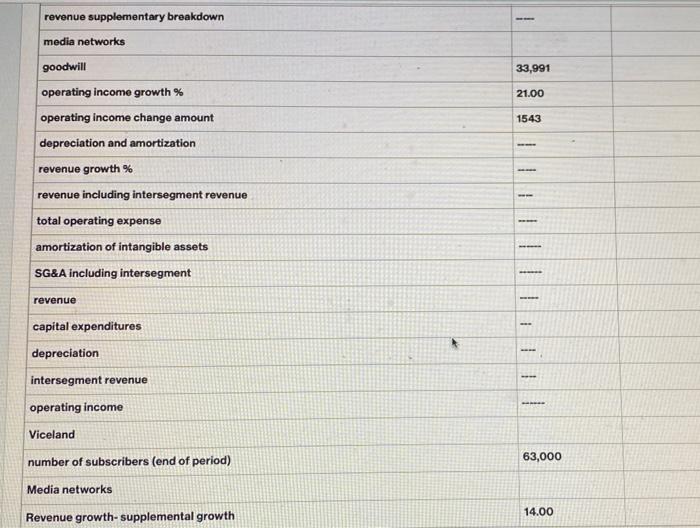

Use financial statement ratios to identify a company's primary characteristics and diagnose its strengths and weaknesses. Financial fraud is often uncovered by exploring financial statements. This is easier with a public company than a private one, as we will see by studying the fall of health technology cor-portion Theranos. This case study's pre-work article takes a close look at the startup Theranos which was founded and run by Elizabeth Holmes. It is a tale of a 19 year old female startup founder that led her company to a $6 billion evaluation by some in Silicon Valley that turned into a story of lies and corruption. This lesson is designed to help students become more fluent in interpreting financial statement ratios in order to learn more about a company. Using Theranos as a lens, the class activity examines how to construct an income statement and balance sheet. We'll dive deeper into these statements and the value they can bring to investors. You'll learn through reading the pre-work article the value of these statements to investors and what happens when they are largely ignored. The homework Case Study asks students to dissect the financial statements of The Walt Disney Company and describe its structure and drivers. You will be tasked with using the Bloomberg terminal to answer a set of 3 questions that are meant to prove an understanding of financial statements and how they can impact a person's understanding of a company. Case Questions 1) Using the information on the previous pago, Identity how Disney makes money, .e. where it earns its revenue. 2) Using the Terminal Tutorial at the end of the case study, calculate each business segment's contribution to Disney's total revenue and operating income. 3) Using the information on the previous page and the data from question 2, what Is the primary driver of revenue for each of Disney's segments. Financial data below: Walt Disney co/the (dis us). by segment 2020 2021 In millions of usd except per share 12 months ending Parks, Experiences and Products 17,038 16552 revenue 455 471 operating income 2.437 2377 goodwill depreciation room nights available revenue per available room revenue growth % occupancy rate operating income growth % revenue including intersegment revenue revenue growth- supplemental breakdown total operating expense amortization of intangible assets SG&A including intersegment revenue including intersegment-supplemental operating income change amount reconciliation revenue operating income depreciation and amortization goodwill media and entertainment division revenue operating income 5550 2328 == 355 -37 41 -12 17,038 -42 11,485 109 2642 17,038 -6839 -762 -4314 2095 ****** 49,112 7653 5550 2269 MADE 374 -3.00 37 4.00 16,552 -3.00 10,799 108.0 2886 16,552 *** -892 -4761 1943 www 51,758 7295 operating income depreciation and amortization capital expenditures goodwill depreciation revenue growth % operating income growth % revenue including intersegment revenue total operating expense amortization of intangible assets SG&A including intersegment revenue including intersegment-supplemental corporate capital expenditures depreciation operating income growth % revenue operating income goodwill 7653 813 -783 638 -- 49112 32258 175 9084 48,350 -335 174 -45 *** **** **** 7295 791 -862 72,521 613 5.00 -5.00 51,758 34,578 178 9889 50,866 -444 186 A+E 364,000 328,000 number of subscribers (end of period) Disney number of subscribers (end of period) 217,000 189,000 Freeform 85,000 76,000 number of subscribers (end of period) ESPN-Domestic number of subscribers (end of period) International Channels number of subscribers (end of period) 349,000 317,000 1,252,000 1,183,000 FX 226,000 196,000 number of subscribers (end of period) National Geographic number of subscribers (end of period) Direct-to-customers & International 145,000 127,000 88,700 58,300 net subscriber additions 120,600 178,900 20,353 number of subscribers (end of period)- supplemental goodwill operating income growth % -53 81 revenue growth- supplemental breakdown operating income change amount 1835 depreciation and amortization Theatrical distribution licensing revenue by distribution channel affiliate revenue by distribution channel advertising revenue by distribution channel Theme park admissions revenue by distribution channel Retail Merchandise, Food & beverage revenue by distribution channel TV/SVOD Distribution Licensing revenue by distribution channel Other revenue by distribution channel Resorts and Vacations revenue by distribution channel merchandise licensing revenue by distribution channel home entertainment revenue by distribution channel subscription fees 2134 17,929 10855 4038 4952 6253 3136 3402 3242 1802 920 17,760 12429 3848 4957 5266 2905 2701 3598 1014 10000 subscription fees revenue by distribution channel SVOD only average revenue per user (ARPU) Live TV+SVOD average revenue per user (ARPU) ESPN plus average revenue per user (ARPU) Disney + average revenue per user (ARPU) TFCF & Hulu average revenue per user (ARPU) Studio entertainment goodwill operating income growth % revenue growth-supplemental breakdown operating income change amount depreciation and amortization revenue growth % revenue including intersegment revenue total operating expense amortization of intangible assets 7645 12.24 67.24 4.35 4.80 1921 17,795 -7.00 -13.00 -185.00 www wwwww *** www** 12020 12.86 81.35 4.57 4.08 1757 33,991 21.00 1543 revenue supplementary breakdown media networks goodwill operating income growth % operating income change amount depreciation and amortization revenue growth % revenue including intersegment revenue total operating expense amortization of intangible assets SG&A including intersegment revenue capital expenditures depreciation intersegment revenue operating income Viceland number of subscribers (end of period) 63,000 Media networks 14.00 Revenue growth-supplemental growth Use financial statement ratios to identify a company's primary characteristics and diagnose its strengths and weaknesses. Financial fraud is often uncovered by exploring financial statements. This is easier with a public company than a private one, as we will see by studying the fall of health technology cor-portion Theranos. This case study's pre-work article takes a close look at the startup Theranos which was founded and run by Elizabeth Holmes. It is a tale of a 19 year old female startup founder that led her company to a $6 billion evaluation by some in Silicon Valley that turned into a story of lies and corruption. This lesson is designed to help students become more fluent in interpreting financial statement ratios in order to learn more about a company. Using Theranos as a lens, the class activity examines how to construct an income statement and balance sheet. We'll dive deeper into these statements and the value they can bring to investors. You'll learn through reading the pre-work article the value of these statements to investors and what happens when they are largely ignored. The homework Case Study asks students to dissect the financial statements of The Walt Disney Company and describe its structure and drivers. You will be tasked with using the Bloomberg terminal to answer a set of 3 questions that are meant to prove an understanding of financial statements and how they can impact a person's understanding of a company. Case Questions 1) Using the information on the previous pago, Identity how Disney makes money, .e. where it earns its revenue. 2) Using the Terminal Tutorial at the end of the case study, calculate each business segment's contribution to Disney's total revenue and operating income. 3) Using the information on the previous page and the data from question 2, what Is the primary driver of revenue for each of Disney's segments. Financial data below: Walt Disney co/the (dis us). by segment 2020 2021 In millions of usd except per share 12 months ending Parks, Experiences and Products 17,038 16552 revenue 455 471 operating income 2.437 2377 goodwill depreciation room nights available revenue per available room revenue growth % occupancy rate operating income growth % revenue including intersegment revenue revenue growth- supplemental breakdown total operating expense amortization of intangible assets SG&A including intersegment revenue including intersegment-supplemental operating income change amount reconciliation revenue operating income depreciation and amortization goodwill media and entertainment division revenue operating income 5550 2328 == 355 -37 41 -12 17,038 -42 11,485 109 2642 17,038 -6839 -762 -4314 2095 ****** 49,112 7653 5550 2269 MADE 374 -3.00 37 4.00 16,552 -3.00 10,799 108.0 2886 16,552 *** -892 -4761 1943 www 51,758 7295 operating income depreciation and amortization capital expenditures goodwill depreciation revenue growth % operating income growth % revenue including intersegment revenue total operating expense amortization of intangible assets SG&A including intersegment revenue including intersegment-supplemental corporate capital expenditures depreciation operating income growth % revenue operating income goodwill 7653 813 -783 638 -- 49112 32258 175 9084 48,350 -335 174 -45 *** **** **** 7295 791 -862 72,521 613 5.00 -5.00 51,758 34,578 178 9889 50,866 -444 186 A+E 364,000 328,000 number of subscribers (end of period) Disney number of subscribers (end of period) 217,000 189,000 Freeform 85,000 76,000 number of subscribers (end of period) ESPN-Domestic number of subscribers (end of period) International Channels number of subscribers (end of period) 349,000 317,000 1,252,000 1,183,000 FX 226,000 196,000 number of subscribers (end of period) National Geographic number of subscribers (end of period) Direct-to-customers & International 145,000 127,000 88,700 58,300 net subscriber additions 120,600 178,900 20,353 number of subscribers (end of period)- supplemental goodwill operating income growth % -53 81 revenue growth- supplemental breakdown operating income change amount 1835 depreciation and amortization Theatrical distribution licensing revenue by distribution channel affiliate revenue by distribution channel advertising revenue by distribution channel Theme park admissions revenue by distribution channel Retail Merchandise, Food & beverage revenue by distribution channel TV/SVOD Distribution Licensing revenue by distribution channel Other revenue by distribution channel Resorts and Vacations revenue by distribution channel merchandise licensing revenue by distribution channel home entertainment revenue by distribution channel subscription fees 2134 17,929 10855 4038 4952 6253 3136 3402 3242 1802 920 17,760 12429 3848 4957 5266 2905 2701 3598 1014 10000 subscription fees revenue by distribution channel SVOD only average revenue per user (ARPU) Live TV+SVOD average revenue per user (ARPU) ESPN plus average revenue per user (ARPU) Disney + average revenue per user (ARPU) TFCF & Hulu average revenue per user (ARPU) Studio entertainment goodwill operating income growth % revenue growth-supplemental breakdown operating income change amount depreciation and amortization revenue growth % revenue including intersegment revenue total operating expense amortization of intangible assets 7645 12.24 67.24 4.35 4.80 1921 17,795 -7.00 -13.00 -185.00 www wwwww *** www** 12020 12.86 81.35 4.57 4.08 1757 33,991 21.00 1543 revenue supplementary breakdown media networks goodwill operating income growth % operating income change amount depreciation and amortization revenue growth % revenue including intersegment revenue total operating expense amortization of intangible assets SG&A including intersegment revenue capital expenditures depreciation intersegment revenue operating income Viceland number of subscribers (end of period) 63,000 Media networks 14.00 Revenue growth-supplemental growthStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started