Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Your company board is evaluating a bond issue proposal. As part of the exercise the Board would like to understand the potential impact

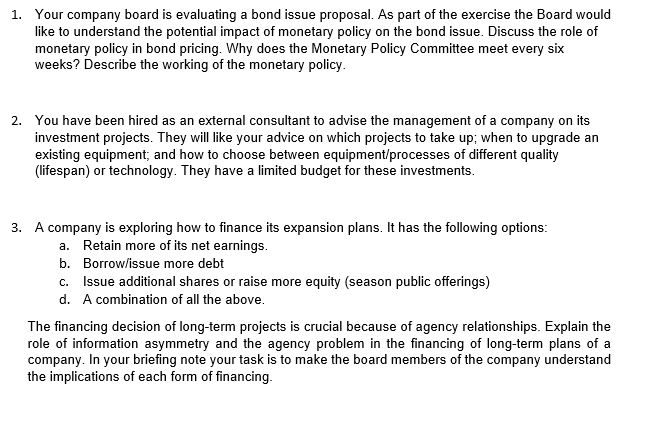

1. Your company board is evaluating a bond issue proposal. As part of the exercise the Board would like to understand the potential impact of monetary policy on the bond issue. Discuss the role of monetary policy in bond pricing. Why does the Monetary Policy Committee meet every six weeks? Describe the working of the monetary policy. 2. You have been hired as an external consultant to advise the management of a company on its investment projects. They will like your advice on which projects to take up; when to upgrade an existing equipment, and how to choose between equipment/processes of different quality (lifespan) or technology. They have a limited budget for these investments. 3. A company is exploring how to finance its expansion plans. It has the following options: a. Retain more of its net earnings. b. Borrow/issue more debt c. Issue additional shares or raise more equity (season public offerings) d. A combination of all the above. The financing decision of long-term projects is crucial because of agency relationships. Explain the role of information asymmetry and the agency problem in the financing of long-term plans of a company. In your briefing note your task is to make the board members of the company understand the implications of each form of financing.

Step by Step Solution

★★★★★

3.39 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

1 Role of Monetary Policy in Bond Pricing Monetary policy plays a crucial role in bond pricing through its influence on interest rates When a central bank such as the Federal Reserve in the United Sta...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started