Answered step by step

Verified Expert Solution

Question

1 Approved Answer

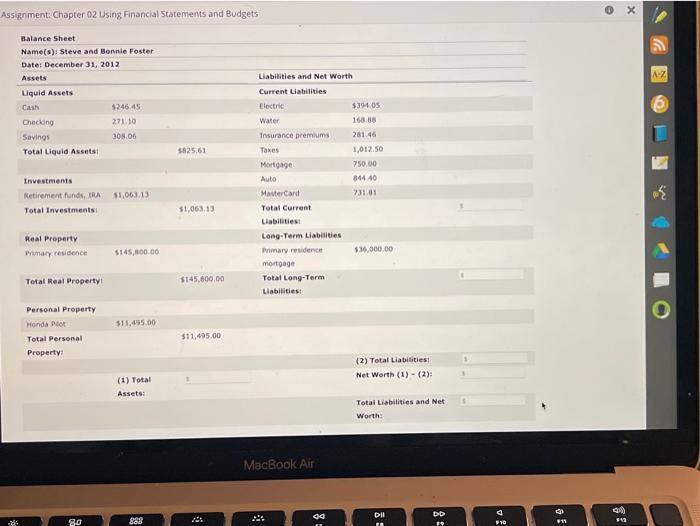

answer the blank Assignment Chapter 02 Using Financial Statements and Budgets A-Z Balance Sheet Name(o): Steve and Bonnie Foster Date: December 31, 2012 Assets Liquid

answer the blank

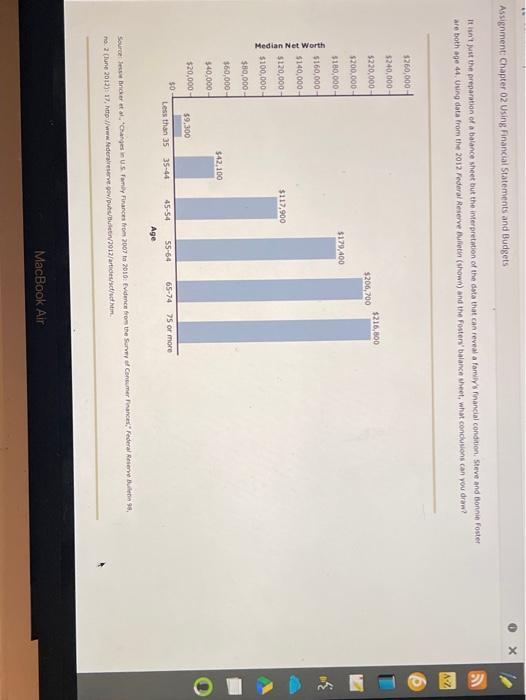

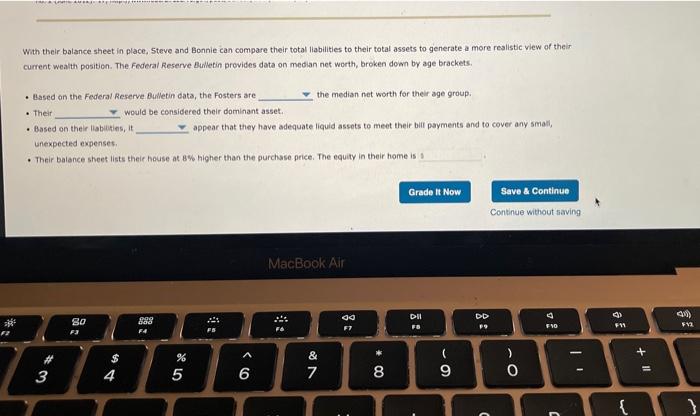

Assignment Chapter 02 Using Financial Statements and Budgets A-Z Balance Sheet Name(o): Steve and Bonnie Foster Date: December 31, 2012 Assets Liquid Assets Cash 5246.45 Checking 271.10 Savings 308.06 Total Liquid Assets $825.61 Investments Retirement funds, TRA Total Investments Liabilities and Net Worth Current Liabilities Electric $394.05 Water 168.88 Insurance premiums 281.46 Taxes 1,012.50 Mortgage 750.00 Auto 84440 MasterCard 231.83 Total Current Liabilities Long-Term Liabilities Primary residence $36.000.00 mortgage Total Long-Term Liabilities: $1,063.13 51,063,13 Real Property Primary residence $145,000.00 Total Real Property $145.800.00 $11.495.00 Personal Property Honda Piot Total Personal Property $11,495.00 (2) Total Liabilities Net Worth (1) - (2) (1) Total Assets: Total Liabilities and Net Worth: MacBook Air 00 Dll DD 23 549 80 d 10 888 11 e Assignment Chapter 02 Using Financial Statements and Budgets It is the preparation of a balance sheet but the interpretation of the data that can reveal a family financial condition, Steve and Bonnie Foster are both age 44. Using data from the 2012 Federal Reserve Bulletin (shown) and the Fosters' balance sheet, what conclusions can you draw? AZ $260,000 $240,000 $220,000 $200.000 $216,800 $206,700 $179,400 5180,000 $160,000 $140,000 Median Net Worth $120,000 $117.900 $100,000 $80,000 $60,000 $42.100 $40.000 $20,000- $9,300 $0 Less than 35 35-44 45-54 55-64 65-74 75 or more Age Source de changes in Us Family Finances from 2007 to 2010: Evidence from the survey of Consumer Federal Reserve Bulen, no. 2 (lune 20123: 17. ://www.federaleserve outlet/2012/artides MacBook Air RAWAT with their balance sheet in place, Steve and Bonnie can compare their total liabilities to their total assets to generate a more realistic view of their current wealth position. The Federal Reserve Bulletin provides data on median net worth, broken down by age brackets . Based on the Federal Reserve Bulletin data, the Fosters are the median net worth for their age group. . Their would be considered their dominant asset. Based on their liabilities, appear that they have adequate liquid assets to meet their bill payments and to cover any small unexpected expenses Their balance sheet lists their house at 8% higher than the purchase price. The equity in their home is a Grade It Now Save & Continue Continue without saving MacBook Air 80 FJ 888 F4 00 F7 DI 78 DD P9 a) F1 1) F12 FYO A # 3 $ 4 % 5 & 7 00* ( 9 ) O . N + 6 {} Assignment Chapter 02 Using Financial Statements and Budgets A-Z Balance Sheet Name(o): Steve and Bonnie Foster Date: December 31, 2012 Assets Liquid Assets Cash 5246.45 Checking 271.10 Savings 308.06 Total Liquid Assets $825.61 Investments Retirement funds, TRA Total Investments Liabilities and Net Worth Current Liabilities Electric $394.05 Water 168.88 Insurance premiums 281.46 Taxes 1,012.50 Mortgage 750.00 Auto 84440 MasterCard 231.83 Total Current Liabilities Long-Term Liabilities Primary residence $36.000.00 mortgage Total Long-Term Liabilities: $1,063.13 51,063,13 Real Property Primary residence $145,000.00 Total Real Property $145.800.00 $11.495.00 Personal Property Honda Piot Total Personal Property $11,495.00 (2) Total Liabilities Net Worth (1) - (2) (1) Total Assets: Total Liabilities and Net Worth: MacBook Air 00 Dll DD 23 549 80 d 10 888 11 e Assignment Chapter 02 Using Financial Statements and Budgets It is the preparation of a balance sheet but the interpretation of the data that can reveal a family financial condition, Steve and Bonnie Foster are both age 44. Using data from the 2012 Federal Reserve Bulletin (shown) and the Fosters' balance sheet, what conclusions can you draw? AZ $260,000 $240,000 $220,000 $200.000 $216,800 $206,700 $179,400 5180,000 $160,000 $140,000 Median Net Worth $120,000 $117.900 $100,000 $80,000 $60,000 $42.100 $40.000 $20,000- $9,300 $0 Less than 35 35-44 45-54 55-64 65-74 75 or more Age Source de changes in Us Family Finances from 2007 to 2010: Evidence from the survey of Consumer Federal Reserve Bulen, no. 2 (lune 20123: 17. ://www.federaleserve outlet/2012/artides MacBook Air RAWAT with their balance sheet in place, Steve and Bonnie can compare their total liabilities to their total assets to generate a more realistic view of their current wealth position. The Federal Reserve Bulletin provides data on median net worth, broken down by age brackets . Based on the Federal Reserve Bulletin data, the Fosters are the median net worth for their age group. . Their would be considered their dominant asset. Based on their liabilities, appear that they have adequate liquid assets to meet their bill payments and to cover any small unexpected expenses Their balance sheet lists their house at 8% higher than the purchase price. The equity in their home is a Grade It Now Save & Continue Continue without saving MacBook Air 80 FJ 888 F4 00 F7 DI 78 DD P9 a) F1 1) F12 FYO A # 3 $ 4 % 5 & 7 00* ( 9 ) O . N + 6 {} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started