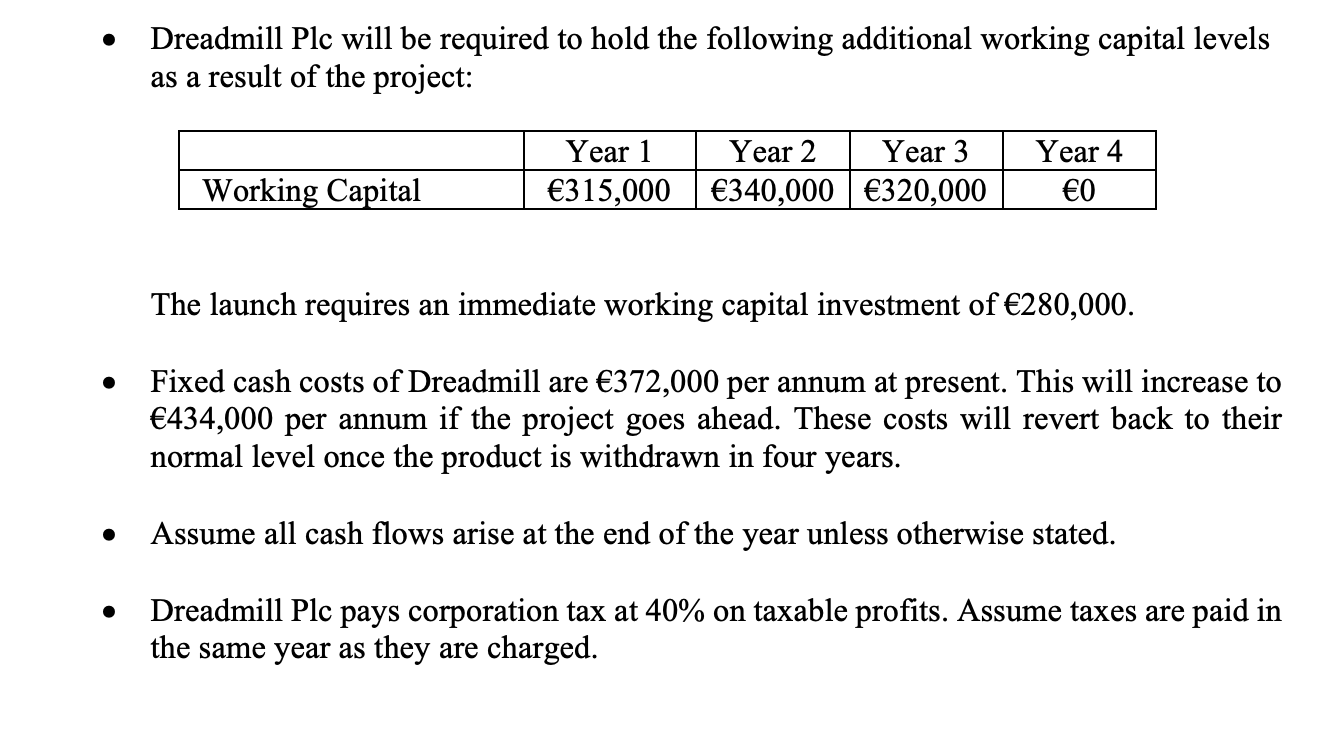

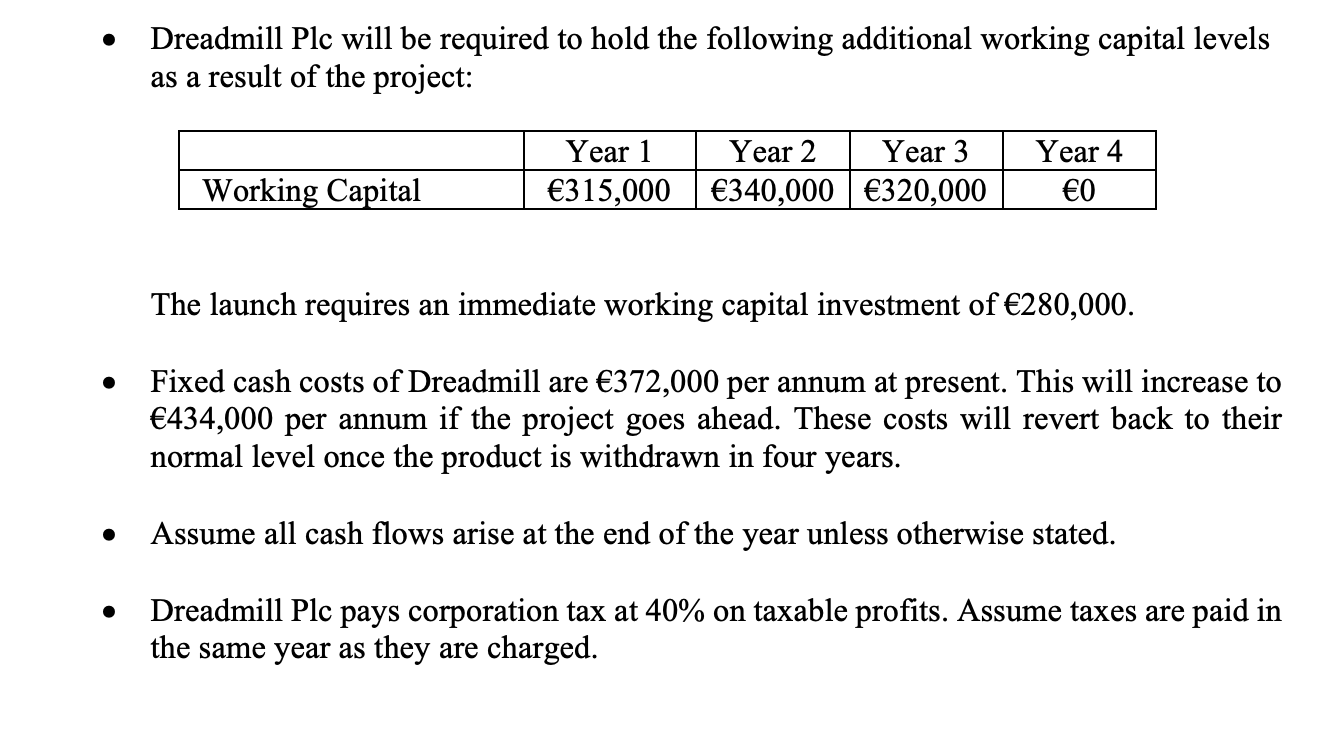

(Answer the compulsory Question 1 in this section - answer both parts A and B) Question 1- Part A Oculus Plc manufactures and distributes insulation panels for corporate customers. In the current year, it has annual sales of 2,400,000 which occur evenly throughout the year. 80% of sales are made on credit and the remaining 20% are made on a cash basis. The company allows its credit customers a period of 30 days credit from the invoice date and a review of recent trends shows that one third of credit customers pay within this period, taking an average of 25 days to pay. The remainder of its credit customers take an average of 50 days to settle their accounts. Oculus plc's finance manager is considering introducing a cash discount of 5% for its customers who settle their accounts within 10 days of the invoice date. The introduction of the discount scheme is expected to have the following implications: 60% of debtors (in value terms) who at present settle their accounts on average in 25 days are expected to take advantage of the discount by paying on the 10th day, and the remaining 40% of this group will, on average, pay on the 25th day; 35% of the customers (in value terms) who presently take an average of 50 days to pay will also avail of the discount by settling their accounts on the 10th day, while the other 65% of this group will take an average of 60 days to pay the amounts due; The discount scheme should also have the effect of reducing the present level of bad debts by 62,000 per year; and The availability of the cash discount should attract new customers who will pay on the 10th day. It is estimated that 310,000 per year in additional sales should be achieved from this source. The company's average variable cost ratio is 70% currently and the current cost of the company's bank borrowings is 10% per year. (Note: assume a 365-day year). Required: (a) Prepare an analysis of the expected costs and benefits of the proposed discount scheme, and prepare an overall recommendation for the finance manager of Oculus Plc. (18 marks) (b) Discuss the challenges created by COVID-19 restrictions for companies when managing their working capital. (9 marks) (Total for Part A: 27 marks) Question 1 continued on the next page ... Question 1 continued.... Question 1 - Part B Dreadmill Plc manufactures and distributes a wide range of health fitness equipment. The company is considering a proposed project to introduce a new fitness tracker smartwatch and has hired a consultancy firm to explore the feasibility of launching this new product on the European market. Dreadmill has received a report from the consultancy firm which details the following: . It is expected that the new product will have initial sales of 650,000 in year 1, and that this will decline by 20% year on year due to newer competitor products coming onto the market. The product will be withdrawn from the market after year 4. The gross profit margin on sales is expected to be 60%. The company will need to upgrade its machinery in order to manufacture the new product. The new machinery is expected to have a useful life of 4 years and its capital cost will be depreciated on a straight-line basis for tax purposes over this period, ignoring residual value. The machinery will be purchased immediately for a cost of 500,000 and is expected to have a cash residual value of 80,000 in four years' time. . The company began development of a prototype of the smartwatch last year. This had a cost of 75,000, of which 40,000 has been paid. The balance will be paid in one year. Dreadmill Plc will be required to hold the following additional working capital levels as a result of the project: Year 1 Year 2 Year 3 315,000 340,000 320,000 Year 4 0 Working Capital The launch requires an immediate working capital investment of 280,000. Fixed cash costs of Dreadmill are 372,000 per annum at present. This will increase to 434,000 per annum if the project goes ahead. These costs will revert back to their normal level once the product is withdrawn in four years. . Assume all cash flows arise at the end of the year unless otherwise stated. . Dreadmill Plc pays corporation tax at 40% on taxable profits. Assume taxes are paid in the same year as they are charged. Question 1 continued ... Required: (a) Prepare a statement of after-tax cash flows attributable to the project for each year of its four-year life. Explain clearly the reasons for omitting any items of financial information provided in the question. (Note: NPV, IRR calculations are not required). (15 marks) (b) Explain what is meant by the agency problem in financial management, and suggest ways in which this problem can be resolved. (8 marks) (Total for Part B: 23 marks) (TOTAL FOR QUESTION 1: 50 MARKS) (Answer the compulsory Question 1 in this section - answer both parts A and B) Question 1- Part A Oculus Plc manufactures and distributes insulation panels for corporate customers. In the current year, it has annual sales of 2,400,000 which occur evenly throughout the year. 80% of sales are made on credit and the remaining 20% are made on a cash basis. The company allows its credit customers a period of 30 days credit from the invoice date and a review of recent trends shows that one third of credit customers pay within this period, taking an average of 25 days to pay. The remainder of its credit customers take an average of 50 days to settle their accounts. Oculus plc's finance manager is considering introducing a cash discount of 5% for its customers who settle their accounts within 10 days of the invoice date. The introduction of the discount scheme is expected to have the following implications: 60% of debtors (in value terms) who at present settle their accounts on average in 25 days are expected to take advantage of the discount by paying on the 10th day, and the remaining 40% of this group will, on average, pay on the 25th day; 35% of the customers (in value terms) who presently take an average of 50 days to pay will also avail of the discount by settling their accounts on the 10th day, while the other 65% of this group will take an average of 60 days to pay the amounts due; The discount scheme should also have the effect of reducing the present level of bad debts by 62,000 per year; and The availability of the cash discount should attract new customers who will pay on the 10th day. It is estimated that 310,000 per year in additional sales should be achieved from this source. The company's average variable cost ratio is 70% currently and the current cost of the company's bank borrowings is 10% per year. (Note: assume a 365-day year). Required: (a) Prepare an analysis of the expected costs and benefits of the proposed discount scheme, and prepare an overall recommendation for the finance manager of Oculus Plc. (18 marks) (b) Discuss the challenges created by COVID-19 restrictions for companies when managing their working capital. (9 marks) (Total for Part A: 27 marks) Question 1 continued on the next page ... Question 1 continued.... Question 1 - Part B Dreadmill Plc manufactures and distributes a wide range of health fitness equipment. The company is considering a proposed project to introduce a new fitness tracker smartwatch and has hired a consultancy firm to explore the feasibility of launching this new product on the European market. Dreadmill has received a report from the consultancy firm which details the following: . It is expected that the new product will have initial sales of 650,000 in year 1, and that this will decline by 20% year on year due to newer competitor products coming onto the market. The product will be withdrawn from the market after year 4. The gross profit margin on sales is expected to be 60%. The company will need to upgrade its machinery in order to manufacture the new product. The new machinery is expected to have a useful life of 4 years and its capital cost will be depreciated on a straight-line basis for tax purposes over this period, ignoring residual value. The machinery will be purchased immediately for a cost of 500,000 and is expected to have a cash residual value of 80,000 in four years' time. . The company began development of a prototype of the smartwatch last year. This had a cost of 75,000, of which 40,000 has been paid. The balance will be paid in one year. Dreadmill Plc will be required to hold the following additional working capital levels as a result of the project: Year 1 Year 2 Year 3 315,000 340,000 320,000 Year 4 0 Working Capital The launch requires an immediate working capital investment of 280,000. Fixed cash costs of Dreadmill are 372,000 per annum at present. This will increase to 434,000 per annum if the project goes ahead. These costs will revert back to their normal level once the product is withdrawn in four years. . Assume all cash flows arise at the end of the year unless otherwise stated. . Dreadmill Plc pays corporation tax at 40% on taxable profits. Assume taxes are paid in the same year as they are charged. Question 1 continued ... Required: (a) Prepare a statement of after-tax cash flows attributable to the project for each year of its four-year life. Explain clearly the reasons for omitting any items of financial information provided in the question. (Note: NPV, IRR calculations are not required). (15 marks) (b) Explain what is meant by the agency problem in financial management, and suggest ways in which this problem can be resolved. (8 marks) (Total for Part B: 23 marks) (TOTAL FOR QUESTION 1: 50 MARKS)