Answered step by step

Verified Expert Solution

Question

1 Approved Answer

answer the following P percentage in S 60% S equity at acquesition consist of 300000 common stock and 100000 retained earning inventory understaed 20000 of

answer the following

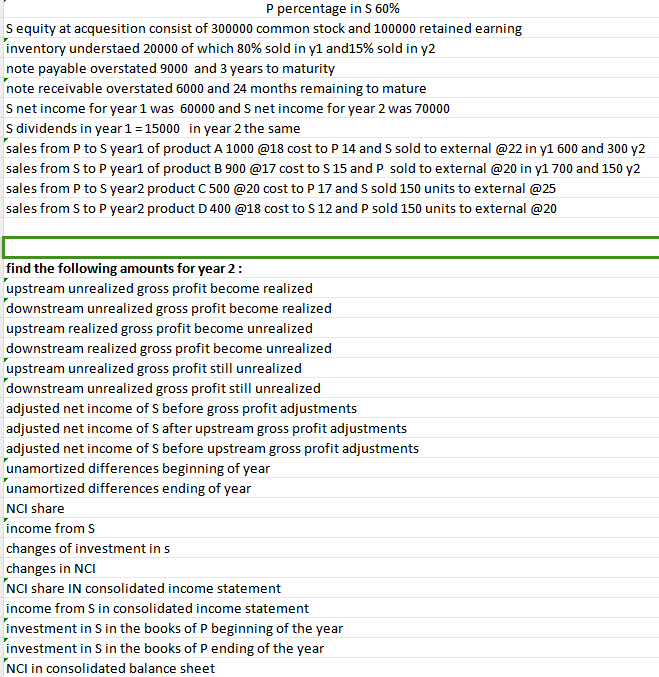

P percentage in S 60% S equity at acquesition consist of 300000 common stock and 100000 retained earning inventory understaed 20000 of which 80% sold in yl and15% sold in Y2 note payable overstated 9000 and 3 years to maturity note receivable overstated 6000 and 24 months remaining to mature S net income for yearl was 60000 and S net income for year 2 was 70000 S dividends in yearl = 15000 in year 2 the same sales from P to S yearl of product A 1000 @18 cost to P 14 and S sold to external @22 in yl 600 and 300 Y2 sales from Sto P yearl of product B 900 cost to S 15 and P sold to external @20 in yl 700 and 150 Y2 sales from P to S year2 product C 500 @20 cost to P 17 and S sold 150 units to external @25 sales from S to P year2 product D 400 @18 cost to S 12 and P sold 150 units to external @20 find the following amounts for year2 : upstream unrealized gross profit become realized downstream unrealized gross profit become realized upstream realized gross profit become unrealized downstream realized gross profit become unrealized upstream unrealized gross profit still unrealized downstream unrealized gross profit still unrealized adjusted net income of S before gross profit adjustments adjusted net income of S after upstream gross profit adjustments adjusted net income of S before upstream gross profit adjustments unamortized differences beginning of year unamortized differences ending of year NCI share income from S changes of investment in s changes in NCI NCI share IN consolidated income statement income from S in consolidated income statement investment in S in the books of P beginning of the year investment in S in the books of P ending of the year NCI in consolidated balance sheet

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started