Answered step by step

Verified Expert Solution

Question

1 Approved Answer

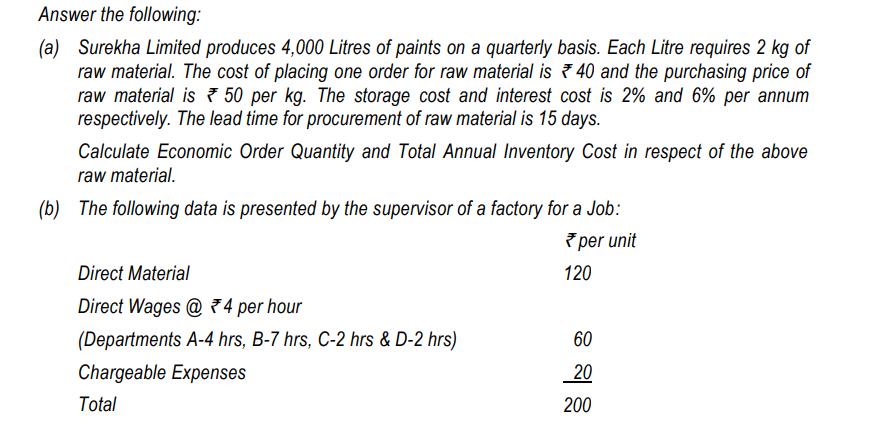

Answer the following: (a) Surekha Limited produces 4,000 Litres of paints on a quarterly basis. Each Litre requires 2 kg of raw material. The

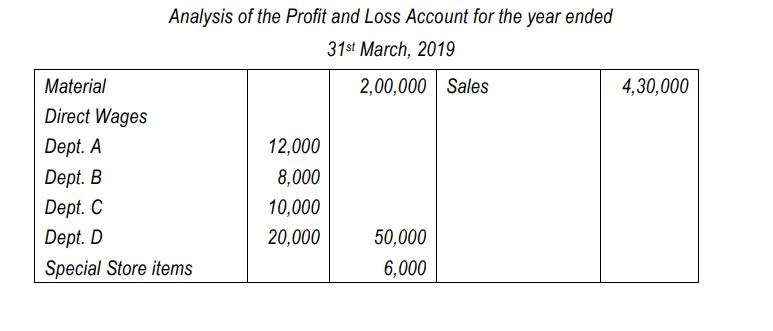

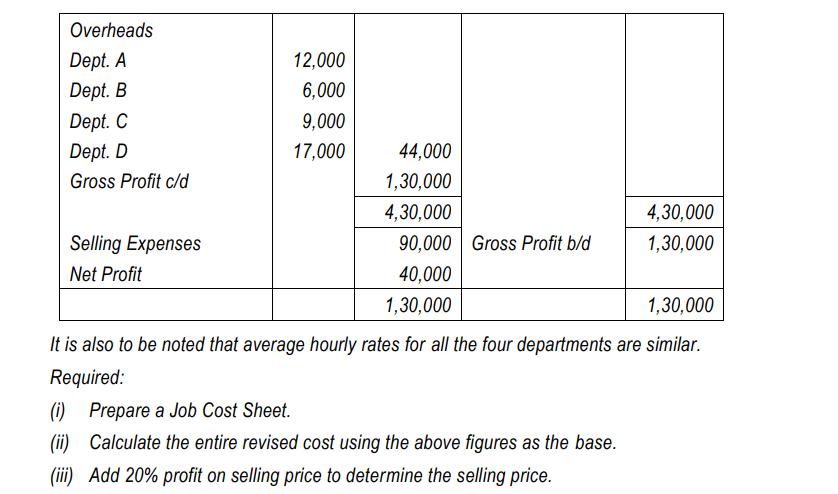

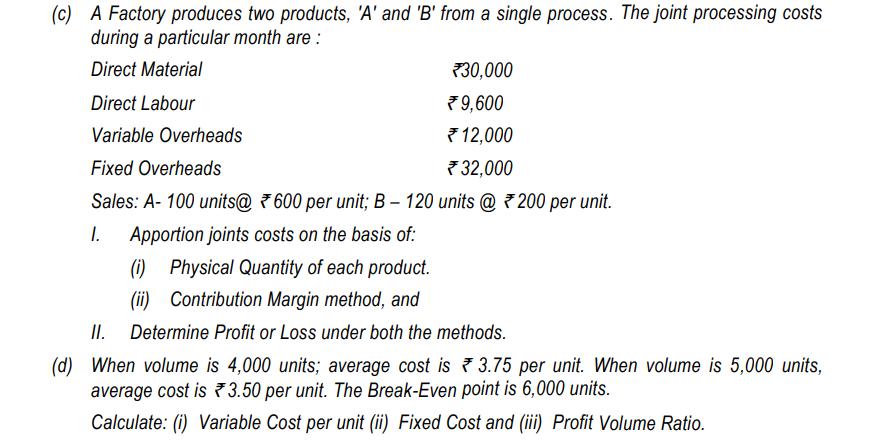

Answer the following: (a) Surekha Limited produces 4,000 Litres of paints on a quarterly basis. Each Litre requires 2 kg of raw material. The cost of placing one order for raw material is 40 and the purchasing price of raw material is 50 per kg. The storage cost and interest cost is 2% and 6% per annum respectively. The lead time for procurement of raw material is 15 days. Calculate Economic Order Quantity and Total Annual Inventory Cost in respect of the above raw material. (b) The following data is presented by the supervisor of a factory for a Job: per unit Direct Material Direct Wages @ 74 per hour (Departments A-4 hrs, B-7 hrs, C-2 hrs & D-2 hrs) Chargeable Expenses Total 120 60 20 200 Analysis of the Profit and Loss Account for the year ended 31st March, 2019 Material Direct Wages Dept. A Dept. B Dept. C Dept. D Special Store items 12,000 8,000 10,000 20,000 2,00,000 Sales 50,000 6,000 4,30,000 Overheads Dept. A Dept. B Dept. C Dept. D Gross Profit c/d Selling Expenses Net Profit 12,000 6,000 9,000 17,000 44,000 1,30,000 4,30,000 90,000 Gross Profit b/d 40,000 1,30,000 4,30,000 1,30,000 1,30,000 It is also to be noted that average hourly rates for all the four departments are similar. Required: (i) Prepare a Job Cost Sheet. (ii) Calculate the entire revised cost using the above figures as the base. (iii) Add 20% profit on selling price to determine the selling price. (c) A Factory produces two products, 'A' and 'B' from a single process. The joint processing costs during a particular month are : Direct Material 30,000 Direct Labour 9,600 Variable Overheads 12,000 Fixed Overheads 32,000 Sales: A-100 units@ 600 per unit; B-120 units @ 200 per unit. 1. Apportion joints costs on the basis of: (i) Physical Quantity of each product. (ii) Contribution Margin method, and II. Determine Profit or Loss under both the methods. (d) When volume is 4,000 units; average cost is 3.75 per unit. When volume is 5,000 units, average cost is 3.50 per unit. The Break-Even point is 6,000 units. Calculate: (i) Variable Cost per unit (ii) Fixed Cost and (iii) Profit Volume Ratio.

Step by Step Solution

★★★★★

3.35 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started