Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ANSWER THE FOLLOWING AND EXPLAIN IN SIMPLE WAY Multiple Choice: GOOD FOR QUESTION 1 AND 2 On January 1, 20x1, Franchisor Co. enters into a

ANSWER THE FOLLOWING AND EXPLAIN IN SIMPLE WAY

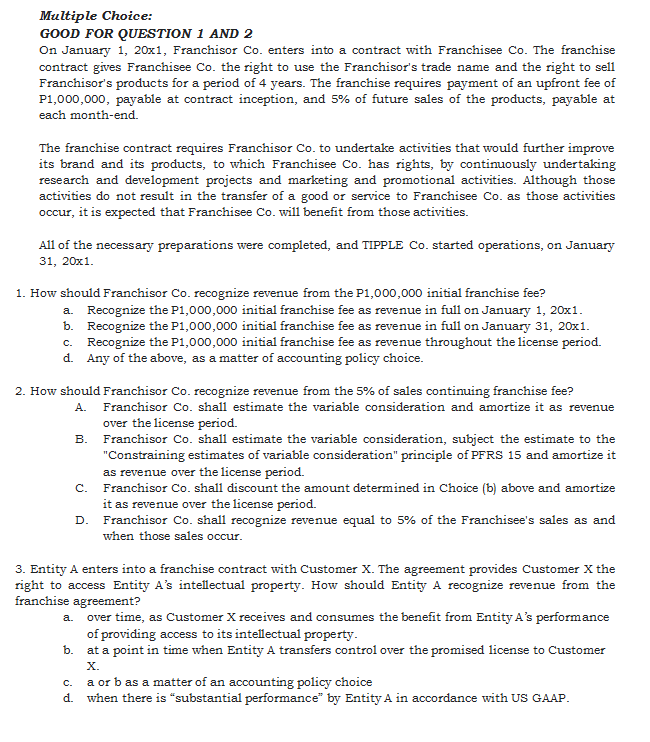

Multiple Choice: GOOD FOR QUESTION 1 AND 2 On January 1, 20x1, Franchisor Co. enters into a contract with Franchisee Co. The franchise contract gives Franchisee Co. the right to use the Franchisor's trade name and the right to sell Franchisor's products for a period of 4 years. The franchise requires payment of an upfront fee of P1,000,000, payable at contract inception, and 5% of future sales of the products, payable at each month-end. The franchise contract requires Franchisor Co. to undertake activities that would further improve its brand and its products, to which Franchisee Co. has rights, by continuously undertaking research and development projects and marketing and promotional activities. Although those activities do not result in the transfer of a good or service to Franchisee Co. as those activities occur, it is expected that Franchisee Co. will benefit from those activities. All of the necessary preparations were completed, and TIPPLE Co. started operations, on January 31, 20x1. 1. How should Franchisor Co. recognize revenue from the P1,000,000 initial franchise fee? a. Recognize the P1,000,000 initial franchise fee as revenue in full on January 1, 20x1. b. Recognize the P1,000,000 initial franchise fee as revenue in full on January 31,20x1. c. Recognize the P1,000,000 initial franchise fee as revenue throughout the license period. d. Any of the above, as a matter of accounting policy choice. 2. How should Franchisor Co. recognize revenue from the 5% of sales continuing franchise fee? A. Franchisor Co. shall estimate the variable consideration and amortize it as revenue over the license period. B. Franchisor Co. shall estimate the variable consideration, subject the estimate to the "Constraining estimates of variable consideration" principle of PFRS 15 and amortize it as revenue over the license period. C. Franchisor Co. shall discount the amount determined in Choice (b) above and amortize it as revenue over the license period. D. Franchisor Co. shall recognize revenue equal to 5% of the Franchisee's sales as and when those sales occur. 3. Entity A enters into a franchise contract with Customer X. The agreement provides Customer X the right to access Entity A's intellectual property. How should Entity A recognize revenue from the franchise agreement? a. over time, as Customer X receives and consumes the benefit from Entity A's performance of providing access to its intellectual property. b. at a point in time when Entity A transfers control over the promised license to Customer X. c. a or b as a matter of an accounting policy choice d. when there is "substantial performance" by Entity A in accordance with US GAAPStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started