ANSWER THE FOLLOWING AND PLEASE INCLUDE STEP BY STEP EXPLANATION:

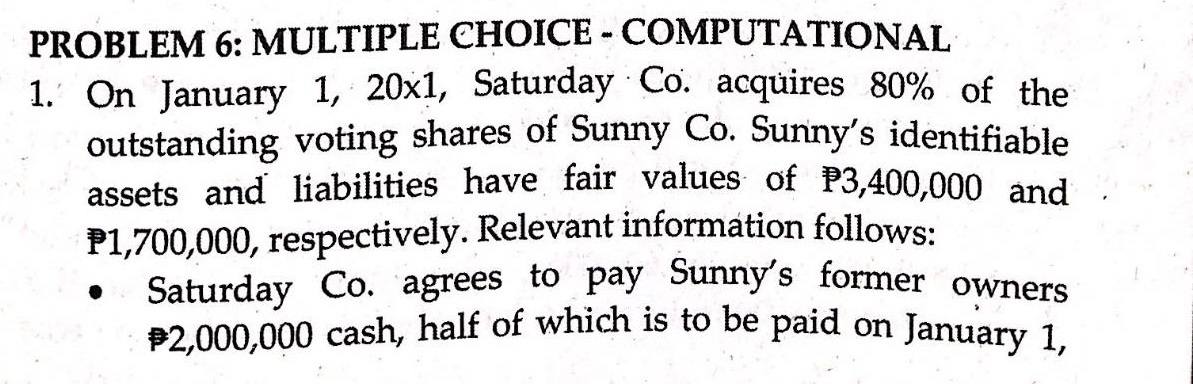

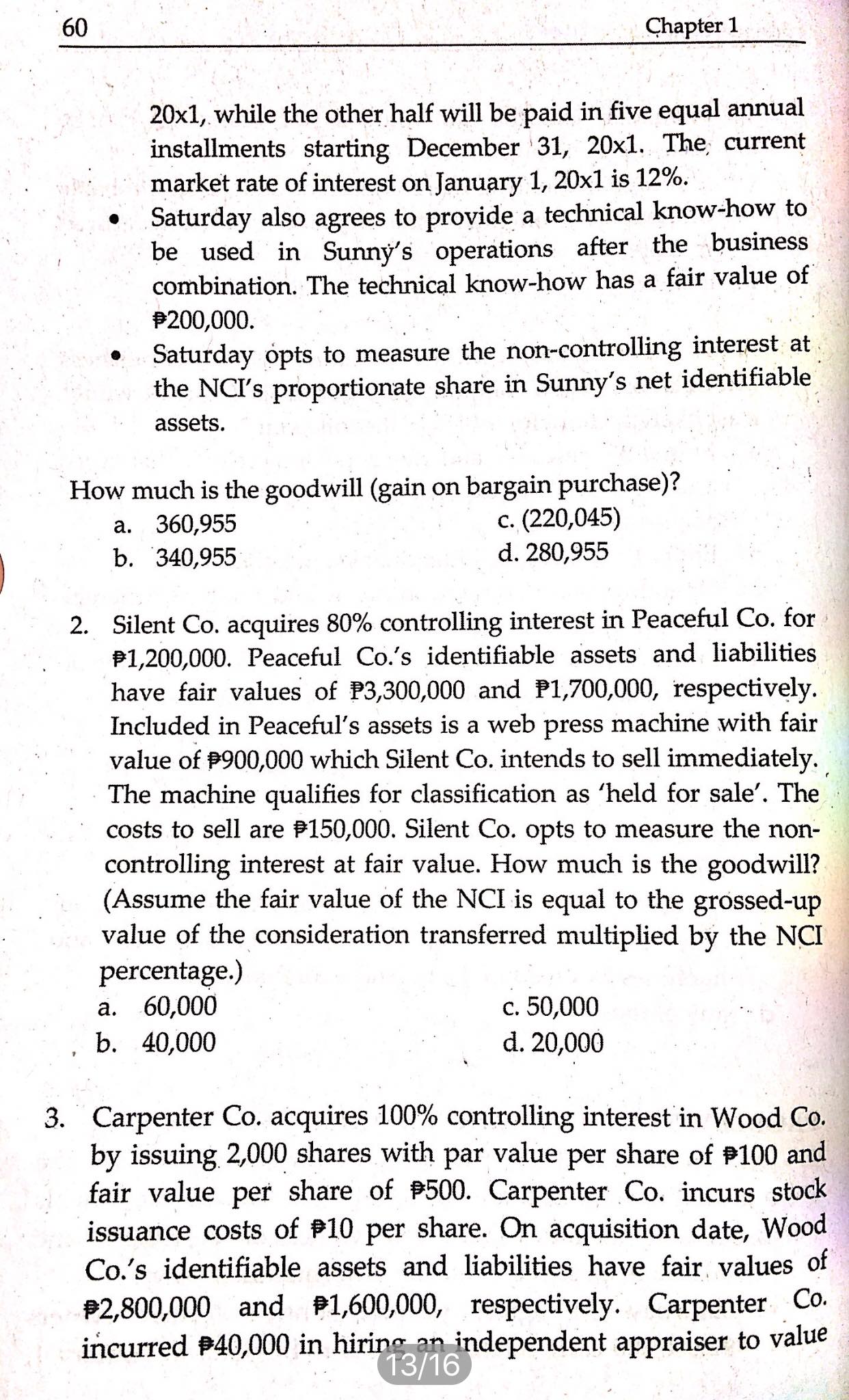

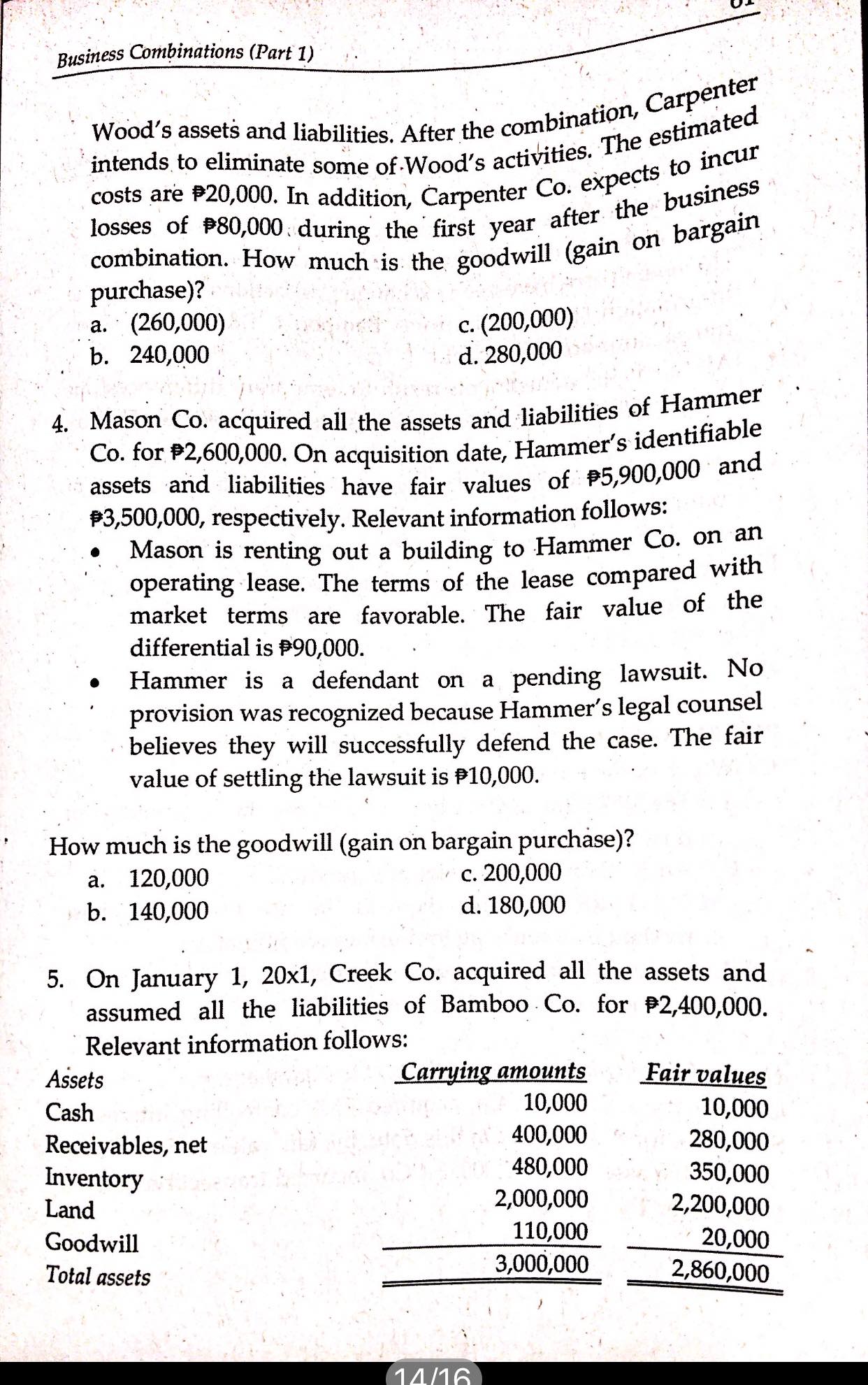

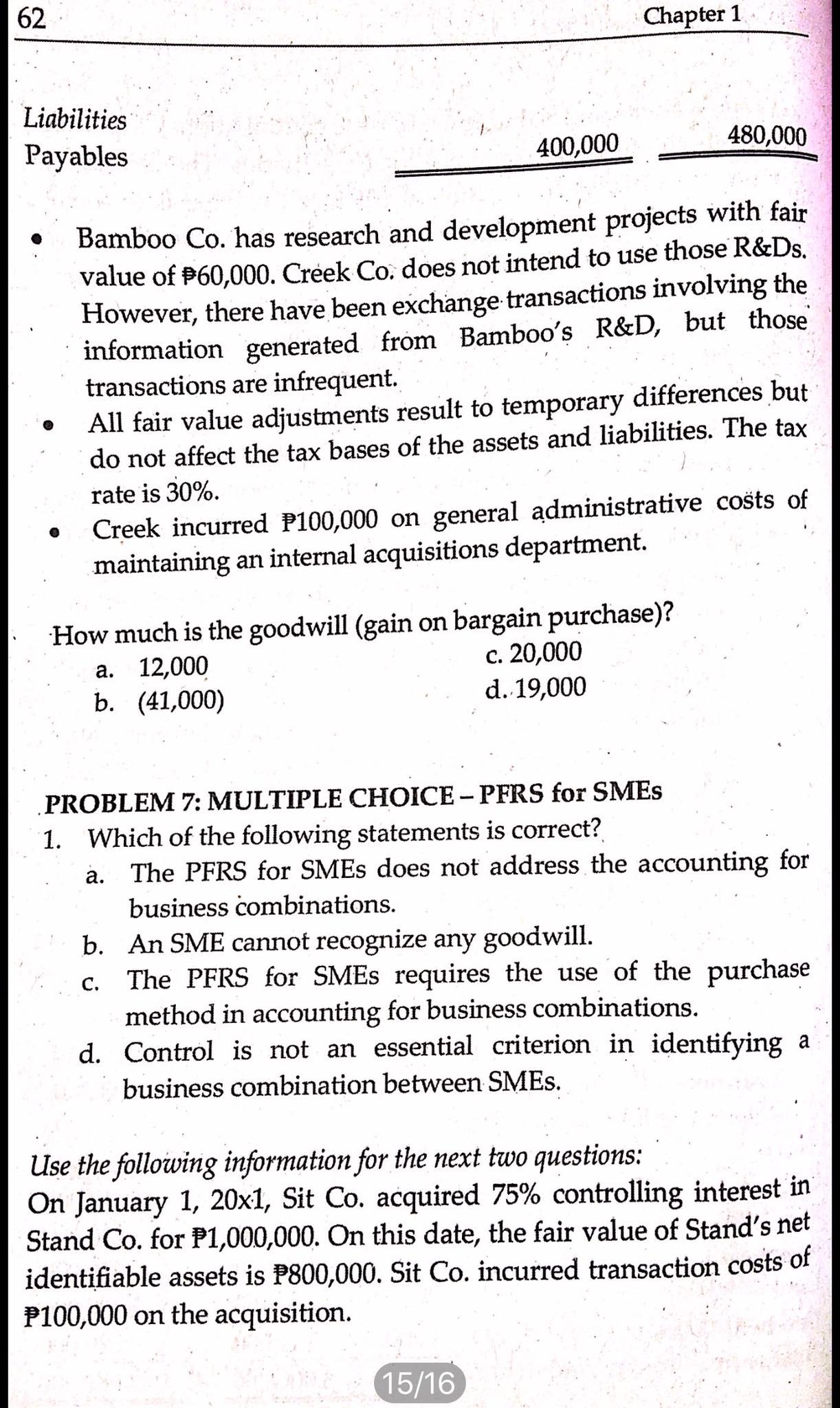

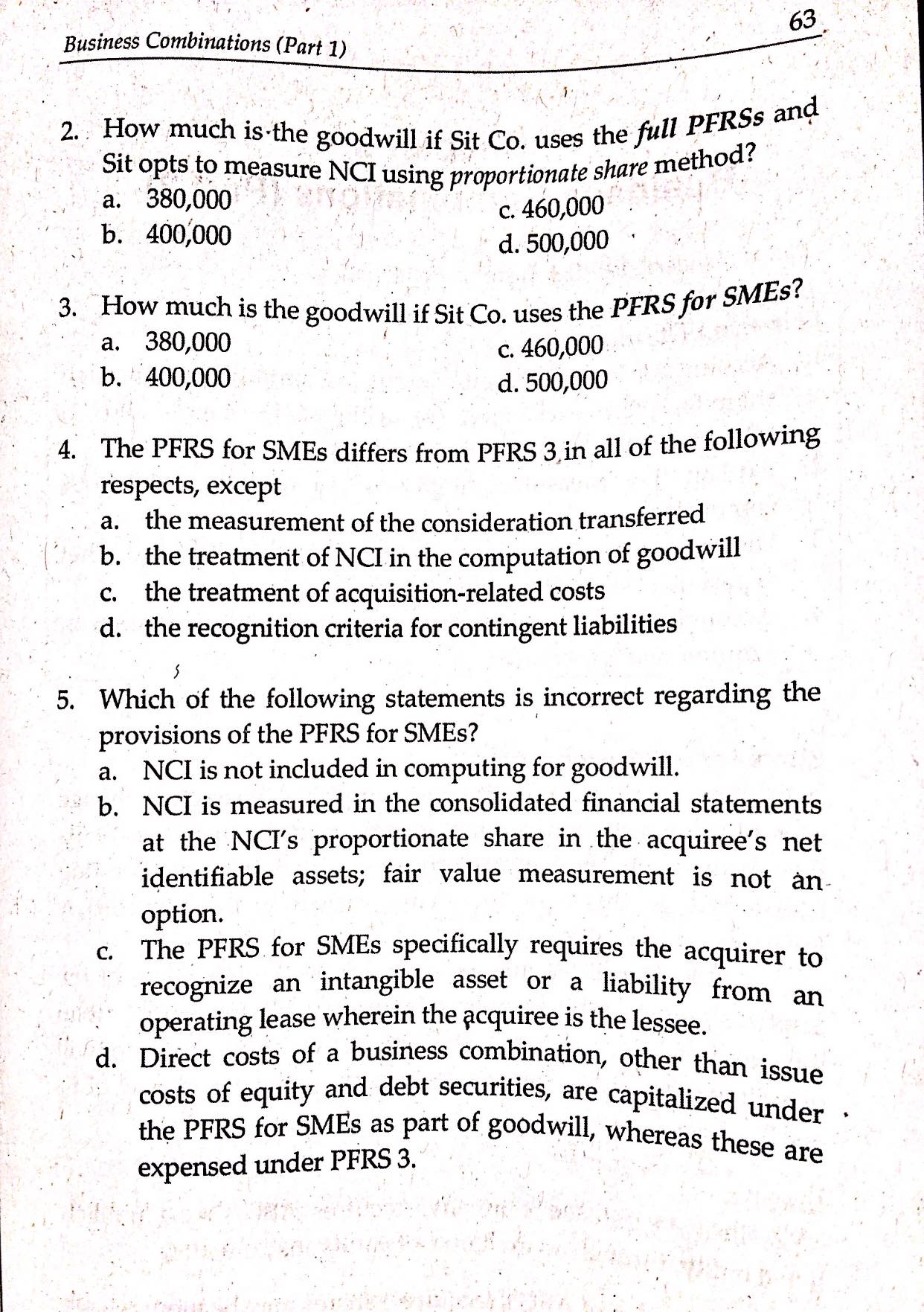

PROBLEM 6: MULTIPLE CHOICE - COMPUTATIONAL 1.' On January 1, 20x1, Saturday Co. acquires 80% of the outstanding voting shares of Sunny Co. Sunny's identifiable assets and liabilities have fair values of P3,400,000 and P1,700,000, respectively. Relevant information follows: Saturday Co. agrees to pay Sunny's former owners #2,000,000 cash, half of which is to be paid on January 1,60 Chapter 1 20x1, while the other half will be paid in five equal annual installments starting December 31, 20x1. The current market rate of interest on January 1, 20x1 is 12%. Saturday also agrees to provide a technical know-how to be used in Sunny's operations after the business combination. The technical know-how has a fair value of #200,000. . Saturday opts to measure the non-controlling interest at the NCI's proportionate share in Sunny's net identifiable assets. How much is the goodwill (gain on bargain purchase)? a. 360,955 c. (220,045) b. 340,955 d. 280,955 2. Silent Co. acquires 80% controlling interest in Peaceful Co. for #1,200,000. Peaceful Co.'s identifiable assets and liabilities have fair values of P3,300,000 and P1,700,000, respectively. Included in Peaceful's assets is a web press machine with fair value of P900,000 which Silent Co. intends to sell immediately. The machine qualifies for classification as 'held for sale'. The costs to sell are #150,000. Silent Co. opts to measure the non- controlling interest at fair value. How much is the goodwill? (Assume the fair value of the NCI is equal to the grossed-up value of the consideration transferred multiplied by the NCI percentage.) a. 60,000 c. 50,000 b. 40,000 d. 20,000 3. Carpenter Co. acquires 100% controlling interest in Wood Co. by issuing 2,000 shares with par value per share of #100 and fair value per share of $500. Carpenter Co. incurs stock issuance costs of #10 per share. On acquisition date, Wood Co.'s identifiable assets and liabilities have fair values of #2,800,000 and P1,600,000, respectively. Carpenter Co. incurred #40,000 in hiring an independent appraiser to value 13/16Business Combinations (Part 1) Wood's assets and liabilities. After the combination, Carpenter intends to eliminate some of Wood's activities. The estimated costs are P20,000. In addition, Carpenter Co. expects to incur losses of P80,000 during the first year after the business combination. How much is the goodwill (gain on bargain purchase)? a. (260,000) c. (200,000) b. 240,000 d. 280,000 4. Mason Co. acquired all the assets and liabilities of Hammer Co. for #2,600,000. On acquisition date, Hammer's identifiable assets and liabilities have fair values of #5,900,000 and $3,500,000, respectively. Relevant information follows: Mason is renting out a building to Hammer Co. on an operating lease. The terms of the lease compared with market terms are favorable. The fair value of the differential is $90,000. Hammer is a defendant on a pending lawsuit. No provision was recognized because Hammer's legal counsel believes they will successfully defend the case. The fair value of settling the lawsuit is $10,000. How much is the goodwill (gain on bargain purchase)? a. 120,000 c. 200,000 b. 140,000 d. 180,000 5. On January 1, 20x1, Creek Co. acquired all the assets and assumed all the liabilities of Bamboo Co. for #2,400,000. Relevant information follows: Assets Carrying amounts Fair values Cash 10,000 10,000 Receivables, net 400,000 280,000 Inventory 480,000 350,000 Land 2,000,000 Goodwill 110,000 2,200,000 Total assets 3,000,000 20,000 2,860,000 14/1662 Chapter 1 Liabilities Payables 400,000 480,000 Bamboo Co. has research and development projects with fair value of #60,000. Creek Co. does not intend to use those R&Ds. However, there have been exchange transactions involving the information generated from Bamboo's R&D, but those transactions are infrequent. All fair value adjustments result to temporary differences but do not affect the tax bases of the assets and liabilities. The tax rate is 30%. Creek incurred P100,000 on general administrative costs of maintaining an internal acquisitions department. How much is the goodwill (gain on bargain purchase)? a. 12,000 c. 20,000 b. (41,000) d. 19,000 PROBLEM 7: MULTIPLE CHOICE - PFRS for SMEs 1. Which of the following statements is correct? a. The PFRS for SMEs does not address the accounting for business combinations. b. An SME cannot recognize any goodwill. c. The PFRS for SMEs requires the use of the purchase method in accounting for business combinations. d. Control is not an essential criterion in identifying a business combination between SMEs. Use the following information for the next two questions: On January 1, 20x1, Sit Co. acquired 75% controlling interest in Stand Co. for P1,000,000. On this date, the fair value of Stand's net identifiable assets is P800,000. Sit Co. incurred transaction costs of P100,000 on the acquisition. 15/1663 Business Combinations (Part 1) 2. How much is the goodwill if Sit Co. uses the full PERSs and Sit opts to measure NCI using proportionate share method? a. 380,000 b. 400,000 c. 460,000 d. 500,000 3. How much is the goodwill if Sit Co. uses the PFRS for SMEs? a. 380,000 c. 460,000 b. 400,000 d. 500,000 4. The PFRS for SMEs differs from PFRS 3 in all of the following respects, except a. the measurement of the consideration transferred b. the treatment of NCI in the computation of goodwill c. the treatment of acquisition-related costs d. the recognition criteria for contingent liabilities 5. Which of the following statements is incorrect regarding the provisions of the PFRS for SMEs? a. NCI is not included in computing for goodwill. b. NCI is measured in the consolidated financial statements at the NCI's proportionate share in the acquiree's net identifiable assets; fair value measurement is not an option. C. The PFRS for SMEs specifically requires the acquirer to recognize an intangible asset or a liability from an operating lease wherein the acquiree is the lessee. d. Direct costs of a business combination, other than issue costs of equity and debt securities, are capitalized under . the PFRS for SMEs as part of goodwill, whereas these are expensed under PFRS 3